- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 24, 2019

October 24

October 242019

Mexican Peso Mixed on Economy, Trade Uncertainty

The Mexican peso is mixed against several major currency pairs on Thursday as investors remain uncertain as to how to trade the country and the currency. There are signs that the economy is still slumping, despite cuts to interest rates and a populist left-leaning government willing to spend money. With trade uncertainty lingering in the background, the peso might be in store for some choppy waters. In August, Mexicoâs economy tumbled 0.9% from the same time […]

Read more October 24

October 242019

Euro Drops as Draghi Defends His Legacy After ECB Rate Decision

The euro fell against the US dollar in the American session following a spike higher shortly after the announcement of the European Central Bank‘s rate decision. The EUR/USD currency pair rallied to its daily highs in the early European session on mixed IHS Markit flash PMI releases from the euro area but later fell. The EUR/USD currency pair today rallied to a high of 1.1162 in the early European session, but had fallen to a low of 1.1108 […]

Read more October 24

October 242019

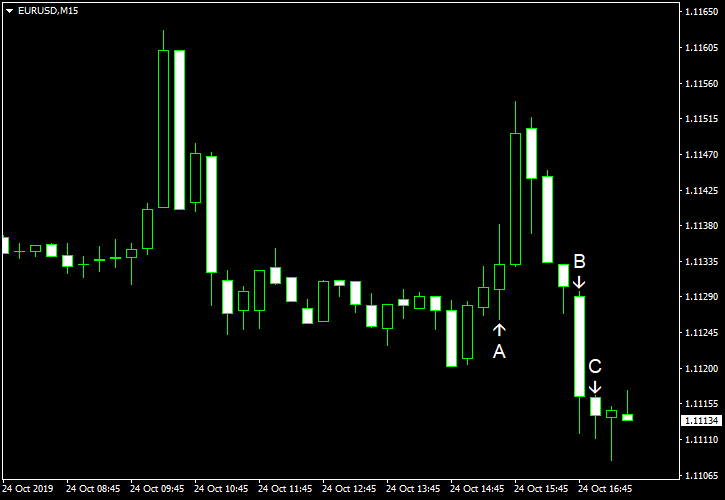

EUR/USD Retreats After Rallying Intraday

EUR/USD attempted to rally intraday after the release of a worse-than-expected report on US durable goods orders but retreated very quickly afterwards. The currency pair did not respond to the better-than-expected manufacturing print. Durable goods orders dropped by 1.1% in September, more than analysts had predicted — 0.5%. The indicator rose 0.3% the month before. (Event A on the chart.) Initial jobless claims were at a seasonally adjusted level of 212k last week, down […]

Read more October 24

October 242019

Japanese Yen Flat After Unfavorable Markit PMIs

The Japanese yen was little changed following a report that showed that economic activity in Japan slowed this month. The services sector barely expanded as its rate of growth slowed sharply compared with September, while the manufacturing sector accelerated the rate of its decline unexpectedly. The Jibun Bank Flash Japan Manufacturing Purchasing Managers’ Index fell to 48.5 in October from 48.9 in September. That is instead of an increase to 49.2 […]

Read more October 24

October 242019

GBP/CAD Correcting from 1.6986

The Great Britain pound versus the Canadian dollar currency pair reached the important level of 1.6986, an area from where two outcomes are possible. Long-term perspective The price, after confirming the weakened support area of 1.5936 as support via the bottoming structure that began in August, started an appreciation that succeeded in overcoming important areas, like 1.6413 and 1.6620, respectively, a behavior that displays bullish commitment. After peaking at 1.7093 while […]

Read more October 24

October 242019

Australian Dollar Falls as Economic Activity Slows

The Australian dollar declined against its most-traded rivals today after flash data showed that economic activity slowed significantly last month. While both the manufacturing and the services sectors continued to expand, the pace of expansion was slower than in the preceding month. The Commonwealth Bank Flash Manufacturing Purchasing Manager’s Index fell to 50.1 in October from 50.3 in September. The Commonwealth Bank Flash Services Business Activity Index demonstrated a much […]

Read more