EUR/USD gained today, rising for the fourth consecutive trading session. Some market analysts explained the rally by US producer inflation, which missed expectations. But other US indicators were good, and it did not seem that macroeconomic data affected the currency pair to a great degree. Other analysts speculated that the euro benefited from the news from Great Britain. The UK Parliament rejected the revised Brexit deal agreed by Prime Minister Theresa May and the European Union. That led to speculations that the Brexit will be delayed.

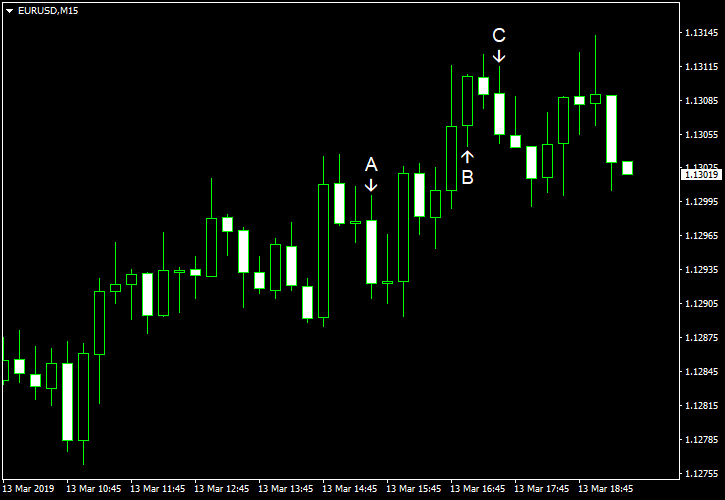

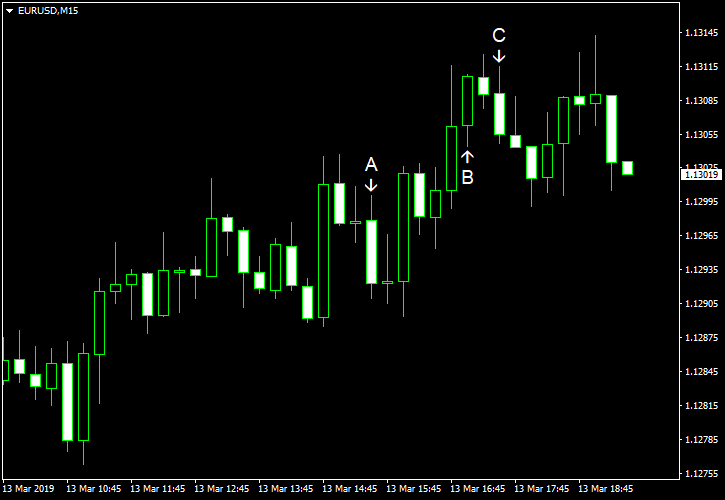

PPI rose 0.1% in February, missing the consensus forecast of a 0.2% increase. The index slipped 0.1% in January. (Event A on the chart.)

Durable goods orders rose 0.4% in January instead of falling 0.5% as analysts had predicted. The orders edged up 1.3% in December. (Event A on the chart.)

Construction spending grew by 1.3% in January from December. That is compared to the consensus forecast of a 0.4% increase and the drop by 0.8% logged in December. (Event B on the chart.)

US crude oil inventories shrank by 3.9 million barrels last week, whereas specialists had predicted a growth by 2.7 million barrels. Nevertheless, the stockpiles remained above the five-year average for this time of year. The week before, the reserves gained by 7.1 million barrels. Total motor gasoline inventories decreased by 4.6 million barrels but were also above the five-year average. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.