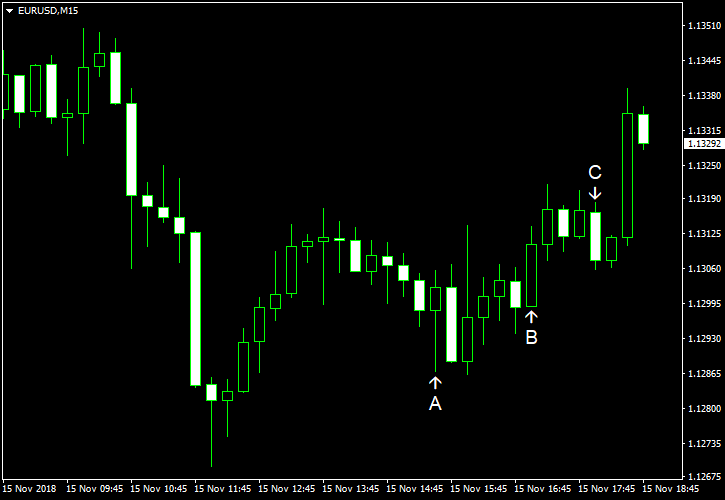

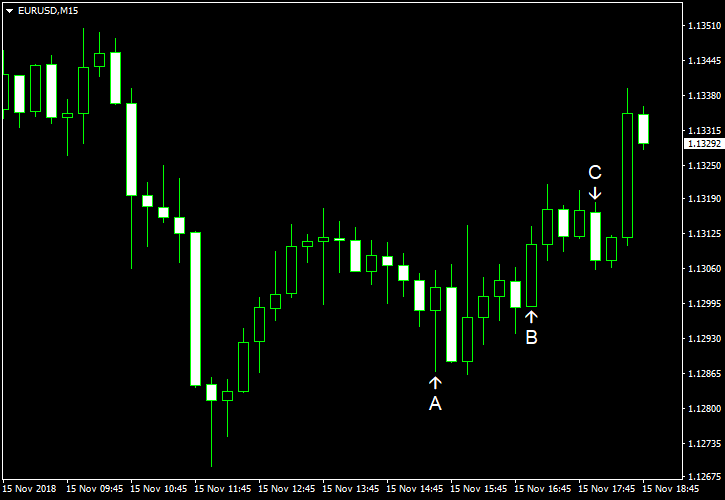

EUR/USD dropped sharply intraday but rebounded later despite the fact that most of US macroeconomic reports released today were better than expectations.

Retail sales rose 0.8% in October, exceeding market expectations of a 0.6% increase. The September reading was revised from an increase by 0.1% to a decrease of the same rate. (Event A on the chart.)

Philadelphia Fed manufacturing index decreased from 22.2 in October to 12.9 in November, far below the forecast value of 20.1. (Event A on the chart.)

NY Empire State Index, on the other hand, edged up from 21.1 to 23.3 in November instead of falling to 19.9 predicted by experts. (Event A on the chart.)

Import and export prices increased in October. Import prices rose 0.5% after increasing 0.2% in September (revised, 0.5% before the revision). Analysts had predicted a smaller increase by just 0.1%. Export prices increased 0.4% after registering no change in the previous month. (Event A on the chart.)

Initial jobless claims rose from 214k to 216k last week on a seasonally adjusted basis. Experts had predicted a reading of 213k. (Event A on the chart.)

Business inventories grew by 0.3% in September, matching forecasts exactly, after increasing 0.5% in the previous month. (Event B on the chart.)

Crude oil inventories swelled by 10.3 million barrels last week and were above the five-year average for this time of year. The increase was far above the predicted gain of 2.9 million barrels and the previous week’s increase of 5.8 million barrels. Total motor gasoline inventories dropped by 1.4 million barrels but remained far above the five-year average. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.