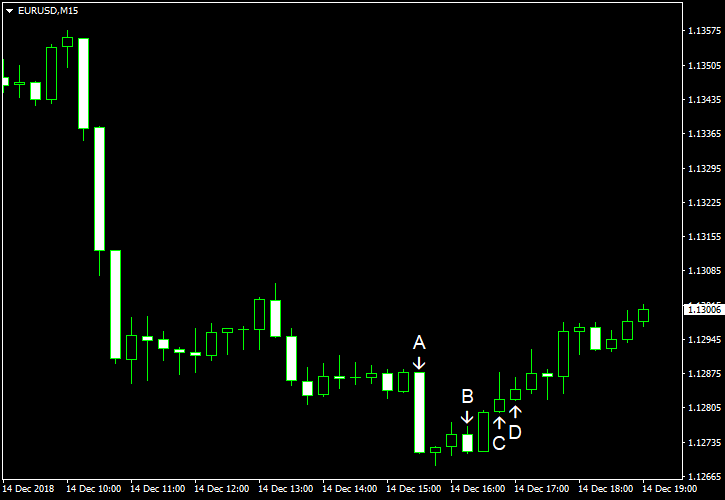

EUR/USD tanked today after economic reports released in the eurozone and China during the trading session turned out to be worse than market participants anticipated, putting the Forex market into a risk-off mode. Meanwhile, US retail sales were slightly above expectations, helping the dollar a bit, though the deviation from forecasts was minimal, and therefore not enough to give the currency any significant boost.

Retail sales rose 0.2% in November, exceeding the average forecast of a 0.1% increase. The increase in October got a positive revision from 0.7% to 1.0%. (Event A on the chart.)

Industrial production and capacity utilization rose in November, though both got a negative revision to their October values. Industrial production rose 0.6%, two times the forecast rate of increase of 0.3%, but the October reading was revised from an increase by 0.1% to a decrease of 0.2%. Capacity utilization was at 78.5%, in line with expectations, up from 78.1% in October (revised from 78.4%). (Event B on the chart.)

Markit manufacturing PMI slumped to 53.9 in December from 55.3 in November, far below the forecast level of 55.1. Markit services PMI declined to 53.4 from 54.7, also missing the consensus forecast, which had promised the index to stay unchanged. Both indicators reached the lows not seen in more than a year. (Event C on the chart.)

Business inventories rose 0.6% in October, matching forecasts exactly. The inventories expanded 0.5% in September. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.