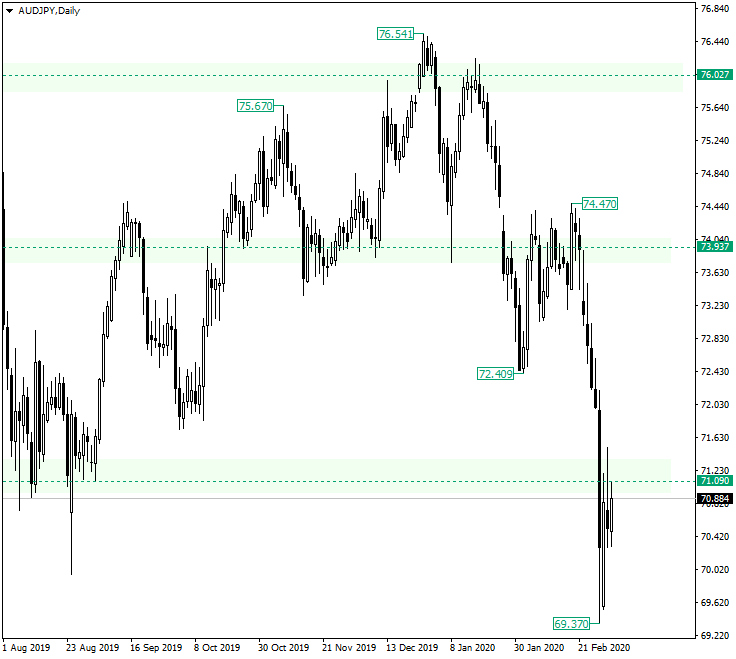

The Australian dollar versus the Japanese yen currency pair is consolidating just under the 71.09 level.

Long-term perspective

After confirming the level of 71.09 as support late in August 2019, the price began an ascending trend that managed to conquer the 73.93 level but failed to do so with the next resistance level, 76.02, respectively, peaking at 76.54.

After the second strand, in the middle of January 2020, the price depreciated strongly, piercing the support level of 73.93 and extending until 72.40.

The consolidation that followed, despite the bullish attempts, did not reconquer the 73.93 level, leading to a very convinced fall, one that pierced the 71.09 support and printed the low of 69.37.

The session on March 2, was clearly a bullish one, recovering almost half of depreciation that took place on Friday, February 28. Even if the candle closed just under the important support of 71.09, the bulls had hope that they can continue their endeavor on the next day.

However, the candle on March 3, oscillated above the level and the high of the candle on March 2, only to close very far — at 70.51 — from the target level, 71.09 respectively, thus displaying a bearish profile.

So, as long as 71.09 keeps its role as a resistance, further movement towards the south is to be expected, the previous low of 69.37 being the first target. Only if 71.09 turns support, then the price could reach the psychological level of 72.00 — not highlighted on the chart.

Short-term perspective

After almost touching the resistance of 74.56, the price began a depreciation that, after getting beneath 72.47, accelerated until the low of 69.37.

The price is now consolidating just under the 71.10 resistance level, after a relatively strong retracement from the low.

As long as 71.10 remains a resistance, further decline is in the cards, the first target being at 70.30, while the second one just above the low of 69.37.

Only if the bulls manage to reconquer 71.10, then the price may extend until 72.47, with an intermediary profit taking area at the 72.00 psychological level — not highlighted on the chart.

Levels to keep an eye on:

D1: 71.09 and the low of 69.37

H4: 71.10 70.30 72.47

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.