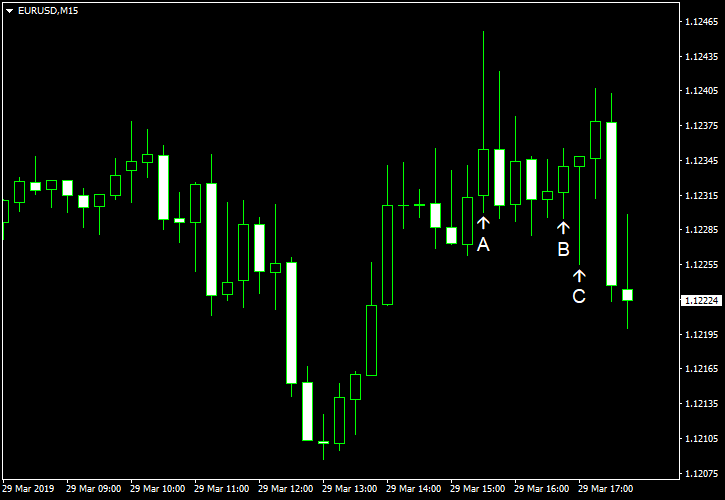

EUR/USD attempted to bounce today after three consecutive days of decline. Some market analysts speculated that the reason for that was the inflation data miss. But the currency pair was actually moving in a range after the US releases, failing to push further up.

Personal income rose 0.2% in February after falling 0.1% in January and climbing 1.0% in December. Personal spending rose 0.1% in January following the 0.6% drop registered in December. The data about spending in February was unavailable due to the government shutdown at the start of the year. Analysts had predicted an increase of 0.3% for both indicators. Core PCE inflation rose 0.1% in January, while experts had anticipated the same 0.2% rate of growth as in December. Inflation data for February was unavailable as well. (Event A on the chart.)

Chicago PMI dropped to 58.7 in March from 64.7 in February, below the 61.1 figure predicted by analysts. (Event B on the chart.)

Michigan Sentiment Index climbed to 98.4 in March from 93.8 in February according to the revised estimate. Market participants were expecting the same 97.8 reading was in the preliminary estimate. (Event C on the chart.)

New home sales were at the seasonally adjusted annual rate of 667k in February, up from 636k in January (positively revised from 607k). That is compared to the analysts’ average estimate of 625k. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.