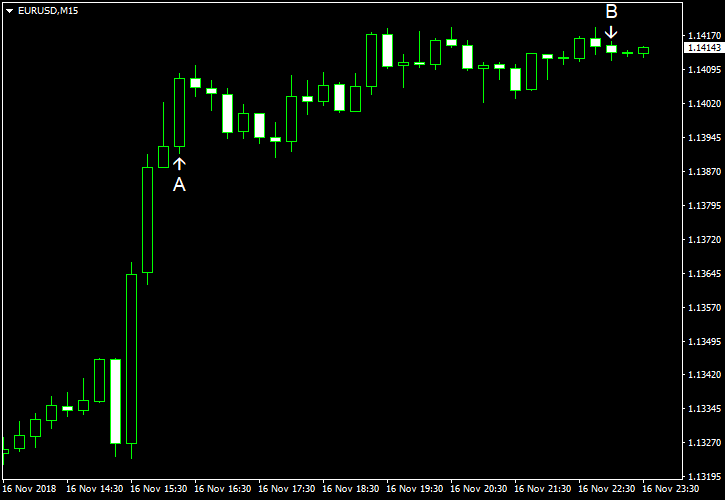

EUR/USD jumped today. Market analysts speculated that the possible reason for that was the dovish tone of several Federal Reserve officials. While Fed Chairman Jerome Powell was optimistic about US economic growth, he cautioned against headwinds to growth and fading fiscal stimulus. Fed Vice Chairman Richard Clarida said that the benchmark interest rate is getting close to a neutral level. Meanwhile, US economic reports released on Friday were disappointing, giving additional reason for the currency pair to rise.

Industrial production rose 0.1% in October, while analysts had predicted the same 0.2% rate of growth as in September (revised, 0.3% before the revision). Capacity utilization was 78.4%, in line with expectations. The September’s increase got a positive revision from 78.1% to 78.5%. (Event A on the chart.)

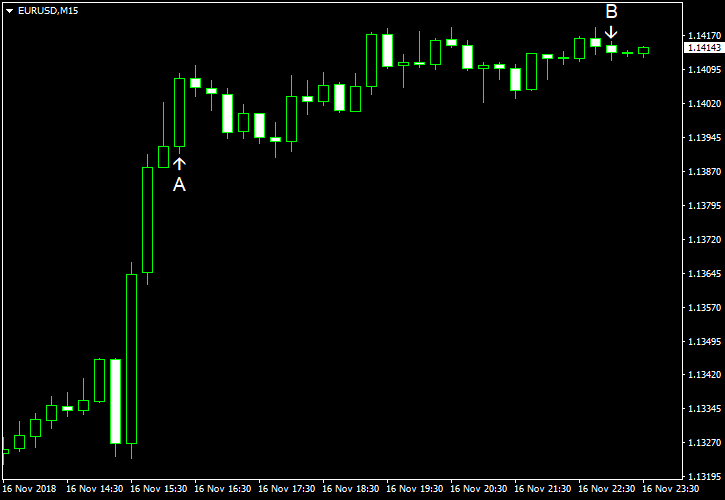

Net foreign purchases were at $30.8 billion in September. That is compared to $46.2 billion predicted by analysts and $131.7 billion registered in August. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.