- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 14, 2019

August 14

August 142019

US Dollar Rallies Despite Recession Talk Amid Inverted Yield Curve

The US dollar is strengthening against other most-traded currencies midweek, possibly befuddling some passive investors after noticing a lot of recession talk trending across the online world. As the financial markets drown in an ocean of red ink and the primary measurement of the yield curve temporarily inverted, there is a fear that the US economy is on the cusp of slipping into a downturn. The biggest story on Wednesday was the key gauge of the yield curve. This […]

Read more August 14

August 142019

Eruo Falls as Fears of a Recession in Germany Dominate Markets

The euro today attempted to rally against the US dollar but failed to make any significant gains as investors sold the single currency on disappointing German GDP data. The EUR/USD currency pair failed to break above the crucial 1.1200 level amid selling pressure as fears of a German recession drove investors to the safe-haven dollar. The EUR/USD currency pair today rallied to a high of 1.1191 in the mid-European session before falling to a low of 1.1137 in the American session […]

Read more August 14

August 142019

Pound Rallies on Upbeat UK Inflation, Drops on Recession Fears

The Sterling pound today rallied higher against the US dollar in the early London session following the release of the latest UK inflation data, which beat expectations. The GBP/USD currency pair later trimmed its gains as fears of a recession in the UK hit investors following the inversion of the UK yield curve for the first time since the 2008 financial crisis. The GBP/USD currency pair today rallied from a daily low of 1.2045 to a high of 1.2100 on the upbeat […]

Read more August 14

August 142019

Positive Domestic Data Unable to Help Australian Dollar

The Australian dollar fell today, joining its New Zealand peer in decline. While domestic macroeconomic data was good, it was not enough to outweigh the impact of disappointing economic indicators released in China, Australia’s biggest trading partner. The Australian Bureau of Statistics reported that the Wage Price Index rose 0.6% in the June quarter from the previous three months on a seasonally adjusted basis. Ahead of the report, analysts had predicted […]

Read more August 14

August 142019

NZ Dollar Retreats After Chinese Indicators Miss Expectations

The New Zealand dollar declined today following yesterday’s gains. While the positive news about the US-China trade conflict supported riskier commodity currencies yesterday, a big miss in some important Chinese macroeconomic indicators overshadowed the supportive fundamentals today. The National Bureau of Statistics of China released several important macroeconomic indicators for July today. Industrial production rose 4.8%, year-on-year, slowing from 6.3% in June and missing the median forecast of a 6.0% […]

Read more August 14

August 142019

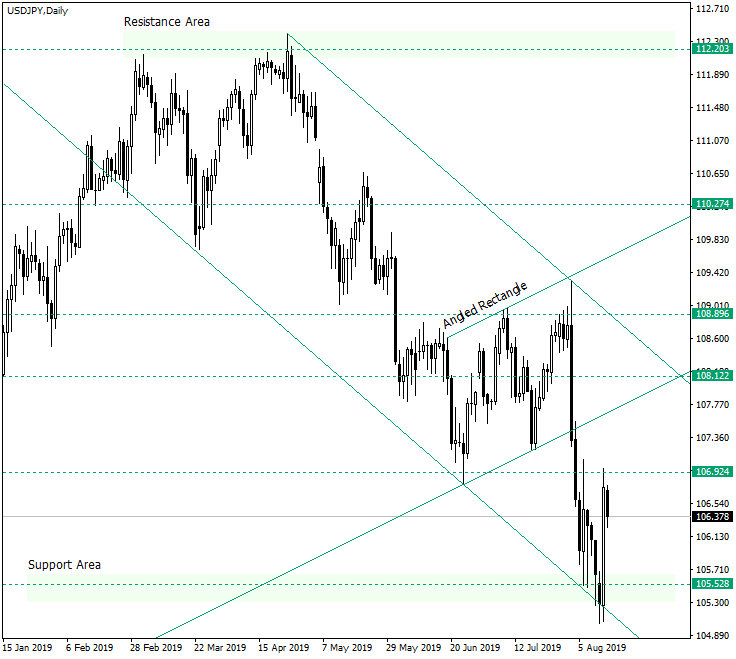

At 105.50 USD/JPY Takes a Pause from Descending

The US dollar versus the Japanese yen currency pair retraced shapely from the important support area of 105.50 and reached the previous resistance level of 106.92. There are several possibilities in the books for the upcoming time. Long-term perspective From 112.20 the price is in a descending trend. Along the way it is embossed by important levels like 105.52 which ended the impulse started from 108.89, 106.92 which is the starting point of the previous […]

Read more August 14

August 142019

EUR/USD Declines as USA Postpones Tariffs on Chinese Goods

EUR/USD declined for the second day today after Washington announced yesterday that it will delay implementation on new tariffs on Chinese goods till December. It will be done to relieve pressure on consumers during the Christmas season. US macroeconomic data was decent enough to provide an additional boost to the dollar. Both import and export prices rose 0.2% in July after falling in June. Analysts did not expect any […]

Read more