US Market Snapshot via IG: DJIA -0.3%, Nasdaq 100 -0.1%, S&P 500 -0.1%

Major Headlines

- EU reach an 11th hour immigration deal

- Eurozone Inflation to highest in a year

- UK GDP revised higher to 0.2% vs. Prev. 0.1%

- Canadian GDP Prints above expectations, boosting July rate hike bets

EUR: The Euro is among the outperforming currencies today following reports that the EU struck an eleventh-hour dealon the highly charged issue of immigration into the bloc. Alongside this, month end selling in the USD has also helped push the Euro higher with the pair hovering around 1.1650. Additionally, Eurozone inflation rose to its highest level in over year, rising 2% following another surge in energy prices, however, core inflation continues to remain subdued, with the reading printing at 1%.

GBP: UK Q1 GDP saw a surprise revision higher to 0.2% from 0.1%, as such, this helped lift the Pound, which now firmly sits above 1.31. However, despite the better than expected monthly reading which will likely grab the headlines, annual GDP growth at 1.2% still represents the weakest reading since Q2 2012, while business investment saw its largest fall since Q4 2016, having dipped 0.4%.

CAD: The Loonie firmer this morning after Canada GDP unexpectedly grew by 0.1% against expectations for no change. Given that on Wednesday, BoC Governor Poloz stated that economic data would decide the next move in interest rates, market pricing jumped to 83% from 67% for a July rate hike.

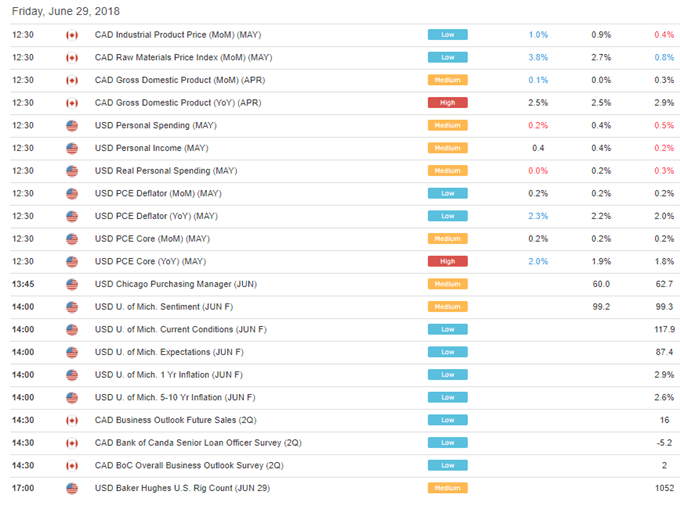

DailyFX Economic Calendar: Friday, June 29, 2018 – North American Releases

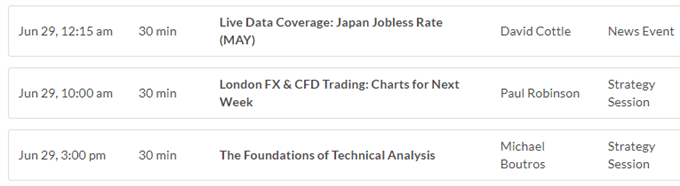

DailyWebinar Calendar: Friday, June 29, 2018

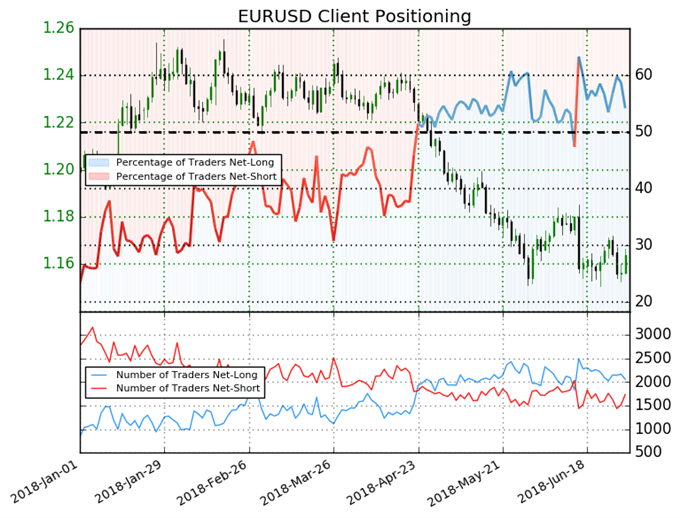

IG Client Sentiment Index: EURUSD Chart of the Day

EURUSD: Data shows 54.2% of traders are net-long with the ratio of traders long to short at 1.19 to 1. In fact, traders have remained net-long since Jun 14 when EURUSD traded near 1.17988; price has moved 1.3% lower since then. The number of traders net-long is 7.0% lower than yesterday and 11.2% lower from last week, while the number of traders net-short is 11.6% higher than yesterday and 4.4% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading

- “Gold & Silver Price Analysis – Long-term Trend-lines in Play” by Paul Robinson, Market Analyst

- “CAD Outlook and Near Term BoC Rate Path to be Dictated by Canadian GDP” by Justin McQueen, Market Analyst

- “Charts for Next Week – EUR/USD, GBP/USD, USD/JPY, Gold Price & More”by Paul Robinson, Market Analyst

- “EUR up as Eurozone Inflation hits 2% led by surge in oil prices”by Justin McQueen, Market Analyst

- “EURGBP Rally Halted; Next Move is Unclear” by Nick Cawley, Market Analyst

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX