- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 28, 2019

June 28

June 282019

Canadian Dollar Trades a Tad Higher After Positive Surprise from GDP

The Canadian dollar logged gains today, though they were very mild. As many other currencies, the loonie traded not far from the opening level as traders were waiting for news about the trade talks between the Unite States and China. As for domestic news, Canada’s gross domestic product provided a positive surprise, and other macroeconomic indicators were also above expectations. Statistics Canada reported that GDP rose 0.3% in April […]

Read more June 28

June 282019

US Dollar Flat on Mixed Data As Market Expects Sideways Trade in Second Half

The US dollar ended the trading week flat against a basket of currencies as an influx of economic data came out. While spending and inflation matched market expectations, consumer sentiment was a lot lower than the median estimates. With the first half of 2019 in the history books, the market now anticipates the greenback to either weaken or trade sideways in the second half. According to the Bureau of Economic Analysis (BEA), personal income rose 0.5% in May, unchanged […]

Read more June 28

June 282019

Pound Strongest on Friday, Remains Among Weakest for the Week

The Great Britain pound was the strongest major currency today, rising against all of its most-traded rivals. While there were plenty of macroeconomic reports released in the United Kingdom during the trading session, the most likely reason for the rally was profit-taking by bears as the sterling was still one of the weakest currency during this week. The current account deficit widened to £30.0 billion in the first quarter of 2019 from £23.7 billion in the previous […]

Read more June 28

June 282019

Swiss Franc Loses Gains, Domestic Data Doesn’t Help

The Swiss franc attempted to rally today but by now has lost its gains against almost all of its most-traded rivals, with the exception of the euro. Domestic macroeconomic data was not helpful to the currency. The KOF Economic Barometer was at 93.6 in June, down a little from 93.8 in May. Ahead of the report, analysts had predicted an improvement to 94.2. Tellingly, the report was titled “Stagnation at a Low Level”, and it commented on the result: […]

Read more June 28

June 282019

Euro Rallies on Upbeat German and Eurozone Data, Later Falls

The euro today rallied higher against the US dollar following the release of upbeat German and eurozone macro data in the early European session. The EUR/USD currency pair later fell from its highs as investor sentiment shifted, but rallied briefly on the weak US macro releases before falling again. The EUR/USD currency pair today rallied from a daily low of 1.1359 in the Asian session to a high of 1.1394 twice each time retracing […]

Read more June 28

June 282019

EUR/USD Gains as Eurozone Inflation Accelerates

EUR/USD gained today. Market analysts speculated that the reason for the rally were inflation figures released in the eurozone today, most of which exceeded expectations and showed accelerating inflation. Meanwhile, US core PCE inflation remained stable, and other macroeconomic indicators were mixed. Both personal income and spending rose in May. Personal income rose 0.5%, the same as in April and exceeding the average forecast of an increase by 0.3%. Personal spending increased 0.4%, […]

Read more June 28

June 282019

Australia’s Private Sector Credit Remains Stable, Aussie Pays Little Attention

The Australian dollar was either flat or lower versus its major rivals today as currencies were struggling to find directions ahead of the US-China trade talks on the weekend. Domestic macroeconomic data, which came out within expectations, was of limited interest to traders. The Reserve Bank of Australia reported that private sector credit rose 0.2% in May from the previous month, seasonally adjusted. It was the same rate of growth as in April. […]

Read more June 28

June 282019

Japanese Yen Flat as Markets Wait for G20 Outcome

The Japanese yen was trading either flat or slightly lower versus its most-trade rivals today as traders were cautious, waiting for the outcome of the meeting between the leaders of the United States and China at the Group of Twenty summit. There were plenty of macroeconomic reports released in Japan today. The Bank of Japan also released the Summary of Opinions at its latest monetary policy meeting. The BoJ released today the Summary of Opinions at the last week’s monetary policy […]

Read more June 28

June 282019

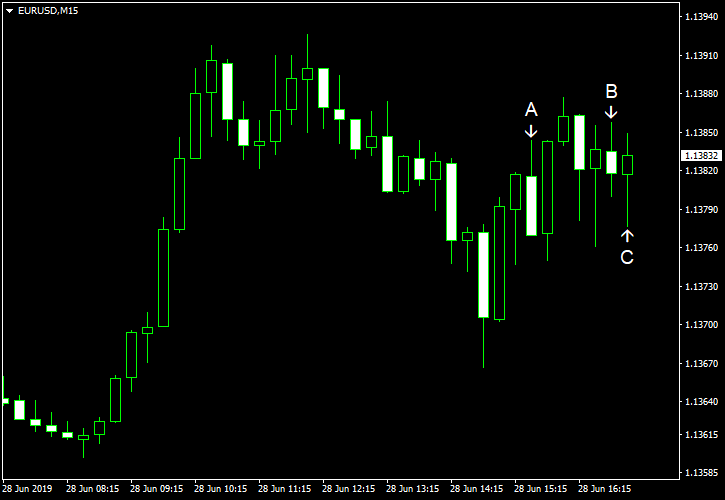

USD/JPY Prepared to Continue the Way to 105.50

The US dollar versus the Japanese yen currency pair looks well contained into the descending trend, a context for which the bears could only be joyful for. Long-term perspective Since the end of April 2019, after the price confirmed once more the important resistance area of 112.20, the price materialized a descending trend that, until now, extended as far as 106.92 and by doing so also pierced the important support area of 108.12. Of course, […]

Read more