US Market Snapshot via IG: DJIA 0.55%, Nasdaq 100 0.3%, S&P 500 0.34%

Major Headlines

- US-China end trade talks without deal

- AUD Rises on Strong Data; Focus on RBA Tonight

- UK Construction PMI Beats Expectations at 52.5 (Exp. 52)

AUD: The Australian Dollar is the clear outperformer this morning (biggest one-day gain since August 2017), with AUDUSD up over 1.1%. This has largely been down to the encouraging data overnight, with retails sales and business inventories beating expectations, while the broad risk-on tone has also underpinned gains. AUDUSD now firmly above 0.76, hitting the 0.7650 area with shorts squeezed, eyes on the RBA rate decision tonight, whereby the central bank will likely stick to its neutral tone.

USD: Last week’s NFP report, which surprised to the upside, has eliminated any uncertainty over a Fed rate hike next week, which is near enough fully priced in. However, this is not relevant for the USD, what is relevant is the longer-term outlook of Fed policy, which has ticked up. Although, escalating trade tensions after the US imposed steel and aluminium tariffs on its closest allies (EU, Canada and Mexico) on Friday looks to have provided a top in the US Dollar and US bond yields. The USD is back below 94.00 helping its major counterparts gain ground as a trade war will likely weigh on the global economic outlook, resulting in increased downside risks to 3 additional Fed rate hikes this year.

EUR: The Euro is notably firmer, up 0.6% amid the broad-based weakness in the greenback. Signs of easing concerns over Italian politics with 10yr bond yields falling some 16.7bps has helped push the Euro higher. Confidence vote of new government scheduled later this week. Tighter yields between Bunds and BTPs have acted in a supportive manner for EURUSD, which in turn has seen the pair consolidate above 1.17.

GBP: Near-term GBP Direction may be impacted by the upcoming BoE speakers (Tenreyro, Cunliffe and Ramsden), which could help gauge the likelihood of an August rate rise, currently at 34%.Today’s Construction PMI alleviated concerns of a further deterioration in the UK economy with the reading above expectations at 52.5 (Exp. 52.0). Eyes on tomorrow’s Service PMI which is expected to tick up to 53 from 52.8. GBP moving tentatively towards the 1.34 handle which also coincides with the 20DMA.

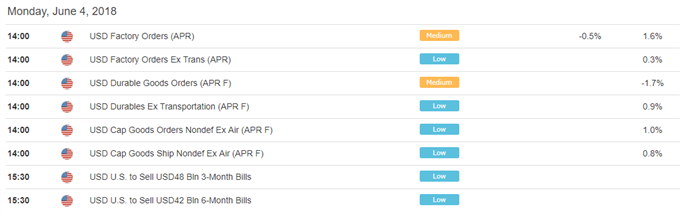

DailyFX Economic Calendar: Monday, June 4, 2018 – North American Releases

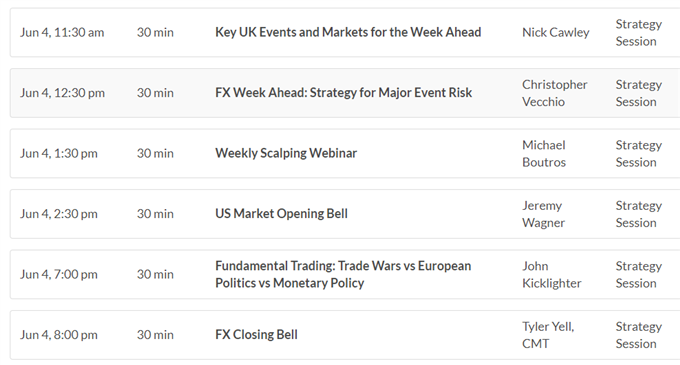

Daily Webinar Calendar: Monday, June 4, 2018

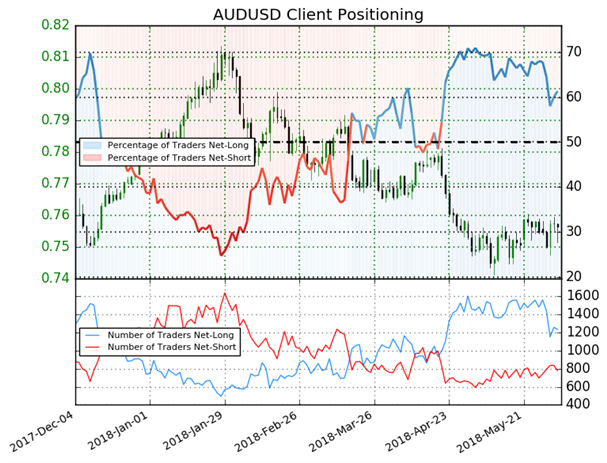

IG Client Sentiment Index: AUDUSD Chart of the Day

AUDUSD: Data shows 61.3% of traders are net-long with the ratio of traders long to short at 1.59 to 1. In fact, traders have remained net-long since Apr 19 when AUDUSD traded near 0.77596; price has moved 2.5% lower since then. The number of traders net-long is 1.6% higher than yesterday and 19.0% lower from last week, while the number of traders net-short is 16.2% lower than yesterday and 9.3% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed AUDUSD trading bias.

Five Things Traders are Reading

- “Euro Forecast: Euro May Have Room for Further Recovery in Short-term” by Christopher Vecchio, CFA, Sr. Currency Strategist

-

“

UK Market Webinar: Is Sterling Turning the Corner?”

by Nick Cawley, Market Analyst - “Cryptocurrency Charts – Ethereum & Bitcoin Turning Near-term Bearish”by Paul Robinson , Market Analyst

- “Weekly CoT Update for Swiss Franc, Euro, Crude Oil, Gold, and More” by Paul Robinson , Market Analyst

- “Trade Wars and Italian Political Concerns Sees Eurozone Investor Confidence at October 2016 Lows” by Justin McQueen, Market Analyst

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX