When assessing your trading performance, it is useful to look not only at such parameters as the average win size, average loss size, or the ratio of winning trades to losing ones. Looking at the maximum one-time gain or, conversely, at the worst losing trade can also shed light on the viability of the employed trading method. However, one of the overlooked parameters is the maximum length of the losing streak encountered by a trader.

For example, catching three losses in a row can be a daunting experience, but even with such a high winning ratio as 70%, there is almost 1% probability of any particular four trades coming one after another to be losers. Longer streaks are definitely possible too, especially when the winning ratio is lower and the trading frequency is high. Yet the danger of losing streaks lies not only in the number of trades, but also (and mainly) in the size of those losses and quite often in the prolonged time before another winning trade. In fact, losing streaks should be categorized by three parameters as described further.

By Number

The simplest form to measure a losing streak is to count the number of red trades encountered without interruption. The worst such streak will be the one composed of the maximum number of losing trades. For example, if we have 12 trades arranged as follows: win, loss, loss, win, win, win, loss, loss, loss, win, loss, win; then our worst losing streak is 3 trades. The advantage of this method is that we can easily detect the highest number of losing trades executed continuously. The tradeoff is that you know nothing about how severe this streak was in terms of money lost. This is where the next method comes handy.

By Size

A method that requires some more calculation is to sum up the loss amount (in actual money) accumulated in a given streak. We can easily imagine that in the above example of 12 trades, the first streak of two losses could be worth, let’s say, $200, while the longest one (three trades) could be worth only $150. Obviously, the 2-trade streak here bears the most devastating effect on the account balance even though it is shorter than the one picked by the previous method. The advantage of this way to look at losing streaks is that you pay attention to the actual performance result of a given streak. Unfortunately, it is telling little us about the time aspect of the trading periods devoid of gains.

By Time

If we consider the duration of trades and also of the periods between the trades, we can come up with another measure to assess the losing streaks — how much time was spent after the first losing trade and the next profitable one? Let’s return to the initial example: the isolated loss (11th trade) does not look too worrisome. But if we assume that the first 10 trades have been done in one week while there have been four months between the last two trades, we get a grim picture — a very long period with just a single loss to look at. After all, a

full-time Forex trader would feel the pressure to make money for a living, and months without a profitable position would be a disaster.

Bad

However we measure our loss series, there are always two main detrimental effect way have on our trading:

- Trade balance erosion — even if we use conservative position sizing techniques, risking no more than 1–2% of our account equity per trade, a streak of several losses will result in a considerable blow to overall performance.

- Emotional strain — getting used to losing and learning to ignore the losses is not easy. More so when the losses are arranged into a straight line with no joy of victory to dilute them. The psychological aspect of long streaks of losses should not be underestimated for it would be a bad idea to try to recuperate from them with overtrading.

Good

It is difficult to see anything good in such a discouraging outcome as an uninterrupted row of losses, but going through a particularly long series of losing trades can be a good medicine against the Martingale strategies. It teaches that however good your strategy is, you still will be encountering strings of bad luck.

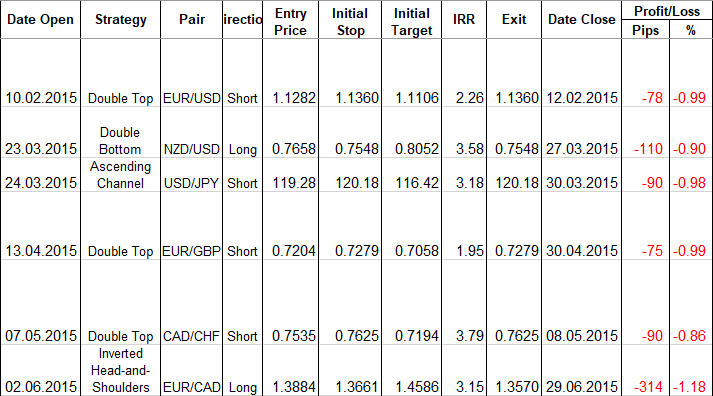

Polls

Three polls are presented below. You can choose what your worst losing streaks were as measured by number of trades, by total loss incurred, and by the duration before the next winning one. I have used our Report Analysis tool to get the numbers for my chart pattern trading strategy and found out that the worst losing streak in 5 years of trading was composed of 6 losses in a row. Coincidentally, it has also been the worst streak in terms of the balance reduction, amounting to about 7% of the balance at the time of the initial trade. The most durable losing streak lasted for 7 months in late 2016 and half of 2017. And what can you say about your worst losing streaks?

Worst Streak by Number of Trades

Worst Streak by Total Loss

Worst Streak by Duration

If you have questions or want to share some details on the longest streak of losses you have withstood in Forex trading, please use the commentary form below.