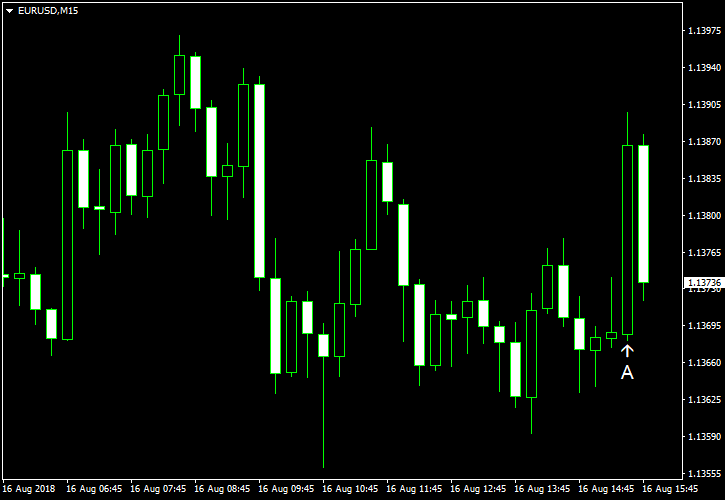

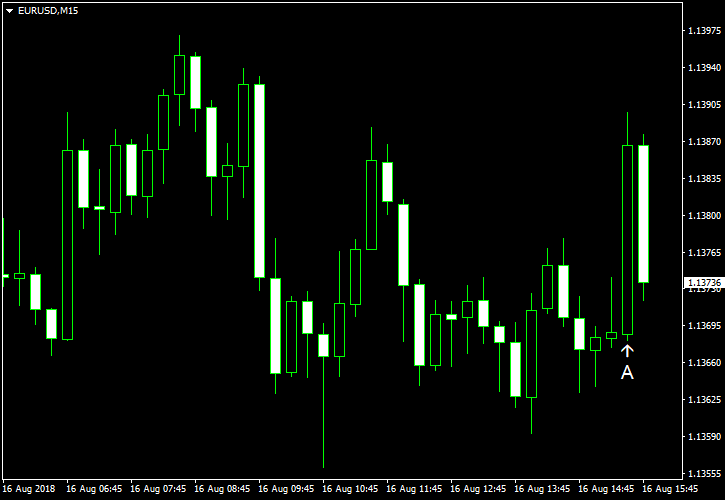

EUR/USD rebounded today, extending its recovery, amid improving market sentiment. Market participants became a bit more optimistic due to the news about Qatar investing in Turkey and renewed trade talks between the United States and China. US macroeconomic data, being rather unimpressive, did not prevent the rally of the currency pair. The Philly Fed manufacturing index was especially disappointing.

Housing starts and building permits rose a bit in July. Housing starts were at the seasonally adjusted annual rate of 1.17 million. It was just a little above the June’s revised level of 1.16 million and below the average forecast of 1.27 million. Building permits were at the seasonally adjusted annual rate of 1.31 million, up from 1.29 million in the previous month and in line with expectations. (Event A on the chart.)

Philadelphia Fed manufacturing index slumped from 25.7 to 11.9 in August — the lowest reading in 21 months. Analysts had predicted a smaller decline to 21.9. (Event A on the chart.)

Initial jobless claims fell to 212k last week from the previous week’s revised level of 214k. The median forecast promised a reading of 215k. (Event A on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.