The Australian dollar versus the New Zealand dollar currency pair might be under bearish pressure.

Long-term perspective

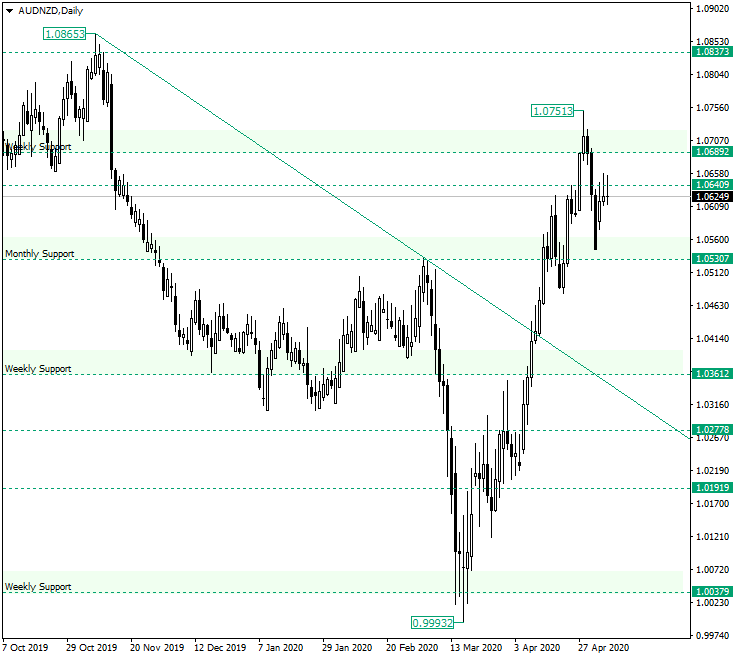

The rally that started from the 0.9993 low after the weekly support level of 1.0037 was confirmed, extended until the high of 1.0751.

But while approaching the old monthly and weekly supports of 1.0530 and 1.0689, respectively, the bulls began to lose momentum. This can be seen in the middle of April when the price oscillated above 1.0530, only to be sent back beneath the level.

Although the bulls recovered, the same seems to have happened with 1.0689, only that this time the retracement from the false pierced level is greater. In fact, it was that pronounced, that it almost touched the next support level, 1.0530. Even more, the bullish reaction from that level seems to have been halted by an intermediary level, 1.0640, respectively. This could be a sign that the bears are stepping in the market.

So, if 1.0640 gets confirmed as resistance, then the first bearish target is represented by 1.0530 which, if taken out, opens the path to 1.0361, which is the second bearish target. If 1.0530 does not give way, then a range trading phase, limited by this support and the resistance of 1.0689, may come into being.

On the other hand, if the bulls do manage to bring the price above 1.0689 and confirm this area as support, then they could head for the next intermediary level, at 1.0837.

Short-term perspective

The fall from the 1.0751 high extended until the 1.0545 low. From there, the price appreciated in an attempt to take over the 1.0635 level. But all it managed was a consolidation phase in its area.

If the bears guard 1.0635 yet again, then they could try to send the price to 1.0589. If this level is confirmed as resistance, then 1.0534 is their next target. If a bounce from 1.0589 does happen, the bullish profile still remains as long as 1.0635 keeps its role as resistance.

On the other hand, if the price oscillates above 1.0635, the bulls should be in guard, because as long as the 1.0658 high is not taken out, a decline could be the next thing to happen. But if 1.0658 is passed, then the bulls could eye the level of 1.0709.

Levels to keep an eye on:

D1: 1.0640 1.0530 1.0361 1.0689 1.0837

H4: 1.0635 1.0589 1.0534 1.0709

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.