The New Zealand dollar versus the Canadian dollar currency pair had the chance to make new lows, but, by failing, it got above a zone that could propel it towards new highs.

Long-term perspective

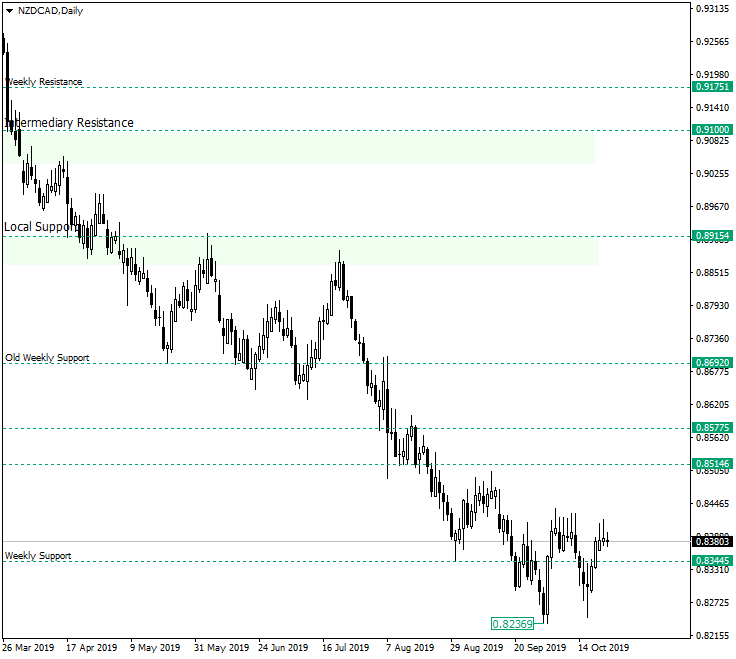

After the second confirmation of the local support of 0.8915 as resistance, the price began a bearish movement that etched a low at 0.8236 and under the 0.8344 weekly support. The bulls pushed the price back above 0.8344 and consolidated there, thus also making a higher high concerning the September 25 high. The consolidation allowed the price to pass back under 0.8344 where it made a new higher low in relation with the low at 0.8236, a development that continued with the price migrating back above 0.8344 yet again.

The previous two closed candles — October 21 and 22, respectively — are pin-bars, hence the expectations would be for the price to print a new downwards leg. But, given the two lows and the fact that they translate into a false piercing of an important support level, the conclusion is that appreciation is the logical expectation.

So, as long as the price oscillates above 0.8344 — and if it doesn’t, as long as the 0.8236 low is not taken out — the target is represented by 0.8514, followed by 0.8692.

Short-term perspective

The price is in a flat limited by the 0.8417 resistance and the 0.8239 support, with an intermediary support at 0.8307.

Given the perspective discussed on the daily, any downwards movement is an opportunity for the bulls. As a consequence, if the price revisits 0.8307, then 0.8417 has great chances to give way.

Of course, the price could print a low way above 0.8307 or it could even try to appreciate from here — at the time of writing, 0.8383. Either way, the bulls still have at least one more try to breach the 0.8417 resistance. Once that happens, 0.8516 is a fist target.

Only a false break of 0.8417 would delay any bullish advancement or even take it off the table for some time.

Levels to keep an eye on:

D1: 0.8344 0.8514 0.8692

H4: 0.8417 0.8307 0.8239 0.8516

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.