Current Developments – Euro, Sentiment and Australian Dollar Rises

A rally in the Euro on Wednesday helped to keep the US Dollar suppressed as the markets searched for yield prospects outside of the world’s largest economy. During the first half of yesterday’s session, comments from ECB Executive Board Member Peter Praet helped push German front-end government bond yields higher, hinting at diminishing dovish monetary policy bets.

Mr. Praet said that inflation expectations are increasingly consistent with their aim and that it is ‘clear’ that the central bank will have to assess next week if to unwind their quantitative easing programme. This excited Euro bulls who now arguably see September as increasingly likely to being the end of QE. Also, higher rate prospects in Australia did not bode well for the greenback either.

There, Australia experienced its fastest pace of economic growth since the second quarter of 2016. Local government bond yields soared as well, helping to push the Australian Dollar higher against its major counterparts. But the sentiment-sensitive unit was also bolstered by a general pickup in risk appetite.

On this front, the Dow Jones climbed 1.4 percent which was its single largest daily advance since April 10. The S&P 500 was also up 0.86%. Earlier in the session, reports crossed the wires that US Treasury Secretary Steven Mnuchin asked President Donald Trump to exempt Canada from the metal tariffs.

This was ahead of a G7 Leaders Summit due at the end of the week. Perhaps the development may have inspired expectations that the world’s largest economy could soften its stance on international trade there. The pickup in sentiment diminished the demand for haven assets and understandably, the anti-risk Japanese Yen and Swiss Franc underperformed.

A Look Ahead – Will Asian Shares Echo US Gains?

If Asian shares echo the gains on Wall Street, then the Japanese Yen could depreciated. Meanwhile, the higher-yielding Australian and New Zealand Dollars could rise. As for the former, we will also get April’s Australian trade balance. Back on Tuesday, we had a softer local current account reading. Since net exports (also known as trade balance) are a portion of the current account, perhaps it won’t be surprising to see a miss there. Such an outcome could bode ill for the Aussie, but risk trends could support it more.

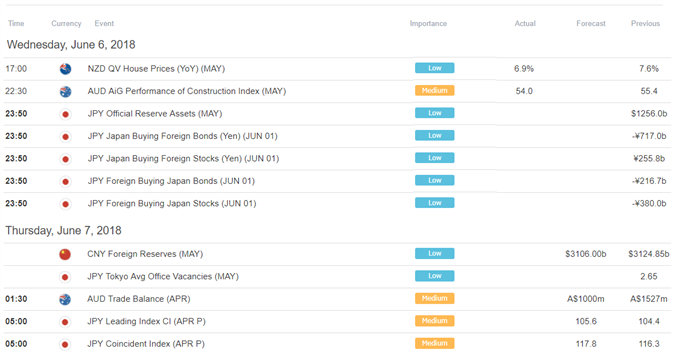

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

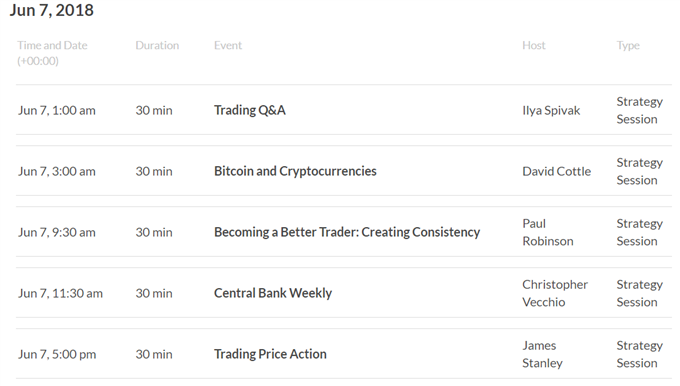

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

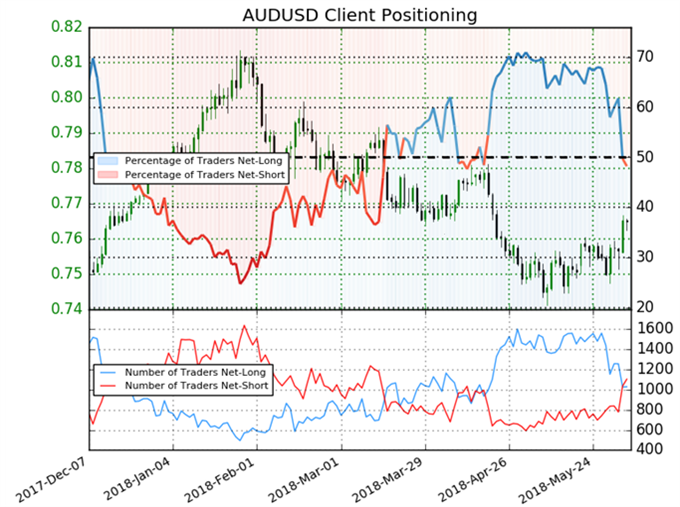

IG Client Sentiment Index Chart of the Day: AUD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 48.2% of AUD/USD traders are net-long with the ratio of traders short to long at 1.07 to 1. The percentage of traders net-long is now its lowest since Apr 13 when AUD/USD traded near 0.77596. The number of traders net-long is 19.0% lower than yesterday and 26.8% lower from last week, while the number of traders net-short is 32.1% higher than yesterday and 43.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bullish contrarian trading bias.

Five Things Traders are Reading:

- GBP/USD Technical Outlook: Sterling Rebound Eyes Initial Resistance by Michael Boutros, Currency Strategist

- Oil Prices to Succumb to Rising U.S. Output, Increased OPEC Supply by David Song, Currency Analyst

- Weekly Technical Perspective on the Japanese Yen (USD/JPY)by Michael Boutros, Currency Strategist

- S&P 500 Continues to Rise After Reaching the Highest Level in 3 Months by Abdullah AI Amoudi, DailyFX Research

- AUD/USD Forecast: Break of Bearish Trendline to Fuel Larger Recovery by David Song, Currency Analyst

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter