- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 20, 2019

June 20

June 202019

US Dollar Hurt by Philly Fed Manufacturing Index, Buoyed by Jobless Claims

The US dollar is trading downwards one day after the Federal Reserve left interest rates unchanged, but the central bank leaving the door open to a future rate cut should the data support a move might be driving down the dollar. The greenback declined more on the Philadelphia Federal Reserve Bank manufacturing survey, though its descent was capped by lower-than-expected jobless claims. According to the Bureau of Labor Statistics (BLS), the number […]

Read more June 20

June 202019

Canadian Dollar Attempts to Rally Following Rising Prices for Crude

The Canadian dollar attempted to rally against its major rivals today. While the currency managed to log gains against most of them, the rally was limited, and the loonie was unable to outperform the extremely strong Swiss franc. The Canadian currency gained after the news that Iran shot a US drone. While usually geopolitical tensions and resulting risk aversion hurt the loonie, the event was beneficial for crude oil, and by the same token for the Canadian […]

Read more June 20

June 202019

Swiss Franc Strongest due to Middle East Tensions

The Swiss franc was in spotlight today, being the strongest currency on the Forex market. The reason for that was geopolitical tensions in Middle East. The reason for the franc’s extremely good performance was the news that Iran downed a US drone. Unsurprisingly, the event worsened the already strained relationships between the United States and Iran. The Swissie, being considered a safe currency, often thrives in an environment of fear and risk aversion, and that was certainly the case today. […]

Read more June 20

June 202019

Sterling Rallies on USD Weakness, Falls on Dovish BoE Decision

The British pound today fell from its daily highs in the mid-London session following the dovish outlook painted by the Bank of England following its rate decision. The GBP/USD currency pair had rallied to its daily highs earlier in the session by riding on the wave of broad US dollar weakness following yesterday’s dovish FOMC statement. The GBP/USD currency pair today rallied from an opening low of 1.2651 to a high of 1.2727 in the mid-London session before […]

Read more June 20

June 202019

Yen Soft After BoJ Meeting, Domestic Data

The Japanese yen rose against the US dollar but fell versus most other currencies today following the monetary policy announcement from the Bank of Japan and the release of all industry activity data. As was widely expected, the BoJ left its monetary policy unchanged, with the main interest rate staying at -0.1% and the size of annual asset purchases at Â¥80 trillion. Regarding the outlook for the domestic economy the central bank said: […]

Read more June 20

June 202019

Aussie Mixed After Lowe Talks About Interest Rate Cuts

The Australian dollar was mixed today, falling against some rivals and rising versus others. The Aussie remained vulnerable due to prospects for additional interest rate cuts from the Reserve Bank of Australia. RBA Governor Philip Lowe said in a speech today that additional interest rate cuts are possible: The most recent data â including the GDP and labour market data â do not suggest we are making […]

Read more June 20

June 202019

NZ Dollar Rallies as Economic Growth Remains Stable

The New Zealand dollar rallied today after a report showed that nation’s economic growth remained stable. Statistics New Zealand reported that gross domestic product rose 0.6% in the March quarter from the previous three months. It was the same pace of growth as in the previous quarter and matched forecasts exactly. On an annual basis, GDP grew 2.7%. NZD/USD surged from 0.6537 to 0.6587 as of 10:29 GMT today. NZD/JPY gained […]

Read more June 20

June 202019

Norwegian Krone Soars After Norges Bank Hikes Interest Rate

The Norwegian krone surged today after the nation’s central bank announced an interest rate hike and signaled about probability of additional hikes in the future. The Norges Bank announced today that it raises its main interest rate by 0.25 percentage point to 1.25 percent. The bank commented on the decision: Growth in the Norwegian economy is solid, and capacity utilisation is estimated to be somewhat above a normal level. Underlying inflation is a little […]

Read more June 20

June 202019

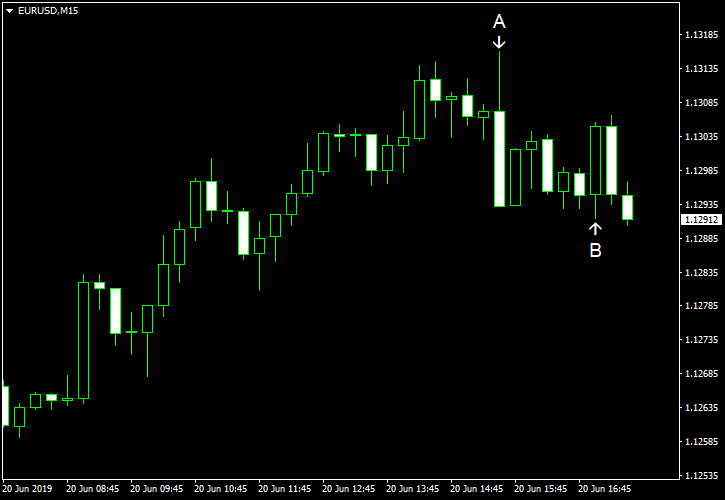

EUR/USD Extends Rally on Dovish Fed, Poor US Data

EUR/USD extended yesterday’s rally today as the US dollar remained extremely weak due to unexpectedly strong dovishness of the Federal Reserve. US macroeconomic data was not helping the greenback either as almost all indicators released today failed to meet expectations. Philadelphia Fed manufacturing index dropped from 16.6 in May to 0.3 in June, far below the forecast level of 10.6. (Event A on the chart.) Current account balance deficit narrowed to $130.4 […]

Read more