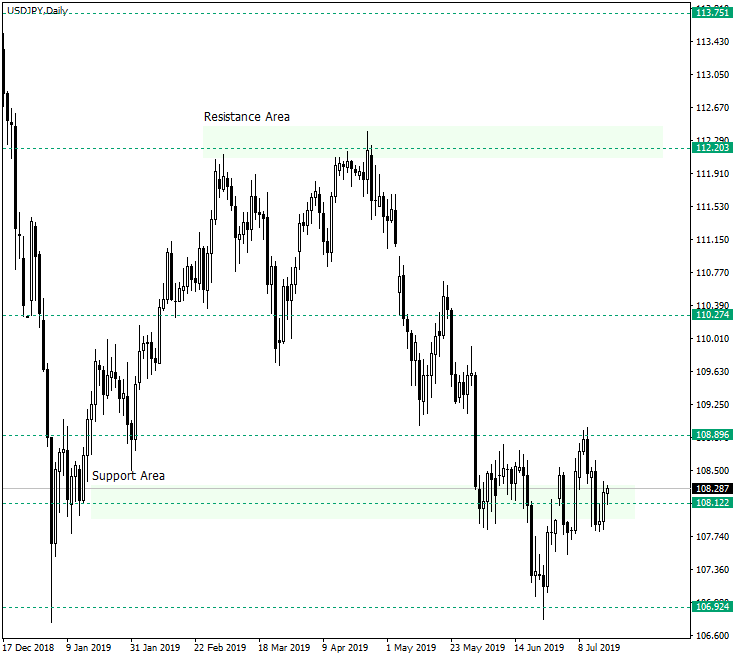

The US dollar versus the Japanese yen might look as if it is ready for a rally, but the chart tells a different story.

Long-term perspective

After confirming the resistance area at 112.20, the price entered a descending phase that confirmed, on June 25, 2019, the support of 106.92, which corresponds to the psychological level of 107.00. Adding the fact that the same level was confirmed at the beginning of 2019, the price should have appreciated in a very convinced manner. But what happened is that it got stuck at the previous support area of 108.12, and that after it failed to pierce 108.89.

In other words, it looked like 108.12 was falsely pierced and that the price will confirm it, yet again, as support and continue the move to the north. However, the takuri on 11 July was invalidated by the next day’s bearish engulfing candle. Even if it is not the classic engulfing pattern the facts that it engulfed that takuri and it made a lower low spoils the bullish optimism.

Given these circumstances, any appreciation is seen by the bears as a new opportunity to short the market. As long as 108.89 is not taken out, 107.00 (106.92 on the chart) remains a prime target.

Short-term perspective

The 106.77 low and the 108.98 high are joined by the concentration of the price in a flat lined up by 108.49 as resistance and 107.55 as support.

The fall from 108.98 that brought the price under 108.49 and caused the confirmation of the latter as resistance points again to a bearish dominance.

The Fibonacci retracement’s key levels match with the edges of the flat. Once 61.8 (or 107.55) is taken out, the price will test once again the previous low, at 106.77. For the moment the 38.2 level seems to hold but if the price will not be able to pierce and confirm as support the 23.6 level (or 108.49) or if it falls again under 38.2, then 50.0 might not be able to withstand a new bearish pressure. In this case, the door to 107.55, followed by 107.89 and 106.77, will be open.

Levels to keep an eye on:

D1: 108.12 106.92 108.89

H4: 107.55 107.08 108.49

Fibonacci retracement on H4: 38.2 50.0 23.6

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.