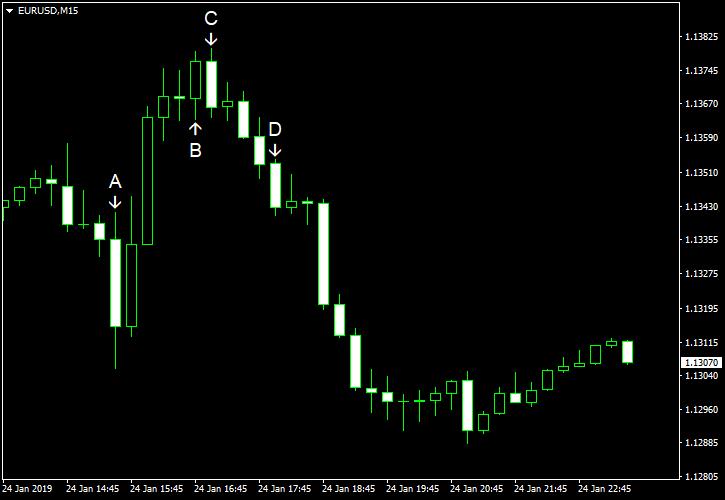

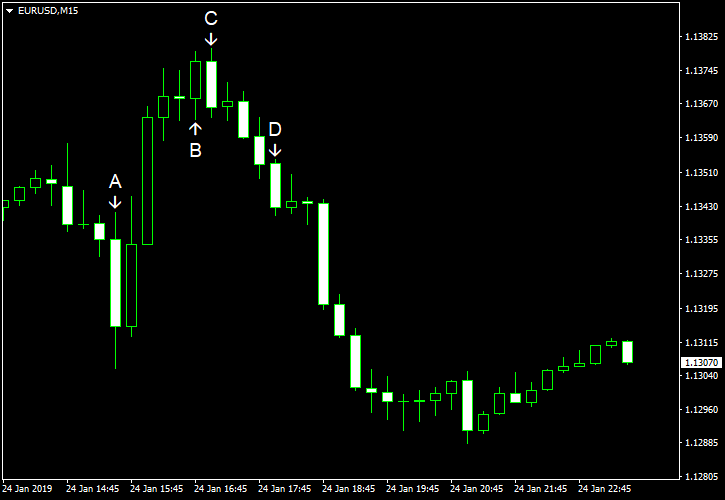

EUR/USD dropped today. The decline was largely a result of dovish comments from European Central Bank President Mario Draghi, though poor PMIs for the eurozone hurt the currency pair as well. (Event A on the chart.) Meanwhile, US reports were decent, with the unemployment and manufacturing reports being especially positive.

Initial jobless claims fell to 199k last week from the previous week’s slightly revised level of 212k. It was the lowest reading since 1969. Analysts were completely wrong with their predictions of an increase to 219k. (Event A on the chart.)

Markit manufacturing PMI rose to 54.9 in January from 53.8 in December instead of falling to 53.5 as analysts had predicted. Markit services PMI slipped to 54.2 from 54.4 but was above the 54.0 level predicted by forecasters. (Event B on the chart.)

Consumer confidence fell 0.1% in December, matching forecasts exactly, after rising 0.2% in November. (Event C on the chart.)

US crude oil inventories climbed by 8.0 million barrels last week, catching market participants off guard as they were expecting a small decline by 0.2 million barrels. Total motor gasoline inventories increased as well, rising by 4.1 million barrels. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.