- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 17, 2019

July 17

July 172019

Japanese Yen Mixed After Fitch Maintains Credit Rating

The Japanese yen was mixed today after Fitch Rating maintained Japan’s sovereign credit rating. The forecasts made by the agency were not all good, though. Fitch Ratings maintained Japan’s Long-Term Foreign-Currency Issuer Default Rating at ‘A’. The outlook is stable. The rating agency cited the following reasons for its decision: Japan’s ratings balance the strengths of an advanced and wealthy economy, with high governance standards and strong public institutions, […]

Read more July 17

July 172019

Euro Struggles to Rally Despite Upbeat Eurozone Inflation Data

The euro today attempted to rally against the US dollar from the Asian session but encountered massive resistance despite the release of upbeat euro area inflation data. The EUR/USD currency pair could not muster enough momentum to mount a sustained rally as each attempt was quickly countered by a retracement as the bears stepped in. The EUR/USD currency pair today rallied from a low of 1.1200 in the early European session to a high of 1.1233 in the American […]

Read more July 17

July 172019

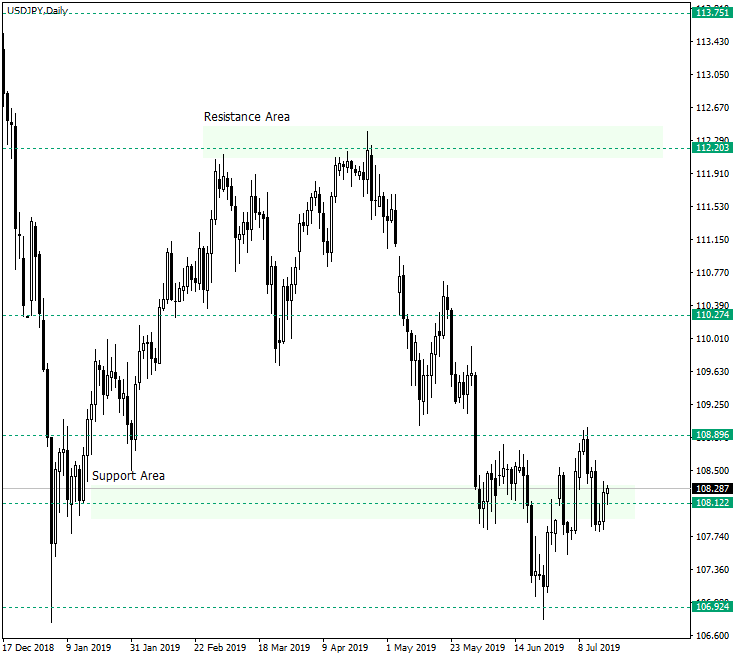

USD/JPY Possibly Preparing a New Leg Down Towards 107.00

The US dollar versus the Japanese yen might look as if it is ready for a rally, but the chart tells a different story. Long-term perspective After confirming the resistance area at 112.20, the price entered a descending phase that confirmed, on June 25, 2019, the support of 106.92, which corresponds to the psychological level of 107.00. Adding the fact that the same level was confirmed at the beginning of 2019, the price should have appreciated in a very convinced […]

Read more July 17

July 172019

US Dollar Takes a Breather After Strong Data Sparks Rally

The US dollar is taking a breather midweek following a strong session on Tuesday, driven by strong economic data that left investors feeling ebullient. A string of housing numbers did come out, but the market did anticipate weakness in the sector, which could adjust tradersâ minds about the worldâs largest economy being on solid footing. It has been a rough year for the national real estate market, and the mortgage applications data […]

Read more July 17

July 172019

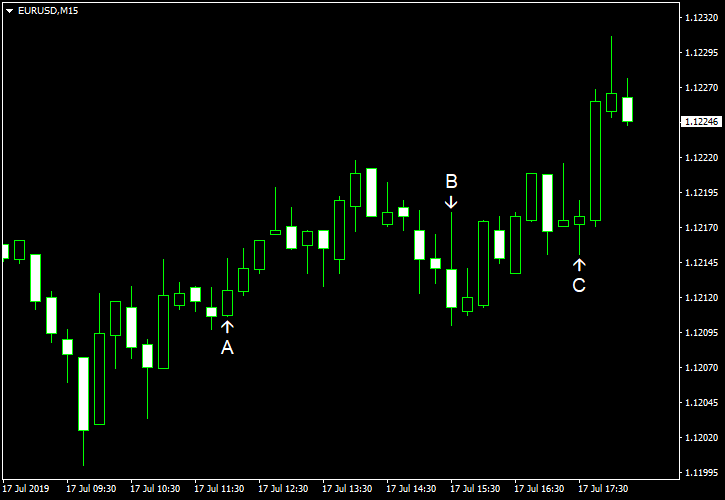

EUR/USD Rebounds on Eurozone CPI

EUR/USD dipped intraday but rebounded later today after the release of a better-than-expected eurozone consumer inflation report. (Event A on the chart.) The session was light in terms of US macroeconomic releases. Both housing starts and building permits fell in June. Housing starts were at the seasonally adjusted annual rate of 1.25 million, down from 1.27 million in May. Building permits were at the seasonally adjusted annual rate of 1.22 million, down […]

Read more