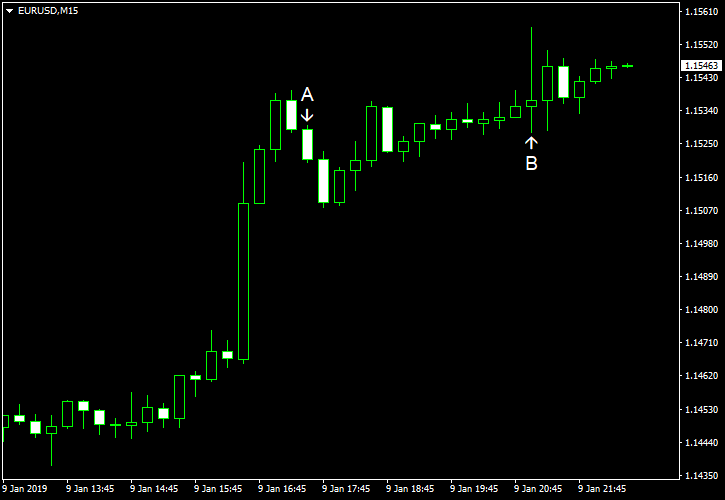

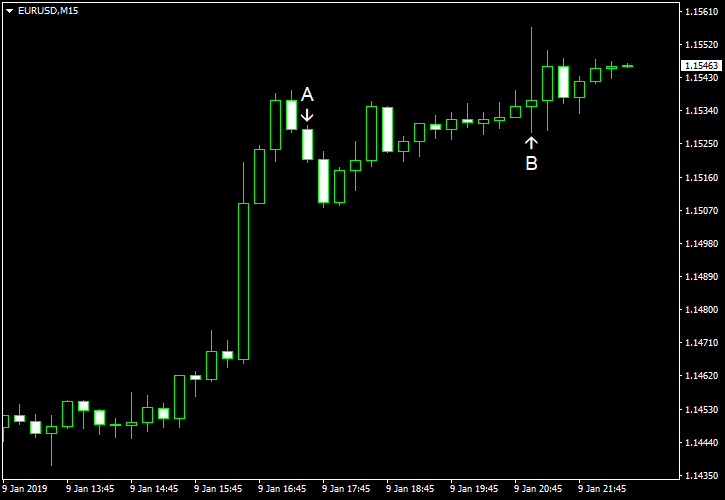

EUR/USD surged today as dovish comments from US policy makers resulted in doubts whether the Federal Open Market Committee will continue monetary tightening in 2019. FOMC minutes released today added to such doubts as markets considered the notes to be dovish.

US crude oil inventories shrank by 1.7 million barrels last week, though the decrease was not as big as 2.4 million predicted by analysts. The stockpiles remained above the five-year average for this time of year. The reserves were unchanged the week before. Total motor gasoline inventories increased by 8.1 million barrels and were also above the five-year average. (Event A on the chart.)

FOMC released minutes of its December monetary policy meeting today, in which it said (event B on the chart):

With an increase in the target range at this meeting, the federal funds rate would be at or close to the lower end of the range of estimates of the longer-run neutral interest rate, and participants expressed that recent developments, including the volatility in financial markets and the increased concerns about global growth, made the appropriate extent and timing of future policy firming less clear than earlier. Against this backdrop, many participants expressed the view that, especially in an environment of muted inflation pressures, the Committee could afford to be patient about further policy firming.

On Monday, a report on ISM services PMI was released, showing a drop to 57.6% in December from 60.7% in November. The average forecast had promised a higher reading of 59.6%. (Not shown on the chart.)

Yesterday, a report on consumer credit was released, showing an increase by $22.2 billion in November. That is compared to the increase by $24.9 billion registered in October and $17.3 billion predicted by analysts. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.