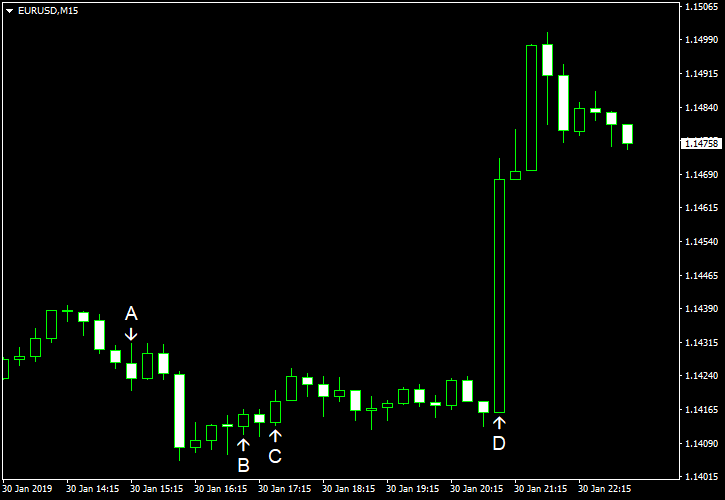

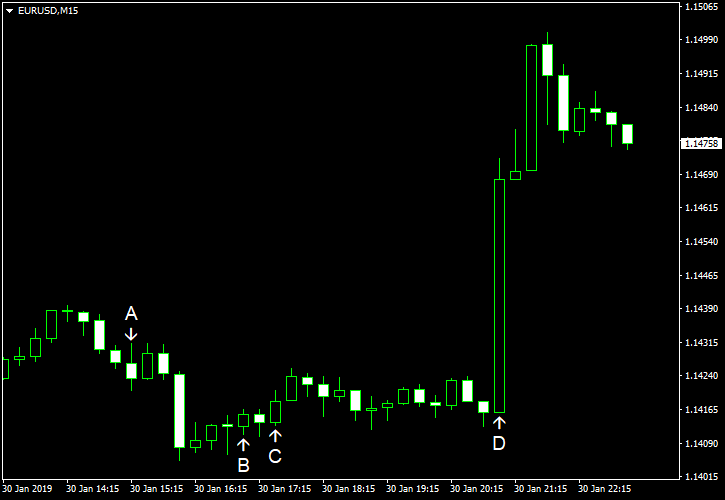

EUR/USD jumped sharply today after the Federal Open Market Committee demonstrated a dovish stance in its monetary policy statement. Before the release, the dollar was boosted by the better-than-expected employment data.

ADP employment rose by 213k in January, exceeding the average forecast of 180k. The December increase got a negative revision from 271k to 263k. (Event A on the chart.)

Pending home sales dropped by 2.2% in December instead of rising by 0.8% as analysts had predicted. The November drop was revised from 0.7% to 0.9%. (Event B on the chart.)

US crude oil inventories increased by 0.9 million barrels last week, far less than analysts had predicted — by 3.0 million barrels. The stockpiles were above the five-year average for this time of year. The week before, the reserves swelled by 8.0 million barrels. Total motor gasoline inventories decreased by 2.2 million barrels last week but remained above the five-year average. (Event C on the chart.)

FOMC left interest rates unchanged, as it was widely expected, and issued a dovish monetary policy statement. (Event D on the chart.) The Committee talked about patience in determining appropriate timing for further rate hikes:

In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.

Furthermore, at the press conference after the monetary policy meeting Federal Reserve Chairman Jerome Powell said that the case for raising interest rates has weakened.

Yesterday, a couple of reports were released (not shown on the chart):

S&P/Case-Shiller home price index rose by 4.7% in November, year-on-year, whereas experts had anticipated the same 5.0% rate of growth as in October. Month-on-month, the index fell 0.1%.

Consumer confidence dropped to 120.2 in January from 126.6 in December. Analysts had predicted a much smaller decline to 125.0.

If you have any comments on the recent EUR/USD action, please reply using the form below.