The Australian versus the New Zealand dollar currency pair seems to have entered into a consolidation phase. Is this only a pause of the bullish advancement?

Long-term perspective

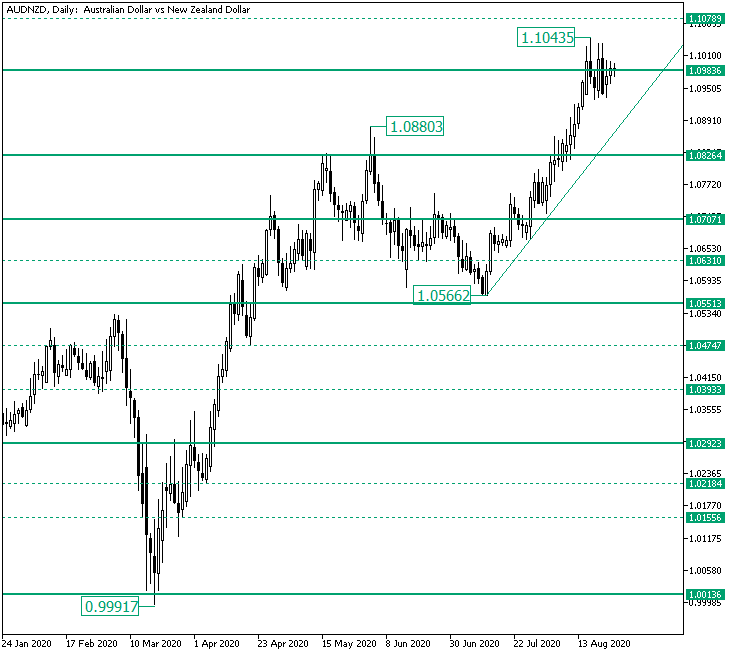

The rally from the 0.9991 low extended — in a first phase — until the 1.0880 high. From there, a corrective movement began, one that after finding support a hair away from 1.0551 — and etching the 1.0566 low — fueled a rise that printed the 1.1043 high.

Even if the 1.1043 high is above the firm 1.0983 resistance area and the price retraced twice under the level, the price action cannot — at least yet — be considered a false piercing of the level, as, after the retracement under it, the price did not start a sustained depreciation.

On the contrary, it looks like a range is taking shape, one with the support well above the previous high and as part of the ascending movement that starts from 1.0566, as highlighted by the trendline.

So, one possible scenario is for the price to continue the consolidation phase until the trendline is in reach. Once it is validated as support, the trendline can serve a new rise.

However, another possible scenario is to see the price piercing and confirming 1.0983 as support. Both scenarios open the door to the 1.1078 intermediary level.

If the price depreciates until the 1.0880 high, then the situation turns neutral, with the possibility of 1.0826 to be revisited.

Short-term perspective

The appreciation from the 1.0669 low extended to as high as 1.1043, being limited by the firm 1.1030 resistance level.

After both attempts to pierce 1.1030, the price found support at the 1.0921 intermediary level. On the last occasion, the rise seems to be restrained to the 1.0987 level.

This behavior could be a way in which the bulls secure a support area closer to the target they want to pierce, that being 1.1030. If they do succeed, 1.1078 is their first target.

On the flip side, another fall towards 1.0921 is possible. If it is confirmed as support, the bulls get another chance, but if it cedes, then the bears could send the price to 1.0866.

Levels to keep an eye on:

D1: 1.0983 1.1078 1.0826

H4: 1.0987 1.1030 1.1078 1.0921 1.0866

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.