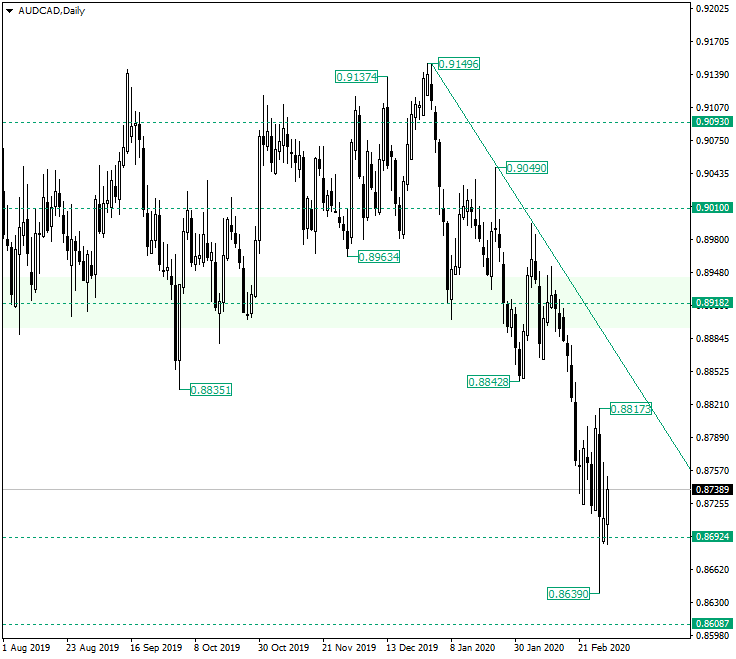

The Australian dollar versus the Canadian dollar currency pair consolidates at 0.8692. Will the bulls take their chance?

Long-term perspective

After the flat — lined up by the resistance of 0.9093 and the support of 0.8918 — ended, the price dropped, reaching the level of 0.8692.

This fall seems to be an impulsive swing which is part, of course, of a descending trend, the resistance of which is the line obtained by joining the highs of 0.9149 with 0.9049, respectively.

The strong drop seemed to decelerate as the price went closer to the support level of 0.8692, but, surprisingly, the bears tried a very offensive push, aiming to pierce the support on February 28.

However, all they could do was to print the low of 0.8639, as the bulls were defending the level of 0.8692.

Given the variables, it can be considered that the low of 0.8639 marks the end of the impulsive swing.

A first possible scenario is the one in which the bulls challenge the high of 0.8817. But, as long as the price resides under the trendline, thus in the descending trend, such a development would simply favor the sellers, as they are given better prices to short from.

Another scenario favors the formation of lower highs, while the price price always returns to the support of 0.8692. This would show that, even if the bulls are attempting to materialize appreciations, the bears are keeping them in check.

Both scenarios aim for the level of 0.8698. Only if the high of 0.8817 is taken out, and the descending trendline pierced, then the buyers would be able to revisit the resistance level of 0.8918.

Short-term perspective

The depreciation that was put into motion after 0.8985 was confirmed as resistance, seems to have ended — or at least paused — just above the level of 0.8694.

The price unfolds a megaphone, which has the important resistance and support boundaries at 0.8801 and 0.8694, respectively.

The first plausible scenario is the one in which the resistance of 0.8801 is confirmed, fueling a movement towards the south that is expected to be able to pierce the support.

On the other hand, if 0.8801 does get taken out, the bulls might be challenged by the bears parked at the double resistance made possible by the level of 0.8872 and the upper trendline that defines the megaphone. For these scenarios, 0.8694 is the main target.

There is also yet another possibility, respectively the one in which the bulls are not able to drive the prices that high. This would allow the bearish pressure to dive the price under the support of 0.8694, and once it turns resistance, the 0.8600 psychological level — not highlighted on the chart — becomes the main bearish target.

Levels to keep an eye on:

D1: 0.8692 0.8698 0.8918

H4: 0.8801 0.8872 0.8694

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.