The Australian dollar versus the Canadian dollar currency is in a position from where it could go either up or down. Is there any hint on the direction?

Long-term perspective

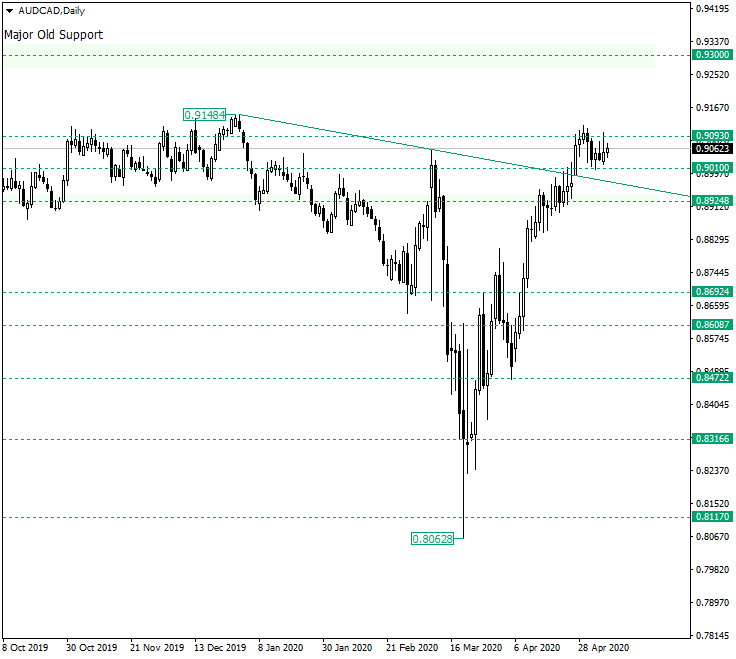

The appreciation that started from the low of 0.8062, after the level of 0.8117 was confirmed as support, continued until it reached the double resistance area made possible by the level of 0.8924 and, more importantly, the trendline that starts from 0.9148.

Once reaching it, although, with some drawbacks, the bulls were able to pierce it and extend until the intermediary level of 0.9093. The price then retraced to find support at the 0.9010 level. Thus, it can be considered that the price is now in a consolidative phase limited by the two latter mentioned levels.

The fact that the price was able to pierce the double resistance gives credit to the bulls which, as a result, would be entitled to believe that they should be the ones making the next move. Their scenario would be that the price further consolidates above the 0.9010 level. This consolidation could extend, for a short amount of time, under the level and towards the trendline, to confirm it as support. This would render 0.9093 as an intermediary target and once invalidated and confirmed as support, it may open the way to the major old support of 0.9300.

On the other hand, it should be noted that the candle on May 5 quickly retracted after the attempt to oscillate above 0.9093. Coupling this with the fact that the price stopped at 0.9093 after piercing the aforementioned double resistance, when after such accomplishment the bullish optimism should have made out of 0.9093 a level of the least importance, sends the bears the message that they are in an advantage.

This may lead to the bears piercing 0.9010 and heading on for 0.8924, with the purpose of confirming it as a resistance. If this happens, the double resistance would be back on its post, meaning that the bears could then target the level of 0.8692.

Short-term perspective

After confirming the 0.8872 level as support, the price began an ascending movement, one that eventually reached the are of the 0.9105 resistance.

From there, the price retraced but respected the supportive trendline. So, as long as the line maintains its role, further advancement could be seen, with 0.9105 being the first target. But for this to happen, 0.9075 has to be taken out first.

If the bulls manage to pierce and confirm 0.9105 as support, then they could send the price towards 0.9153, and later on to 0.9204.

But if 0.9105 resists, then the bears could put the trendline under pressure, which in turn may lead to the double support formed by the trendline and the 0.9041 level to be pierced. If this happens, 0.8985 is the first bearish target, followed by 0.8923.

Levels to keep an eye on:

D1: 0.9010 0.9093 0.9300 0.8692

H4: 0.9075 0.9105 0.9153 0.9204 0.9041 0.8985 0.8923

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.