ISM Manufacturing Talking Points:

– ISM manufacturing composite missed estimates at 57.3% vs 58.5% expected

– Supply chains remain strained despite robust demand

– DXY climbed to the highest level since January ignoring today’s bearish ISM report

– See the DailyFX Economic Calendar for upcoming economic data and for a schedule of live coverage see the DailyFX Webinar Calendar.

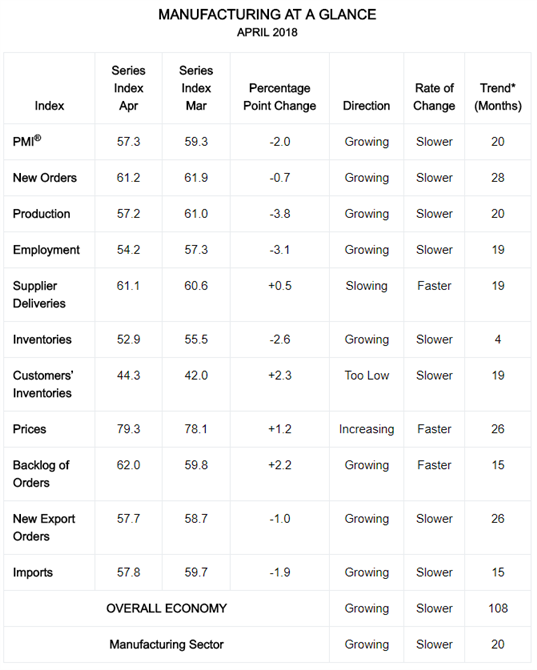

ISM Surveys Plummet, Prices On the Rise

The Institute for Supply Management’s (ISM) Timothy Fiore, issued today’s rather disappointing PMI report. He reported that reported that the manufacturing sector survey fell by 2% to 57.3% from the March reading of 59.3%. This marks the lowest reading since July 2017 at 56.5%. The Production Index recorded an even steeper decline at -3.8% to 57.2% in April from 61% in the previous month. Similarly, the Employment Index recorded a sharp drop of its own at 54.2% falling 3.1% from the 57.3% reading in March. And again, the New Orders Index fell, but by only 0.7% to 61.2% from 61.9% in March. One of the few ISM indices that rose was the Price Paid Index which recorded a 1.2% increase to 79.3%. Fiore stated that this “indicated higher raw materials prices for the 26th consecutive month.

Overall the commentary from the ISM panel reflected continued expansion in business strength. Despite the disappointing figures in April, demand remained strong as the New Orders Index was above 60 fro the 12th consecutive month. Additionally, the backlog of Orders Index expanded and reached the highest reading since May 2004. Fiore stated that demand remained robust but “the nation’s employment resources and supply chains continue to struggle.”

Comments from the Panel

Robust demand remains the theme as the New Orders Index remained above 60 for the 11th consecutive month. This has dragged down the customers’ inventories index to its lowest reading since July 2011. Consumption continued to expand indicating that labor and skill shortages are affecting production output. Supplier deliveries, inventories and imports, were negatively impacted by weather conditions, steel and aluminum disruptions, and equipment shortages.

Asian holidays; lead time extensions; steel and aluminum disruptions across many industries; supplier labor issues; and transportation difficulties due to driver and equipment shortages. Export orders remained strong, supported by a weaker U.S. currency. The Prices Index is at its highest level since April 2011, when it registered 82.6 percent. In March, price increases occurred across 17 of 18 industry sectors. Demand remains robust, but the nation’s employment resources and supply chains are still struggling to keep up.”

See the newly updated fourth quarter forecasts for the US Dollar, Euro, British Pound and more the DailyFX Trading Guides page.

Notable responses from the ISM survey:

- “We are seeing strong sales in the U.S., Europe and Asia.” (Chemical Products)

- “The recent steel tariffs have made it difficult to source material, and we have had to eliminate two products due to availability and cost of raw material.” (Fabricated Metal Products)

- “Demand is up for products. Commodity pricing for steel and other materials increased due to the proposed tariffs. We are seeing commodity futures coming down. A lot of suppliers are asking for increases, and the team is battling those requests.” (Machinery)

- “Business conditions have been good; order book is full and running around 98 percent capacity.” (Primary Metals)

See the full manufacturing survey results below:

Source: April 2018 Manufacturing ISM

Below is a list of economic releases that has driven the US Dollar slightly lower:

– USD ISM Manufacturing (APR): 57.3 versus 58.5 expected, from 59.3

– USD ISM Employment (APR): 54.2 from 57.3 previous

– USD ISM Prices Paid (APR): 79.3 versus 78.5 expected, from 78.2 previous

Chart 1: DXY Index 4-hour Chart (January 7 – May 1, 2018)

The US Dollar Index has completely overlooked today’s bearish ISM report and traded at highest level since January 11th. After reaching 92.50 DXY may continue this uptrend ahead of the FOMC meeting. This is heavily dependent on any indication that Fed will raise rates at least three more times this year marking in four hikes for the year. At the time that this was written DXY traded at 92.52.

— Written by Dylan Jusino, DailyFX Research