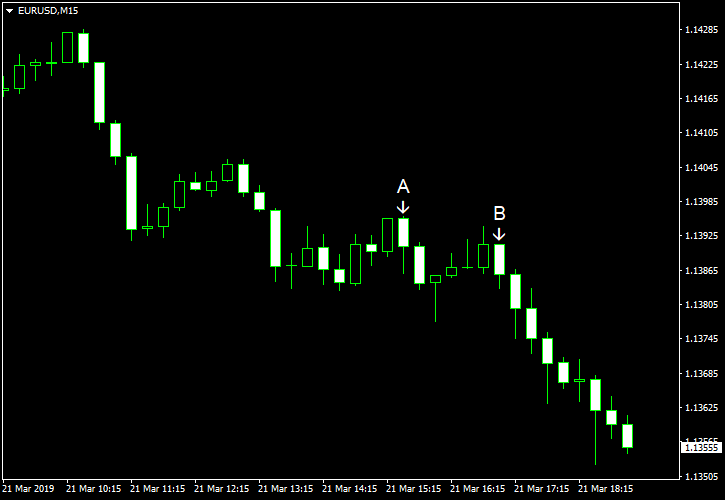

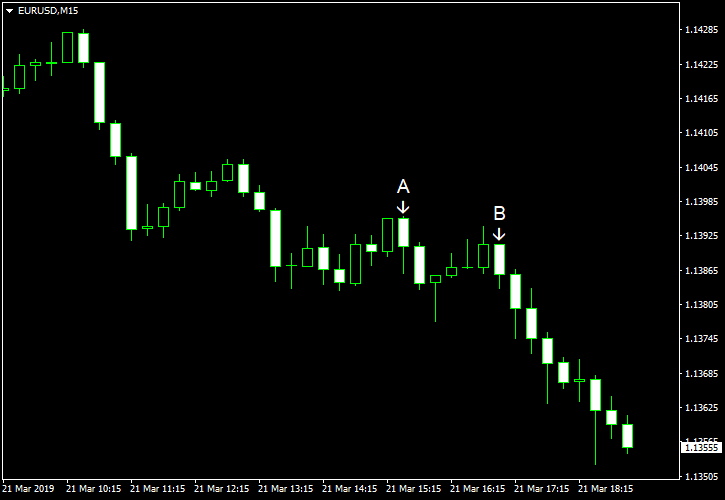

EUR/USD fell today, reversing yesterday’s gains caused by the extremely dovish stance of the Federal Open Market Committee, as traders were digesting the news. Market analysts speculated that the retreat can be just profit-taking after the sharp rally made the currency pair overbought, and in the future the dollar may still feel the pressure from the dovish stance of US policy makers. Yet for now the greenback is rebounding, and today’s US macroeconomic reports, being good across the board, helped the currency.

Philadelphia Fed manufacturing index jumped sharply from -4.1 in February to 13.7 in March. Experts had predicted a much smaller increase to 4.6. (Event A on the chart.)

Initial jobless claims slipped from 230k to 221k last week, below the reading of 226k predicted by analysts. (Event A on the chart.)

Leading indicators rose 0.2% in February after showing no change in January, beating the average forecast of a 0.1% increase. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.