Currency trading is by and large carried out in the OTC (over-the-counter) market. Lack of a central regulatory authority has given rise to numerous Forex brokers with offices in exotic locations. A large section of the retail traders depend on these Forex brokers to trade currencies from the comfort of their home. While it just takes a few minutes to open a real account, the quality of a broker can be understood only when the trader faces some problem. For the majority of traders, the online chat with the customer support executive is the best available option during difficult times. This is followed by the feedback and contact forms provided by most of the FX brokers. Where time is of essence, communications via email is considered as the last choice by retail traders. The customer support facility undeniably forms the backbone of a Forex broker. So, we made a sincere attempt to assess the online brokers based on the quality of their customer support.

Contents

-

1 Methodology

-

2 Survey details

-

2.1 Reasons for no chat with support service

-

2.2 Contact form

-

2.3 Reasons for not using online form

-

3 Response

-

3.1 Reasons for not responding

-

3.2 Basis for assessment of service quality

-

3.3 Form and email response time

-

3.4 Quality of the answers

-

4 Conclusion

The aim of the post is to find brokers that are able to provide timely, accurate, and honest answers. At the same time, we will try to expose brokers with inadequate level of support service — either in response speed or in the answer quality.

Methodology

To assess the customer support facility of so many Forex brokers in an effective and balanced manner, we followed the norms detailed below:

The first mode of contact was chat. In a case where we had difficulty in reaching the customer support executive via online chat, we resorted to the feedback/query forms provided by most of the Forex brokers. If those two did not yield the desired result, we sent an email.

Attempts to chat with the customer support executives were made during the week days (Monday-Friday). The contact time period was between 13:00 and 16:00 UTC.

Response time for the queries was recorded.

The chat transcript was received in our email address. If the facility was not available, we manually copied and saved it in a text document.

All the customer support executives were asked the following three questions:

- Can I lose more than I have in my trading account? Do you provide negative balance protection?

- In a case of bankruptcy of the company, is my capital protected and how?

- Does the company benefit from my loss making trades?

The final assessment was made based on the response time, the precision with which the executive was able to reply to the doubts raised, and the links provided in support of their answers.

Survey details

We made an attempt to contact as many as

241 Forex brokers in a three week period.

We were able to chat with the customer support executive or senior staff of 126 companies. This includes the chat support staff who answered to at least one question or stated that they cater only to clients trading in some other markets.

The customer executives of 61 Forex brokers were busy with other clients when we made an attempt to chat with them. In such cases, we were requested by an automated messaging system to leave our queries for them to respond as early as possible.

Reasons for no chat with support service

Customer support executives were busy or not available online

10Markets, ATC Brokers, ADS Prime, BCapitalsFX, BTFX, Bulbrokers, CM Trading, eToro, Exness, FastBrokers, ForexYard, Formax, FX-Edge, Gallant Capital Markets, Dukascopy, Global Futures, Hadwins, iForex, IG, Infinity Space Inc, JCMFX, Larson & Holz IT, LCG, LQDFx, MFX Broker, MTrading, NetoTrade, Oanda, Pepperstone, RFXT, RoboForex, SolForex, Spread Co, SynergyFX, TeleTrade, TempleFX, TenkoFX, TMSBrokers, Trade360, Tradeo, TradewiseFX, UMOFX, Varianse, Vector Securities, VertiFX, Vinson Financials, and ZARFX.

Chat only in foreign language

Alfa-Forex, ATIG, NAS Broker, and NewForex.

Technical problems

AL Trade, Core Liquidity Markets, SunbirdFX, TMS Brokers, and Xtrade.

No response even though the operator had received the question

FxNet

Chat serves other purposes

Interactive Brokers, SimpleFX, TenkoFX, and TradeKing.

No chat facility — only Skype

1BillionForex, FCI Markets, PFD, Renesource Capital, and Vomma Trading.

Contact form

As many as 37 Forex brokers had no chat facility at all (or at the least we were unable to find it). So, we contacted them through online form.

Forex brokers without chat facility:

ACFX, Advanced Markets, BDSwiss, Bestec NFX, Bolmax Management, Citypoint Trading, CMC Markets, DirectFX, ETX Capital, Euro Pacific Bank, Finam, Finotec, FIPFX GLOBAL, FOREX UKRAINE, ForexCT, Forexite, FXRANEX, FXTSwiss, HMS Markets, HYCM, IfamDirect, Key To Markets, MahiFX, Price Markets, Realtrade, Real-Forex, Romanov Capital, SaudiQuote, Sucden, TFI Markets, Trade Fintech, TraderNovo, Velocity Trade, Vistabrokers, Whaleclub, XGLOBAL Markets, and You Trade FX.

As many as 34 brokers did not provide a feedback or details request form. At the least, it was not available in the Contact Us section. The statistical data also includes those brokers whose online form is not working or has some other restrictions (number of words, for example). So, we sent an email to the support department.

