To get the Asia AM Digest every day, SIGN UP HERE

Current Market Developments – Weaker New Zealand Consumer Confidence

The New Zealand Dollar largely brushed aside local consumer confidence falling to its lowest since August 2016. Meanwhile, more positive US first quarter earnings crossed the wires. Intel and Microsoft beat their revenue targets. Meanwhile, Amazon reported higher net sales at $51.04 billion and forecasted $52.26 billion in sales for the second quarter.

A Look Ahead – All Eyes on BoJ

Keep an eye out for how Asian shares once again react to more positive US earnings news. Yesterday, there was a brief moment of Yen weakness when Tokyo came online as local stocks rose under a similar situation. Later on Friday at an unspecified time during the Asian session, this month’s Bank of Japan monetary policy announcement will cross the wires. The central bank is widely anticipated to leave all of its policy setting tools unchanged.

Prior Session Recap – EUR/USD Falls, Yen Gains Despite Better Sentiment

The Euro was one of the worst performing majors on Thursday, but the ECB monetary policy announcement itself didn’t have a profound impact on the currency. What really drove the Euro and EUR/USD lower afterwards was Mario Draghi’s post press conference. There, he noted that ECB policy makers refrained from discussing the end of asset purchases. Local bond yields fell, signaling reduced hawkish monetary policy expectations.

Despite a positive day for stocks in the US and Europe, the anti-risk Japanese Yen actually outperformed while the Swiss Franc declined. During the early hours of Thursday’s session, Japan’s Internal Affairs Ministers Seiko Noda said that the BoJ should not further expand its stimulus programme. Mrs. Noda is planning on running against current Prime Minister Shinzo Abe to be the new leader of the Liberal Democratic Party. The latter’s approval ratings have lately been underperforming amidst a scandal.

Meanwhile, the US Dollar outperformed at the expense of its European counterpart. The now high-yielding greenback rose alongside the S&P 500 which was in-part boosted by strong earnings from Facebook Inc. In addition, US 2-year government bond yields also rose. The anti-fiat yellow metal, gold, declined.

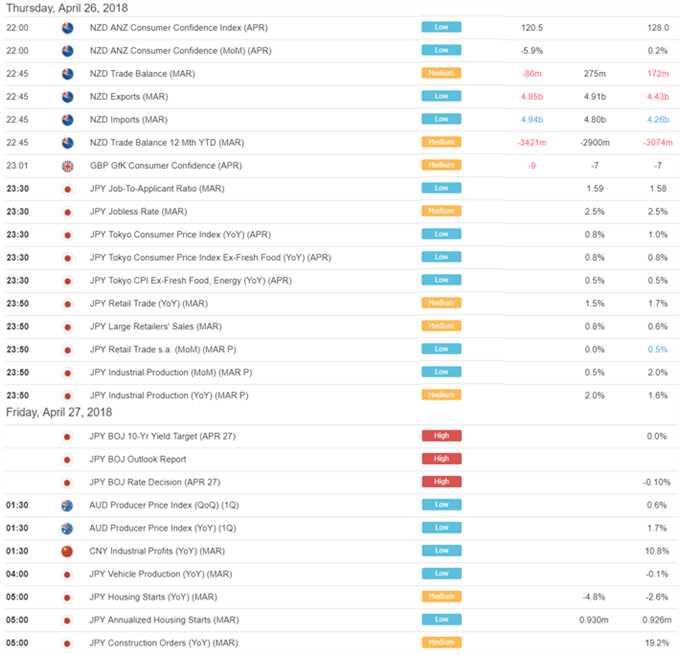

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

![]()

![]()

![]()

![]()

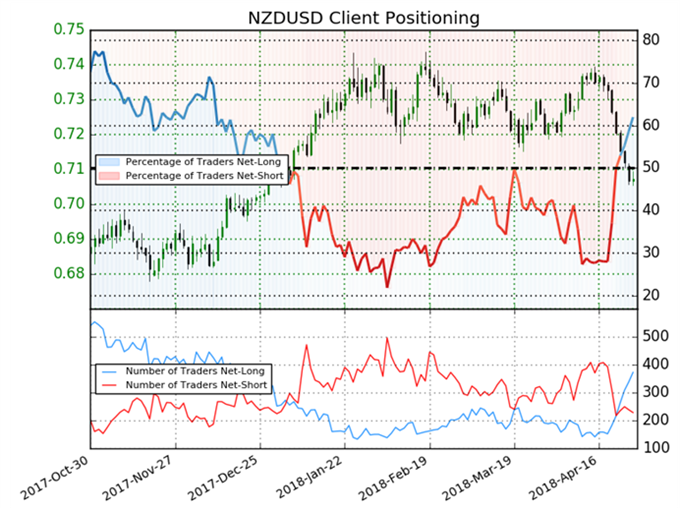

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 62.0% of NZD/USD traders are net-long with the ratio of traders long to short at 1.63 to 1. The number of traders net-long is 28.2% higher than yesterday and 106.1% higher from last week, while the number of traders net-short is 11.9% lower than yesterday and 38.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias.

Five Things Traders are Reading:

- Central Bank Weekly: US Dollar Breaks Year-long Downtrend as US Yields Jump by Christopher Vecchio, Sr. Currency Strategist

- Bitcoin Price in Question As Traders Shift Positioning by Dylan Jusino, DailyFX Research

- GBP Price May Go Lower As Sentiment Sours by Dylan Jusino, DailyFX Research

- USD/JPY Strength Dwindles, RSI Pulls Back Ahead of BoJ Rate Decisionby David Song, Currency Analyst

- EUR/USD Bounces From Key Support as Dovish Draghi Defers Taper Talkby James Stanley, Currency Strategist

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

To receive Daniel‘s analysis directly via email, please SIGN UP HERE