- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: May 1, 2018

May 1

May 12018

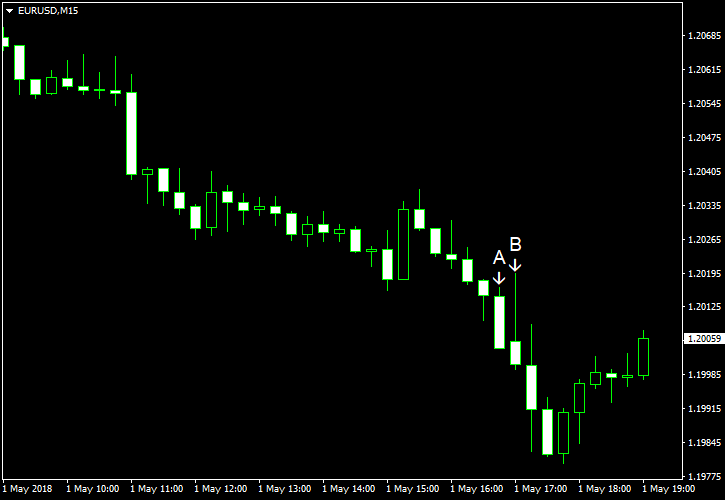

EUR/USD Drops Ahead of Wednesday’s FOMC Announcement

EUR/USD fell today, dropping for the ninth time in eleven session. Market analysts thought that the currency pair was driven by the same forces as previously — mainly by anticipation of higher interest rates from the Federal Reserve. While basically nobody expects the Fed to announce a hike tomorrow, traders still wait for the Fed’s statement, hoping that it may signal whether US policy makers consider four hikes it total this […]

Read more May 1

May 12018

Canadian Dollar Gains as Canada’s Economy Recovers

The Canadian dollar rallied against its major peers, though failed to gain on the US dollar, after the Canadian economy rebounded stronger than expected from the previous decline. Canada’s gross domestic product recovered in February, rising 0.4%, following the slight 0.1% decrease in January. Economists were anticipating a bit slower growth by 0.3%. The report cited following factors contributing to the rebound: The growth was led by a rebound in the mining and oil and gas […]

Read more May 1

May 12018

US Dollar Continues to Demonstrate Strength Ahead of Fed Announcement

The US dollar continued to demonstrate strength today, gaining for nine times in 11 days against the euro. Trading was thinner than usual during the current trading session as markets in many countries were closed for the May Labor Day. Macroeconomic data released in the United States on Tuesday was rather mixed. In particular, the manufacturing Purchasing Managers Index reported by the Institute of Supply Management fell in April to the lowest level since July 2017. […]

Read more May 1

May 12018

Market Sentiment: Positive Towards USD, Negative For GBP

Market sentiment talking points: – The dominant theme in the markets at present is the weakness of EURUSD as the Dollar benefits from high yields while the Euro suffers from poor economic data. – Another important theme is the continuing weakness of the British Pound. – In this webinar I looked at the factors affecting […]

Read more May 1

May 12018

US AM Digest: DXY Surges Before Fed Meeting; GBP Underperforms on Manufacturing PMI Miss

Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here US Market Snapshot via IG: DJIA -0.3%, Nasdaq 100 -0.2%, S&P 500 -0.15% Major Headlines RBA left the cash rate unchanged at 1.50% and reiterated a steady policy US President Trump extended tariff relief for EU […]

Read more May 1

May 12018

ISM Manufacturing Tanks to 9-Month Low, Yet DXY Climbs Higher

ISM Manufacturing Talking Points: – ISM manufacturing composite missed estimates at 57.3% vs 58.5% expected – Supply chains remain strained despite robust demand – DXY climbed to the highest level since January ignoring today’s bearish ISM report – See the DailyFX Economic Calendar for upcoming economic data and for a schedule of live coverage see […]

Read more May 1

May 12018

EUR/USD Drops Ahead of Wednesday’s FOMC Announcement

EUR/USD fell today, dropping for the ninth time in eleven session. Market analysts thought that the currency pair was driven by the same forces as previously — mainly by anticipation of higher interest rates from the Federal Reserve. While basically nobody expects the Fed to announce a hike tomorrow, traders still wait for the Fed’s statement, hoping that it may signal whether US policy makers consider four hikes it total this […]

Read more May 1

May 12018

Australian Dollar Reverses Gains After RBA Stands Pat

The Australian dollar attempted to rally intraday but halted its advance after the Reserve Bank of Australia announced its monetary policy decision. The RBA kept its main interest rate at 1.5%, as was widely expected. The central bank predicted that the Australian economic growth will pick up to a bit above 3% in 2018 and 2019. The bank also mentioned that “employment has grown strongly over the past year” but […]

Read more May 1

May 12018

Sterling Pound Declines on Weak UK Manufacturing PMI

The Sterling pound today declined significantly against the US dollar following the release of the Markit/CIPS UK Manufacturing PMI in the early European session. The pound’s decline was further accelerated by the US dollar’s recovery as it extended its gains at the start of the new month. The GBP/USD currency pair lost over 100 points to decline from an opening high of 1.3773 to trade at a low of 1.3667 at the time of writing. The currency pair’s decline begun in the Asian session […]

Read more May 1

May 12018

Brent Crude Oil Struggles to Breach $75 Mark

Crude oil talking points: – Oil prices are firm in the wake of the Israeli prime minister’s claim that he has proof of a secret Iranian nuclear program. – However, Brent crude – the global benchmark – is struggling to break through the $75/barrel level. Check out the IG Client Sentiment data to help you […]

Read more