- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 12, 2019

June 12

June 122019

US Dollar Mixed on Lower-Than-Expected Inflation Data

The US dollar is mixed against several major currency rivals midweek after new lower-than-expected inflation data was released. Prices have proven to be major drivers of the greenback this week, mainly because there have been little updates to the US-China trade dispute and the brief US-Mexico trade spat concluded. On monetary policy, it will likely be speculation until the next Federal Reserve meeting. According to the Bureau […]

Read more June 12

June 122019

British Pound Rallies on Johnson Campaign Launch, Later Retreats

The British pound today rallied to new weekly highs against the US dollar following Boris Johnson‘s launch of his campaign to become the next Conservative Party leader. The GBP/USD currency pair later fell as the US dollar recovered and investor sentiment shifted away from the pound amid the leadership uncertainty occasioned by Theresa May‘s impending departure. The GBP/USD currency pair today rallied to a weekly high of 1.2759 before falling to a low of 1.2685 […]

Read more June 12

June 122019

Japanese Yen Gains as Risk Appetite Wanes, Domestic Data Supports

The Japanese yen gained today as risk appetite of investors was waning, making them more interested in buying safer currencies, like the yen. Domestic macroeconomic data was also supportive for the Japanese currency. Japan’s Cabinet Office reported that core machinery orders rose by 5.2% in April from the previous month after rising 3.8% in March. That is instead of falling 0.8% as analysts had predicted. The Bank of Japan reported […]

Read more June 12

June 122019

Australian Dollar Remains Soft After Domestic, China’s Data

The Australian dollar continued to demonstrate weakness as risk appetite was slowly coming off markets. Domestic macroeconomic data was weighing on the currency further as the consumer sentiment deteriorated sharply. And while China’s consumer inflation was accelerating, painting a positive picture of the economic health of Australia’s biggest trading partner, that led to concerns that Beijing may withdraw stimulus if prices continue to rise at a fast pace. The Westpac-Melbourne Institute Index […]

Read more June 12

June 122019

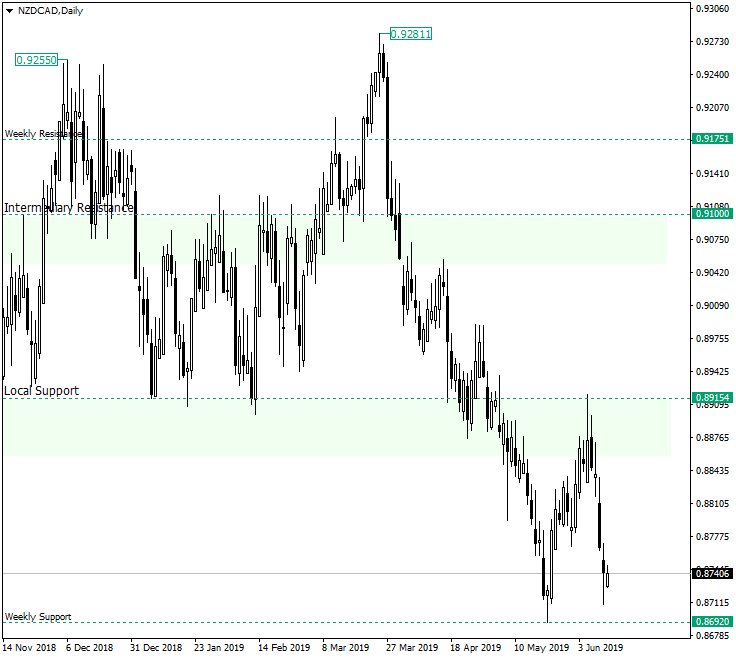

NZD/CAD to Test the Important 0.8692 Weekly Level

NZD/CAD to Test the Important 0.8692 Weekly Level The pair could have a place to recover from, but the current context might just favor the continuation of the descent. Long-term perspective The New Zealand dollar versus the Canadian dollar currency pair looks as if it does not have enough steam to initiate and fuel a rally. Since the high at 0.9281, after which it came beneath two important levels that could have […]

Read more June 12

June 122019

EUR/USD Sinks Despite Slowing US Consumer Inflation

EUR/USD was falling during the Wednesday’s trading session. The currency pair made a short-lived attempt to rally on the back of slowing US inflation but quickly resumed its decline. CPI rose 0.1% in May, in line with expectations, after rising 0.3% in April. (Event A on the chart.) US crude oil inventories increased by 2.2 million barrels last week instead of falling by 1.0 million barrels as analysts had predicted. The stockpiles swelled […]

Read more