Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Market Snapshot via IG: DJIA -0.4%, Nasdaq 100 -0.3%, S&P 500 -0.3%

Major Headlines

- US NFP fell short of expectations at 164k vs. Exp. 192k, wages slow and unemployment rate falls to lowest since December 2000.

- Eurozone Composite and Services PMI underwhelms consensus

- US-Chinese bilateral offer little after conclusion of first round

USD: In an immediate response to the NFP report, the USD index fell to session lows on the back of the weaker than expected headline print, while the wage data also underwhelmed expectations, which in turn led to a slight unwind of bets that there will be three additional rate hikes this year. However, the selling pressure in the USD was short-lived given that the softer readings had been met with a better than expected unemployment rate of 3.9% (Dec’2000 low) with today’s jobs report somewhat mixed. USD-index then continued to gain across the board as GBPUSD broke through its 200DMA, slipping through the 1.3500 handle, while EURUSD also edged towards session lows. First round of US-China bilateral talks concluded this morning, providing little in the way of inspiration for a boost in risk sentiment.

EUR: Eurozone PMI readings for April, confirmed that Euro-Area growth has continued to slowdown. Services PMI fell to 54.7 from the preliminary reading of 55, while the Composite PMI also saw a dip to 55.1 from 55.2. This also follows on from yesterday’s subdued inflation report where the core reading fell to a 1yr low, which may prompt the ECB to delay their announcement in the next shift in policy. As such, this is likely to keep the bearish EURUSD trend intact, while a material break below 1.1936 (61.8% retracement of 1.1553-1.2556 rise) would be needed to give weight to the downside bias and setting up scope for 1.1790.

AUD: Overnight, the RBA released the latest Statement of Monetary Policy (SoMP) whereby the central bank raised their CPI forecast to reach 2% in Q2 18 from Q2 19, while revising higher their unemployment rate forecast to 5.5% from 5.25%. Additionally, they reiterated that higher interest rates will likely be appropriate at some point. In reaction to the statement, AUDUSD saw a slight bounce from the 0.7500, however this had been somewhat short-lived as the RBA signaled that a rate hike is unlikely to happen in the near-term. As it stands, market pricing for a rate hike is for Q1 19.

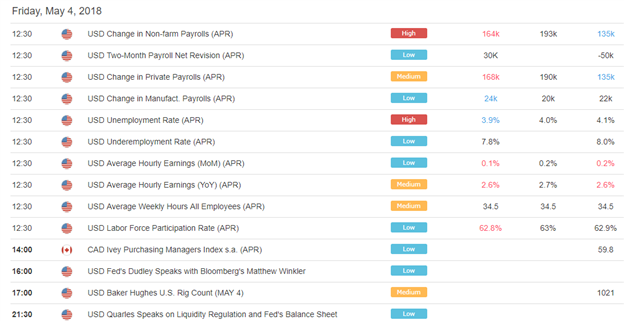

DailyFX Economic Calendar: Friday, May 4, 2018 – North American Releases

DailyFX Webinar Calendar: Friday, May 4, 2018

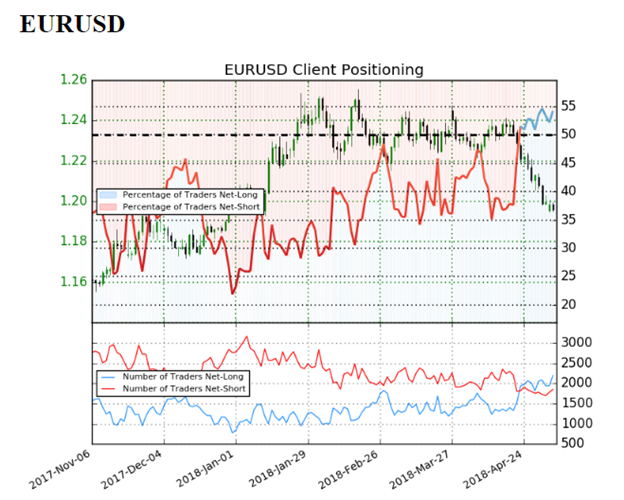

IG Client Sentiment Index: EURUSD Chart of the Day

EURUSD: Data shows 54.3% of traders are net-long with the ratio of traders long to short at 1.19 to 1. The number of traders net-long is 12.2% higher than yesterday and 8.1% higher from last week, while the number of traders net-short is 0.5% higher than yesterday and 4.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bearish contrarian trading bias.

Three Things Traders are Reading

- “DXY Little Changed After Mixed US NFP Report” by Justin McQueen, Market Analyst

- “Eurozone PMI Confirms Cooling Growth; EURUSD Weakness Set to Continue” by Justin McQueen, Market Analyst

- “Crude Oil, Gold Prices May Win Back Ground After US Payrolls” by Ilya Spivak, Senior Currency Strategist

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX