Current Market Developments – ECB Rocked Markets

Thursday’s European Central Bank monetary policy announcement generated large amounts of volatility in the FX and stock spectrum. In short, the ECB followed through with confirming QE tapering bets by announcing that the programme will be cut in September and run until the end of the year. However, a lack of urgency to raise rates thereafter sent the Euro tumbling while fueling European shares higher.

The Euro Stoxx 50 and DAX rose 1.37 percent and 1.68 percent respectively. However, US shares remained quite restrained. In fact, the Dow Jones fell about 0.10% while the S&P 500 rose 0.25%. Keep in mind that we also had a Fed rate hike on Wednesday and now with the ECB behind us, perhaps Wall Street paid more attention to domestic tightening credit conditions as opposed to still loose ones in Europe.

As anticipated, the relatively high-yielding Australian Dollar fell across the board. This was likely due to pronounced US Dollar strength on the ECB which given its higher return, makes the Aussie look relatively unattractive from a yield perspective. Meanwhile, the Japanese Yen rose versus all but the greenback.

A Look Ahead – BoJ Due, But Eyes Will Probably Be on Sentiment

At an unspecified time during Friday’s Asian trading session, we will get the Bank of Japan monetary policy announcement. Though so far this year, the rate decision has tended to cross the wires around 3:00 GMT +-15 minutes. Here, this is likely to be the least market moving central bank rate event this week when comparing to the Fed and ECB. Inflation still remains persistently below target in Japan. This argues for another status quo announcement.

Keep an eye out for how Asian shares react to the aftermath of the ECB rate decision. Given the relatively restrained US market response, local stocks may edge cautiously higher. On a side note, it appears to have been confirmed that US President Donald Trump has approved $50 billion in tariffs against Chinese goods. Meanwhile, Mexico was reported looking into tariffs on US corn and soy. With that in mind, we shall see what the markets will care more about as we await Tokyo open.

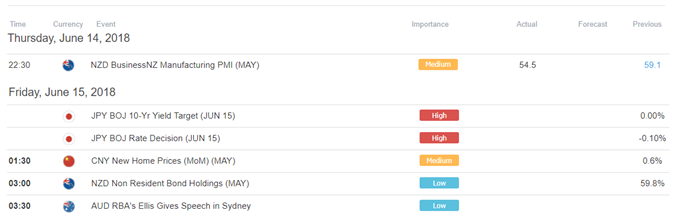

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

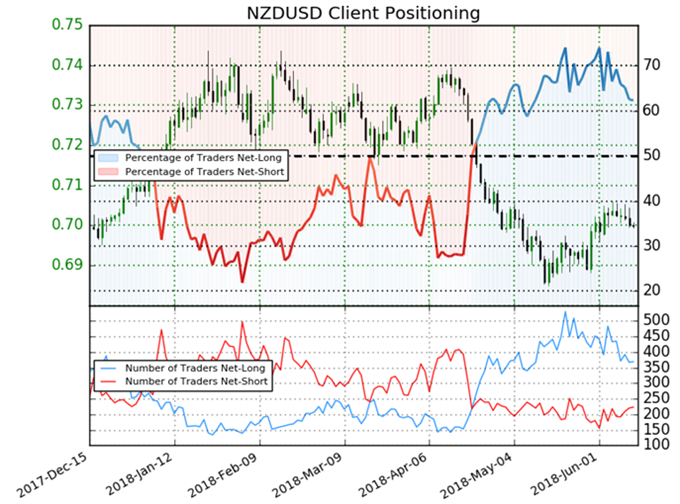

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 62.3% of NZD/USD traders are net-long with the ratio of traders long to short at 1.65 to 1. In fact, traders have remained net-long since Apr 22 when NZD/USD traded near 0.73652; price has moved 5.0% lower since then. The number of traders net-long is 4.7% lower than yesterday and 15.2% lower from last week, while the number of traders net-short is 7.7% higher than yesterday and 1.4% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current NZD/USD price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading:

- ETH/USD Price Analysis: Ethereum Rebounds from Multi-month Lows by Michael Boutros, Currency Strategist

- Post-FOMC USD/JPY Weakness to Persist as Bullish Sequence Snaps by David Song, Currency Analyst

- XAU/USD Technical Outlook: Gold Price Breakout Stallsby Michael Boutros, Currency Strategist

- Another Potential Blow for Euro as Germany’s CSU Defies Merkelby Martin Essex, MSTA, Analyst and Editor

- EUR/USD Crumbles as ECB Unveils Cautious Stimulus Exit by James Stanley, Currency Strategist Analyst

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter