- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 28, 2019

February 28

February 282019

NZ Dollar Weak amid Risk Aversion, Mixed Data

The New Zealand dollar fell on Thursday amid risk aversion and mixed macroeconomic reports. The ANZ Business Confidence index dropped to -30.9 in February from -24.1 in January. The number of building consents gained 17% in January after rising 5.4% in December. The overseas trade index dropped 3.0% in the December quarter from the previous three months after falling 0.3% in the September quarter. Analysts had predicted a smaller drop by 1.0%. NZD/USD dropped […]

Read more February 28

February 282019

Poor Chinese Economic Data Overshadows Australian Reports, Dragging Aussie Down

The Australian dollar fell on Thursday and was one of the weakest currencies on the Forex market during the trading session. While domestic macroeconomic data was decent for the most part, poor reports from China and risk aversion on markets dragged the currency down. China’s official manufacturing Purchasing Managers’ Index fell to 49.2 in February from 49.5 in January, moving further away from the neutral 50.0 level. Economists had expected it to stay […]

Read more February 28

February 282019

Krona Gains as Sweden’s Economic Growth Beats Expectations

The Swedish krona gained today after data showed that the nation’s economy expanded last quarter two times the forecast amount. Statistics Sweden reported that gross domestic product jumped 1.2% in the fourth quarter of 2018 after contracting 0.1% in the previous three months. That is compared to the consensus forecast of a 0.6% growth. It was the fastest pace of expansion since the second quarter of 2017. USD/SEK traded at 9.2383 as of 21:34 […]

Read more February 28

February 282019

Negative Market Sentiment Allows Swiss Franc Ignore Economic Data

The Swiss franc gained today, getting boost from risk aversion on the Forex market. The currency gained even as domestic macroeconomic reports were extremely disappointing, demonstrating weakness of the Swiss economy. Switzerland’s State Secretariat for Economic Affairs reported that gross domestic product rose 0.2% in the fourth quarter of 2018, trailing the consensus forecast of a 0.4% increase. The increase followed the 0.3% drop in the previous quarter. The report explained that manufacturing was […]

Read more February 28

February 282019

US Dollar Weakens As Economy Slows in Q4, Jobless Claims Rise

The US dollar weakened against a basket of currencies on Thursday, driven by a slowing national economy in the fourth quarter and a bump in jobless claims in the last week. The greenbackâs losses were capped by a positive business barometer that suggested renewed activity. According to the Bureau of Economic Analysis (BEA), the gross domestic product (GDP) advanced at a 2.6% annual pace in the October-to-December period, beating market forecasts of 1.9%. While fourth-quarter GDP was higher than median […]

Read more February 28

February 282019

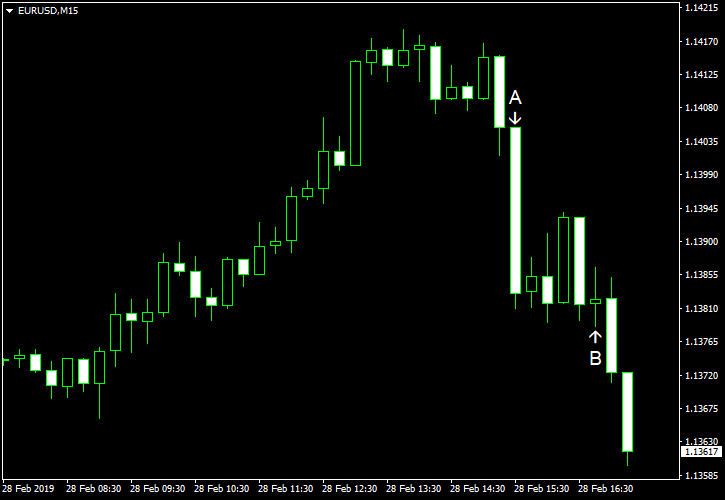

Euro Rallies Driven by Other Currency Cross, Drops on US GDP Data

The euro today rallied higher against the US dollar from the early European session driven largely by investor sentiment to hit over 3-week tops midway through the session. Shortly after, the EUR/USD currency pair plunged lower in a pullback that was compounded by the release of the upbeat US Q4 GDP data. The EUR/USD currency pair today rallied from a low of 1.1366 to a more than 3-week high of 1.1420 before retracing all […]

Read more February 28

February 282019

EUR/USD Loses Gains After Release of US GDP

EUR/USD was rising today but has lost all of its gains by now after a report showed that US gross domestic product rose last quarter more than was expected. Meanwhile, meeting between the US and North Korean leaders ended abruptly, putting markets into a risk-off mode. US GDP rose 2.6% in Q4 2018 according to the advance (first) estimate. Analysts had predicted a smaller increase […]

Read more