- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 21, 2018

June 21

June 212018

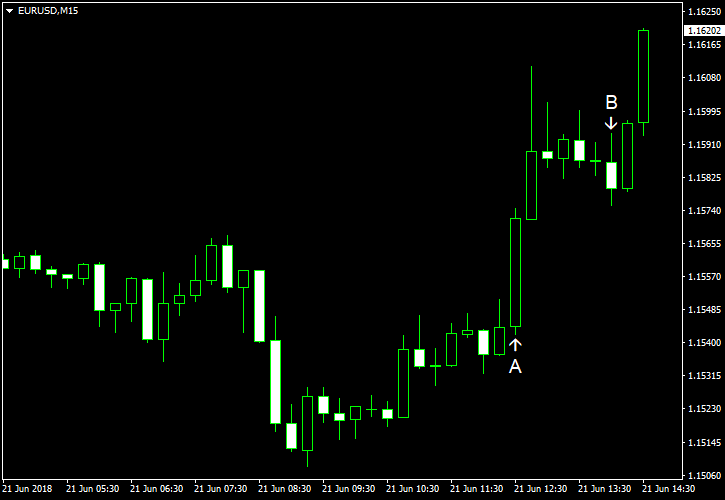

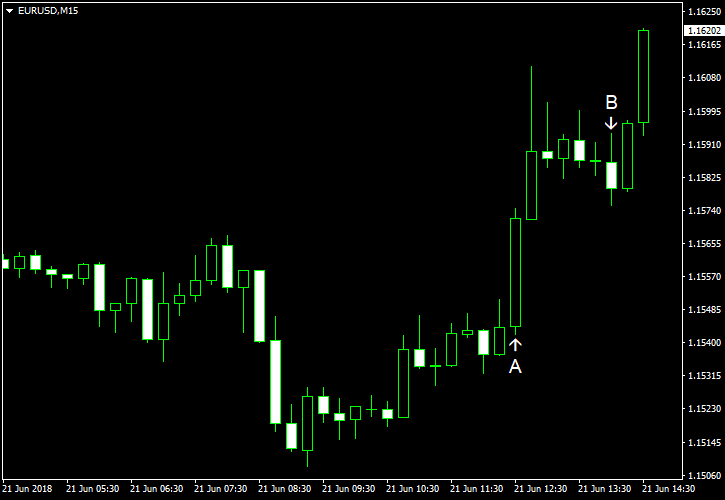

EUR/USD Reverses Losses, Boosted by Weak Manufacturing Index

EUR/USD was falling during the current trading session but managed to reverse its losses. The rebound gained momentum after the Philadelphia Fed reported that its manufacturing index fell this month much more than was expected. The US leading indicators also provided an unpleasant surprise, and unemployment claims was the only decent indicator released in the United States today. Philadelphia Fed manufacturing index fell from 34.4 […]

Read more June 21

June 212018

Canadian Dollar Soft, Recovers vs. US Dollar

The Canadian dollar fell against other most-traded currencies today, though managed to recover versus the US dollar by now. The currency was under pressure from a range of negative factors, including falling prices for crude oil, trade tensions with the United States, and underwhelming domestic macroeconomic data. Automatic Data Processing reported that Canada’s employment increased by 2,905 jobs in May — a far smaller number than 15,100 registered in April, […]

Read more June 21

June 212018

Swiss Franc Firm, Undisturbed by Dovish SNB

The Swiss franc gained on most other major currencies, with the exception of the Great Britain pound, which got a boost from the relatively hawkish stance of the Bank of England. The outlook expressed by Switzerland’s own central bank was far less optimistic, but that did not prevent the Swissie from rising. The Swiss National Bank kept interest rates unchanged at today’s policy meeting, as was widely expected. The interest on sight deposits […]

Read more June 21

June 212018

NZ Dollar Falls As New Zealand Economic Growth Slows

The New Zealand dollar fell today after a report showed that the New Zealand economic growth slowed last quarter. The currency managed to trim losses by now, erasing them against the US dollar entirely. Statistics New Zealand reported that gross domestic product rose 0.5% in the March quarter of 2018 from the previous three months. It was a slower rate of growth than 0.6% registered in the December quarter of 2017 […]

Read more June 21

June 212018

EURUSD and Italian Assets Fall as Italian Political Uncertainty Returns

EURUSD Analysis and Talking Points Italian assets retreat as Italy appoints Eurosceptics EURUSD falls to the lowest level since July 2017 Italian Fears Rise After Appointment of Eurosceptics EURUSD fell to its lowest level since July 2017 at 1.1508 as Italian assets came under pressure with BTPs and the FTSE MIB falling to session lows. […]

Read more June 21

June 212018

Sterling Bulls Offered Hope as Bank of England Raises August Rate Hike Bets

GBPUSD Analysis and News GBP Surges After 6-3 Hawkish Vote Split Market Pricing for an August Rate Hike rises to 45% from 33% prior to announcement See how retail traders are positioning in GBPUSD as well as other major FX pairs on an intraday basis using the DailyFX speculative positioning data on the sentiment page. […]

Read more June 21

June 212018

US AM Digest: GBP Surges on Hawkish BoE, EUR Dips as Italy Appoints Eurosceptics

US Market Snapshot via IG: DJIA -0.4%, Nasdaq 100 0.1%, S&P 500 -0.2% Major Headlines Bank of England Keep Bank Rate at 0.5%, Vote split 6-3 (Prev. 7-2) Italy appoint two Eurosceptics to head finance committee Saudi Arabia sees a 1mln bpd oil increase as a reasonable target. GBP:Sterling bulls have been provided with some […]

Read more June 21

June 212018

EUR/USD Reverses Losses, Boosted by Weak Manufacturing Index

EUR/USD was falling during the current trading session but managed to reverse its losses. The rebound gained momentum after the Philadelphia Fed reported that its manufacturing index fell this month much more than was expected. The US leading indicators also provided an unpleasant surprise, and unemployment claims was the only decent indicator released in the United States today. Philadelphia Fed manufacturing index fell from 34.4 […]

Read more June 21

June 212018

Sterling Pound Rallies Higher on BoEâs Hawkish Interest Rate Decision

The British pound today rallied higher against the US dollar after the Bank of England announced its monetary policy decision with more members than before voting for a rate hike. The pound had traded lower following the release of the disappointing UK public sector finances report for May early in the European session. The GBP/USD currency pair today rallied from a low of 1.3103 to a high of 1.3258 after the BoE rate decision, which […]

Read more June 21

June 212018

GBPUSD Forecast: Central Bank ’Double’ to Govern Sterling’s Fate

GBPUSD Prices, News and Analysis BoE monetary policy decision at 11:00 GMT – no change expected. Governor Carney’s Mansion House speech due at 20:15 GMT IG Client Sentiment data show that retail are 72.5% net-long of GBPUSD – a contrarian bearish set-up – but recent positional changes gives us a mixed trading bias. GBPUSD Driven […]

Read more