Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Market Snapshot via IG: DJIA -0.6%, Nasdaq 100 -0.5%, S&P 500 -0.5%

Major Headlines

- Eurozone Inflation slows in April; Core CPI falls to 0.7%

- UK Service PMI rebounds, however misses expectations

- US Trade Deficit Narrows in March

USD: The US Dollar rally has come to a halt after the FOMC slightly disappointed hawkish bets by maintaining their gradual approach. The statement had a slightly hawkish change in language, however indicated that they would be willing to let inflation overshoot target, subsequently signaling that there is not a case to raise rates aggressively. As such, the USD has slightly lost its recent momentum, focus will be on tomorrows NFP report.

Elsewhere, bilateral talks between the US and China have begun where both parties will be looking to strike a trade deal and avoid punitive tariff measures. Today’s trade figures will definitely lighten the mood, where the US trade deficit narrowed the most since the financial crisis with the deficit with China also narrowing.

GBP: Today’s UK Service PMI rounded up what has been another disappointing week on the macro front for the UK. The release saw a slight pick up to 52.8 in April from the 20-month low of 51.7, however, underwhelmed expectations of 53.5, suggesting that the underlying economy remains fragile as opposed to weather induced weakness, in response GBPUSD fell through 1.3600 to revisit lows of 1.3555.

IHS Markit reported that the PMI surveys collectively, pointed to Q2 GDP of 0.2% (second weakest since the Brexit vote). In turn, the most recent data points, coupled with cautious comments from BoE members indicate that a rate hike for May is completely off the table. Eyes on August QIR meeting where OIS markets are pricing in a 55% chance of a 25bps rate hike.

EUR: Benign inflation in the Euro-Area continues to be a headache for the ECB, today’s reading saw the headline rate fall from 1.3% to 1.2%, while the core measure fell to 0.7% (lowest since March 2017). EURUSD saw a slight dip, however this had not been sustained given that the reading would have been somewhat priced in due to the recent subdued German, Spanish and Italian figures, while seasonal effects (Easter) had also been evident for the drag in inflation. However, this may well prompt the ECB to delay the next policy shift to July, while the current bond buying program will most likely be extended to the end of the year.

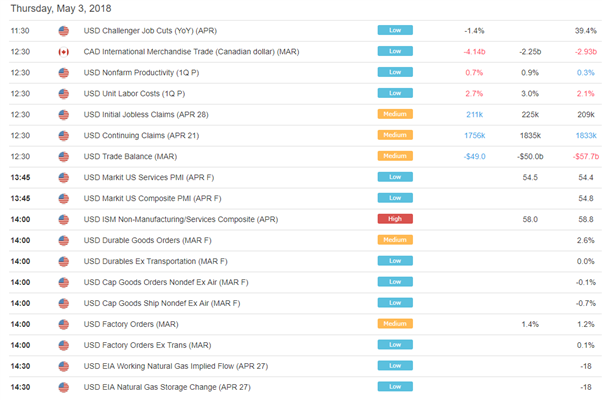

DailyFX Economic Calendar: Thursday, May 3, 2018 – North American Releases

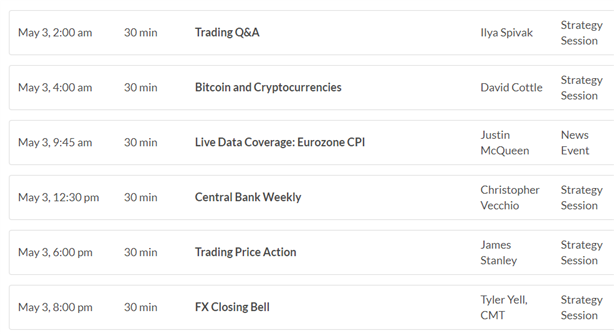

DailyFX Webinar Calendar: Thursday, May 3, 2018

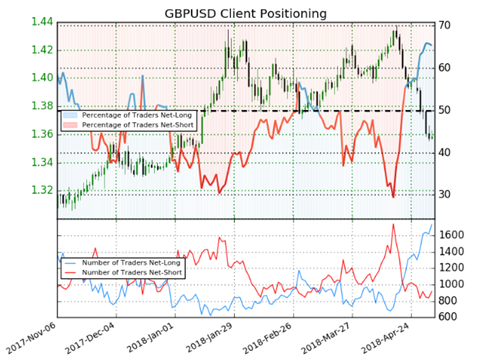

IG Client Sentiment Index: GBPUSD Chart of the Day

GBPUSD: Data shows 65.4% of traders are net-long with the ratio of traders long to short at 1.89 to 1. In fact, traders have remained net-long since Apr 20 when GBPUSD traded near 1.40793; price has moved 3.5% lower since then. The number of traders net-long is 0.7% lower than yesterday and 33.0% higher from last week, while the number of traders net-short is 2.8% higher than yesterday and 15.5% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

Four Things Traders are Reading

- “US Dollar Hits Pause after FOMC, Awaits Clues for April NFP” by Christopher Vecchio, SeniorCurrency Strategist

- “Slowing UK Economy Weighs on GBPUSD Outlook” by Justin McQueen, Market Analyst

- “EURUSD Eases as Euro-Zone Inflation Data Miss Expectations” by Martin Essex, MSTA, Analyst and Editor

- “Gold Price Drop May Resume as US Data Bolsters Fed Optimism” by Ilya Spivak, Senior Currency Strategist

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX