Australian Dollar Talking Points:

- Australian Dollar could be in for some near-term volatile price action against USD

- The Aussie may decline versus the greenback on a hawkish Fed after status quo RBA

- AUD/USD fell below a descending channel, will support be able to hold it for long?

Sign up for our RBA rate decision webinar as we cover the Australian Dollar’s response to it

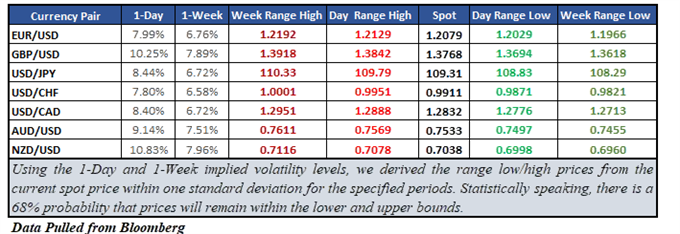

Near-term options-derived support for the Australian Dollar may not hold for long if the currency falls against its US counterpart throughout the week. Looking at the table below, one-day and one-week implied volatility for AUD/USD is amongst the most elevated of the FX majors. A couple of domestic and external event risks may explain why the markets expect heightened price action.

Implied Volatility and Market Range for the FX Majors

For other FX implied volatility articles, please visit the Binaries page.

Immediately facing the Aussie Dollar is May’s RBA monetary policy announcement. The markets are expecting rates to remain unchanged and it isn’t until next year that they start envisioning a potential hike. This paves the way for another status quo release if the central bank remains patient as usual, which allows the Australian Dollar to focus on risk trends and external factors.

What may inspire some short-term volatility in the Australian unit is a local trade balance report on Thursday and RBA’s statement on monetary policy on Friday. The former may positively contribute to GDP as the surplus is expected to rise to A$865 million. The latter will provide fresh inflation estimates that could potentially hint at where rates may go in the near future.

But these gains may prove to be short lived when considering what is developing in the world’s largest economy. There, we will also get the Fed’s rate decision on Wednesday. If policymakers tone echo recent rosy commentary on the economic outlook, then the higher-yielding US Dollar could continue appreciating at the expense of the Australian Dollar in the long run.

AUD/USD Technical Analysis: More Declines Ahead?

On a daily chart, AUD/USD has broken below both the rising trend line from January 2016 and the lower line of a descending channel. This opens the door for what could be more potential losses in the near-term. However, there is quite the barrier that stands in its way that could pose as a stubborn obstacle.

This is the “day range low” options-derived support level around 0.7497. This area closely aligns with both the 61.8% Fibonacci extension and the lows touched in December 2017. Should AUD/USD manage to fall through those, the “week range low” derived support could be the next target at 0.7455.

On the other hand, prices may turn higher and the lower line of the channel could act as former support now resistance. A push above that exposes the “day range high” at 0.7569 followed by the “week range high” at 0.7611.

AUD/USD Trading Resources:

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Just getting started? See our beginners’ guide for FX traders

- See how the Australian Dollar is viewed by the trading community at the DailyFX Sentiment Page

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

To receive Daniel‘s analysis directly via email, please SIGN UP HERE