- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 15, 2018

June 15

June 152018

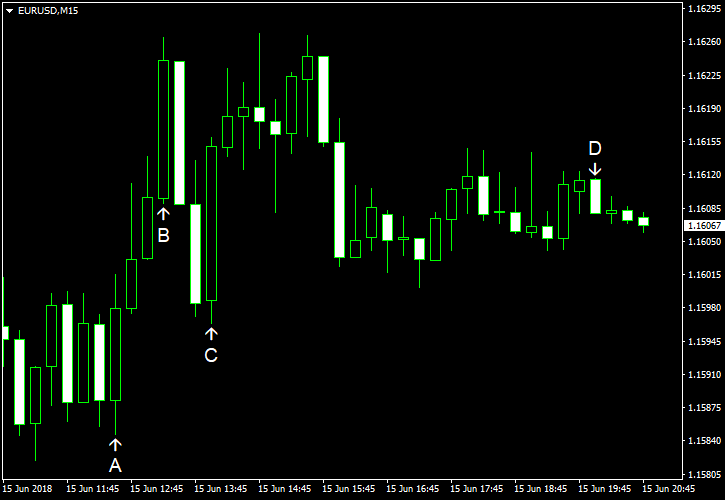

Euro Rallies Slightly Higher on ECB Hint at Policy Normalization

The euro today rallied slightly higher after Ewald Nowotny, an ECB governing council member, stated that the bank should capitalize on the opportunity to normalize its policies soonest possible. The EUR/USD currency pair had a muted reaction to the release of the final Eurozone CPI data early in the European session despite the print being in line with expectations. The EUR/USD currency pair today rallied slightly from a low of 1.1544 to a high of 1.1615, but […]

Read more June 15

June 152018

Asian Shares Mixed on Tariff Fears, USD/JPY Rise at Risk Post BoJ

Asian Stocks Talking Points: Asian shares mixed as trade war fears rose, Bank of Japan downgraded CPI assessment Us to go ahead with $50b in Chinese import tariffs, USD may rise on consumer confidence USD/JPY rising in ascending channel, it faces critical resistance ahead which could hold Just getting started trading the Japanese Yen? See […]

Read more June 15

June 152018

Bitcoin, Ethereum Rally on SEC News; Charts Remain Negative

Cryptocurrency News and Talking Points – SEC classification say that Bitcoin (BTC) and Ethereum (ETH) are not securities. – Market rally flounders as technical resistance remains in place. IG Client Sentimentshows how clients are currently positioned in a wide range of cryptocurrencies and how positioning has changed over the last week – and positioning continues […]

Read more June 15

June 152018

EUR Bears to Remain in Control on Possible German Snap Election

EURUSD Analysis and Talking Points Rift over immigration policy could spell the end for Merkel Snap election likely to weigh on the Euro See our Q2 EUR forecast to learn what will drive the currency through the quarter. End for Merkel? If there is one thing that had been made apparent by yesterday’s 2 big […]

Read more June 15

June 152018

Asia AM Digest: Markets Eye Sentiment Instead of BoJ Post ECB Jolt

Current Market Developments – ECB Rocked Markets Thursday’s European Central Bank monetary policy announcement generated large amounts of volatility in the FX and stock spectrum. In short, the ECB followed through with confirming QE tapering bets by announcing that the programme will be cut in September and run until the end of the year. However, […]

Read more June 15

June 152018

EUR/USD Recovers As US-China Trade War Intensifies

EUR/USD rebounded a bit following yesterday’s big slump, though the rally was not nearly enough to erase losses posted during yesterday’s session. The dollar was relatively weak today due to an intensifying trade war between the United States and China. The USA announced new tariffs on Chinese imports, and China promised to respond in a similar manner, imposing levies on US goods. NY Empire State Index climbed from 20.1 to 25.0 […]

Read more