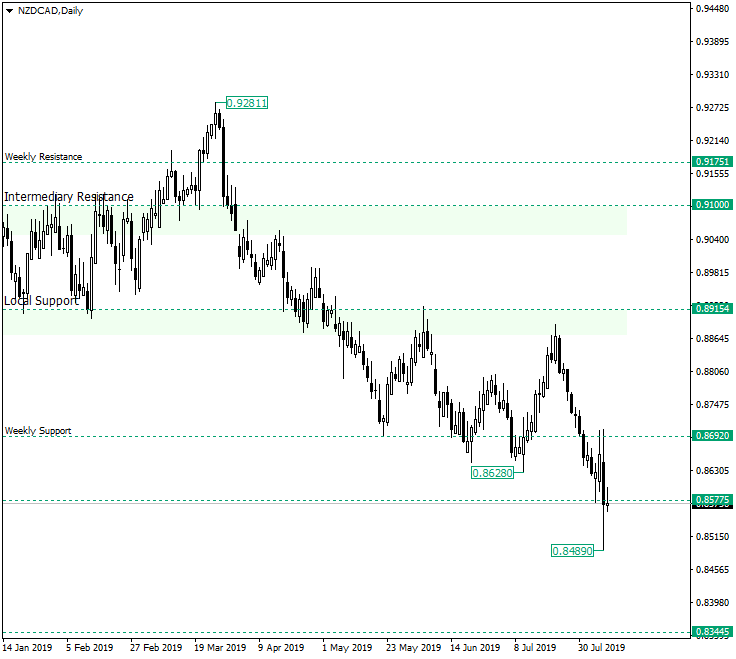

The New Zealand dollar versus the Canadian dollar currency pair managed to confirm as resistance the the last bearish standing point.

Long-term perspective

After the decline it started from 0.9821 the price reached the weekly support of 0.8692. From there it rallied, but instead of regaining 0.8915 it turned it into a resistance and dropped, piercing the 0.8692 support, a well established level. The fall also punctured 0.8577 and extended until 0.8489 where it printed a low.

But the strong retracement left a long lower tail to the very convinced bearish candle, which closed around 0.8577. For the moment this cannot be considered a false break that would credit the bulls, but a cautious profit taking from the bearish side meant to avoid an over-extension.

Of course, after this phase, the bears are expecting new and better prices in order to get back in the market. So, as a consequence, further advancement to the north is to be expected. However, it should not go beyond the body (opening price) of the August 7, 2019, candle. If it does, then it would represent a sign that the bulls just might try a comeback, in which case a false break of 0.8692 must materialize in order to invalidate the bullish attempt.

In other words, any lower high with respect to August 7, 2019, may attract further bears to join the descent towards 0.8344, which represents the main target. Only reconfirming 0.8692 as support will give the bulls another try to pierce 0.8915.

Short-term perspective

The downwards movement ends with an increase in volatility, which calls for a waiting period in order to give the market the chance to find its direction.

As long as the price remains under 0.8667, revisits of the 0.8516 support are to be expected. If the latter is pierced, then — after confirming it as resistance — the price should target the 0.8400 psychological level.

Levels to keep an eye on:

D1: 0.8692 0.8577 0.8344

H4: 0.8667 0.8516 0.8400

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.