- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: March 21, 2019

March 21

March 212019

Sterling Pound Drops on BoE Rate Decision and Brexit Headlines

The Sterling pound today fell to new lows against the US dollar as it was buffeted by negative Brexit headlines from the early London session. The GBP/USD currency pair later fell to new record lows on rumors that the EU will allow an extension of Article 50 up to May 22, which is quite short. The GBP/USD currency pair today fell from a high of 1.3228 to a low of 1.3004 in the American session following […]

Read more March 21

March 212019

Norwegian Krone Gains After Norges Bank Hikes Interest Rates

The Norwegian krone managed to gain on the US dollar even though the greenback was generally strong today, rebounding after yesterday’s losses. The most likely reason for that was the interest rate hike by Norway’s central bank. The Norges Bank raised its main interest rate by 25 basis points to 1% at today’s monetary policy meeting. The central bank mentioned strength of the domestic economy: The Norwegian economy is expanding at a solid pace, […]

Read more March 21

March 212019

Swiss Franc Gains Despite SNB Keeping Negative Interest Rates

The Swiss franc rallied against most major currencies today, with the exception of the US dollar, which was rebounding after yesterday’s losses. Markets largely ignored the monetary policy meeting of the Swiss National Bank. As was expected, the SNB kept its interest rates in the negative territory, with interest on sight deposits staying at â0.75% and the target range for the three-month Libor at between â1.25% and â0.25%. While the central bank admitted that “the Swiss […]

Read more March 21

March 212019

Australian Dollar Surges After Employment Report, Loses Gains Later

The Australian dollar surged after release of a domestic employment report even though the data was mixed. By now, though, the currency has lost its gains, trading below the opening level against its most-traded rivals. The Australian Bureau of Statistics reported that the number of employed persons in Australia rose by just 4,600 in February from the previous month, seasonally adjusted, after increasing as much as 38,300 in January. Analysts had predicted a substantially […]

Read more March 21

March 212019

Euro Surges on Dovish Fed, Capped by Debt Warnings

The euro is rallying against a basket of major currencies on Thursday, buoyed by a dovish Federal Reserve. The gains were capped by a new report that sounded the alarm about public debt binges that threaten the stability of the currency. On Wednesday, the US central bank left its benchmark fed funds rate in the 2.25% to 2.5% range. It also reaffirmed its dovish stance by confirming it plans to raise interest rates just once […]

Read more March 21

March 212019

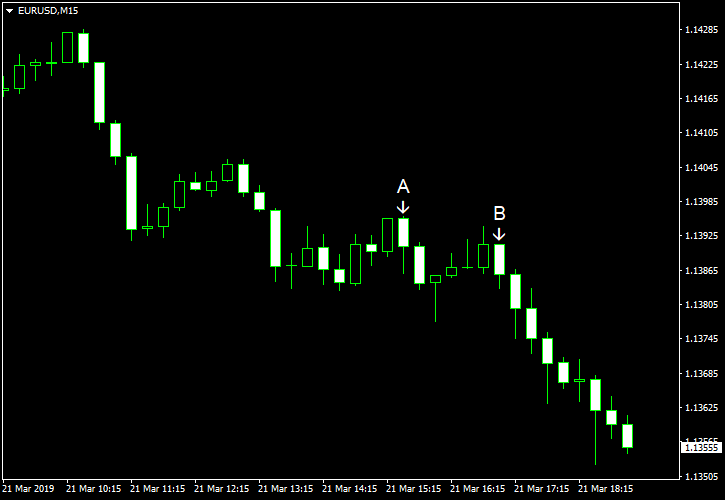

EUR/USD Reverses Gains Caused by Dovish FOMC

EUR/USD fell today, reversing yesterday’s gains caused by the extremely dovish stance of the Federal Open Market Committee, as traders were digesting the news. Market analysts speculated that the retreat can be just profit-taking after the sharp rally made the currency pair overbought, and in the future the dollar may still feel the pressure from the dovish stance of US policy makers. Yet for now the greenback is rebounding, and today’s US macroeconomic reports, being […]

Read more