- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 30, 2019

January 30

January 302019

US Dollar Rises on Strong Jobs Report, Capped by âPatientâ Fed

The US dollar is gaining against its currency rivals midweek after new data shows the labor market entered 2019 on a strong note. But the dollarâs ascent was capped by a âpatientâ Federal Reserve, suggesting that there will not be any moves on interest rates until at least June. According to ADP, US companies added 213,000 jobs in January, beating median estimates of 174,000. The labor gains were […]

Read more January 30

January 302019

Swiss Franc Drops, Dragged Down by Poor Macroeconomic Data

The Swiss franc fell against most of its major rivals today. Poor domestic macroeconomic data has likely played some part in the decline. The KOF Economic Barometer fell to 95.0 in January from 96.4 in December. Analysts had expected an increase to 96.8. The report commented on the result: The downward tendency that emerged at the end of last year continues. KOF added further: This renewed decline is especially attributable to negative developments […]

Read more January 30

January 302019

Australian Dollar Rallies After CPI Beats Expectations

The Australian dollar rallied today against most-traded peers thanks to the inflation print that came out slightly above expectations. The Australian Bureau of Statistics reported that the Consumer Price Index rose 0.5% in the December quarter of 2018 from the previous three months. Analysts had expected the same 0.4% rate of growth as in the September quarter. Year-on-year, the CPI rose 1.8%. The trimmed mean CPI rose 0.4% last quarter — in line with […]

Read more January 30

January 302019

Euro Range Bound on Mixed Eurozone Data, Drops on US Jobs Data

The euro today traded in a tight range amid subdued market activity as investors waited patiently for the FOMC rate decision scheduled for later today. The release of mixed data from across the eurozone had minimal impact on the EUR/USD currency pair, which continued to trade above the crucial 1.1400 level. The EUR/USD currency pair today traded between a high of 1.1450 and a low of 1.1421 before breaking lower following the release of the latest US jobs […]

Read more January 30

January 302019

Sterling Rallies Despite Brexit Uncertainty With Looming Deadline

The Sterling pound today rallied slightly against the US dollar after the UK Parliament approved Sir Brady’s amendment allowing the Prime Minister to renegotiate the Irish backstop plan. The pound’s gains were limited by the fact that the European Union has categorically stated that it will not reopen negotiations regarding the current Brexit deal as it is final. The GBP/USD currency pair today rallied from a low of 1.3066 to a high […]

Read more January 30

January 302019

EUR/USD Jumps After FOMC Dovish Statement

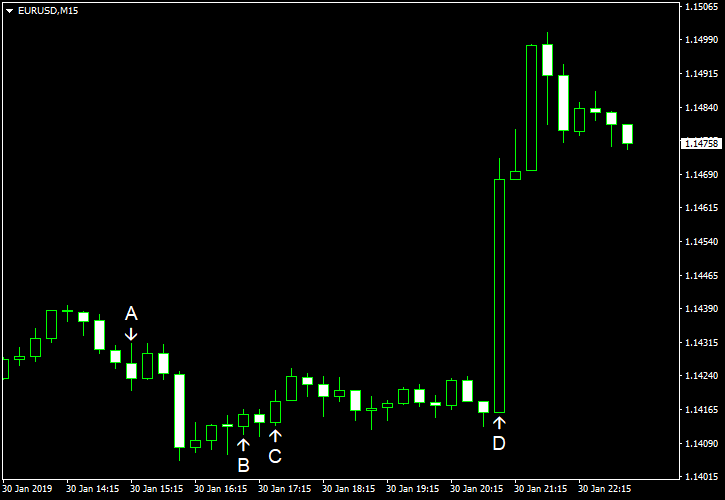

EUR/USD jumped sharply today after the Federal Open Market Committee demonstrated a dovish stance in its monetary policy statement. Before the release, the dollar was boosted by the better-than-expected employment data. ADP employment rose by 213k in January, exceeding the average forecast of 180k. The December increase got a negative revision from 271k to 263k. (Event A on the chart.) Pending home sales dropped by 2.2% in December instead of rising by 0.8% as analysts had predicted. […]

Read more