Reasons for not using online form

Query form is not available in the Contact Us section

AFX Capital, AL Trade, Alfa-Forex, Alpari, BelforFx, CMC Markets, ETX Capital, Finam, Finotec, FIPFX GLOBAL, ForexCT, Forexite, Gallant Capital Markets, HMS Markets, IfamDirect, Key To Markets, MahiFX, NetoTrade, Realtrade, Renesource Capital, RFXT, Romanov Capital, SaudiQuote, Saxo Bank, Vomma Trading, Whaleclub, and XGLOBAL Markets.

Technical problems

1BillionForex, Cornèr Trader, DirectFX, NewForex, Real-Forex, Romanov Capital, TenkoFX, and TFI Markets.

For non-retail traders only

SaudiQuote

Response

Whenever we failed to reach the online customer support executive (if they were available), we sent the query through the online form. If there is no response to the message sent via online form, then we made at least two attempts to communicate with the broker through email. To our disappointment, 47 of the Forex brokers did not respond to us at all. The statistics does not include PhillipCapital.

Reasons for not responding

Reason unknown

1BillionForex, BCapitalsFX, BelforFX, Citypoint Trading, CMC Markets, DirectFX, ETX Capital, Finotec, FIPFX GLOBAL, ForexCT, ForexYard, FX-EDGE, FxNet, FXRANEX, Forex Ukraine, FXTSwiss, IfamDirect, iForex, IG, Key To Markets, MFX Broker, NetoTrade, Questrade FX, Real-Forex, Saxo Bank, SunbirdFX, TeleTrade, TMSBrokers, TraderNovo, Vector Securities, VertiFX, Vistabrokers, and Zar FX.

Technical difficulties on broker’s website

ACFX, FX Dana, Hadwins, and Bestec NFX.

Cater to different markets

Advanced Markets, Alfa-Forex, ATIG, NAS Broker, Romanov Capital, SaudiQuote, and You Trade FX.

Other

PhillipCapital — Emails sent to their Canadian office returned back. We are yet to receive any kind of response from their UK office. However, the Australian office replied promptly.

UMOFX, Vinson Financials — They sent us a message saying that they will soon respond. We are still waiting.

Whaleclub — We were unable to contact them officially in any manner. The form does not work.

Basis for assessment of service quality

To assess the quality of customer service, as stated earlier, we manually saved all the chat messages, sent the chat transcript (if the facility was available) to our email, and recorded the time taken by the executive to respond to the queries. We rounded off the response time to the nearest minute. We then categorized the Forex brokers based on the response time, politeness of support executives, and preciseness and acceptability of the answers. We also gave due consideration to the replies that were more elaborate and backed with relevant links.

On average, it took 2 minutes and 43 seconds for the customer support executives to respond to the first query. The representative of CIBFX took the longest time of 9 minutes to respond to the first query. The chat support executive of FXOpen and Windsor Brokers took 7 minutes and 6 minutes, respectively, to answer the first question. With a response time of about 32 seconds, the customer support executive of FX Giants (Rijo Varghese) was the quickest of all.

The response time of executives of other Forex brokers, for the first query, is as follows:

In 3 minutes and more

Darwinex, Markets.com, WSSolution, Bforex, xCFD, Abshire-Smith, Adamant Finance, Atiora, FreshForex, LiteForex, and OneTrade.

Under 3 minutes

AAAFx, AAATrade, AccentForex, Alvexo, AMarkets, Axiory, Core Spreads, FIBOGroup, Forex.com, ForexChief, FXTM, Fort Financial Services, FxGlory, FXGM, FXPRIMUS, GCI, GKFX, Hydra Markets, ICM Brokers, Kawase, MEX Group, One Financial Markets, PaxForex, PCM Brokers, Plus500, StoxMarket, UFX, Valutrades, and Vantage FX.

Under 2 minutes

Capital Index, City Index, CMS Forex, DeltaStock, DF Markets, easyMarkets, FBS, FinPro Trading, FirewoodFX, Forex Broker Inc., Libertex, Forex Optimum, Forex.ee, Forex4you, ForexMart, FX Choice, FXDD, FXFINPRO Capital, FXFlat, FXGlobe, FxGrow, FXOptimax, FxPro, Gainsy, GBE brokers, GDMFX, GOMarkets, Grand Capital, Hantec Markets, Hirose Financial UK, HiWayFX, HotForex, IamFX, IC Markets, ICM Capital, IFC Markets, Infin Markets, Ingot Brokers, InstaForex, Invast Financial Services, IronFX, JFD Brokers, JustForex, Land-FX, LMFX, MTI Markets, MXTrade, NatureForex, NordFX, OctaFX, Orbex, Profiforex, SuperForex, Tallinex, ThinkMarkets, Tickmill, Trade12, TradeKing, Trader’s Way, Traders Trust, TradeView Forex, TradingBanks, TradingForex.com, TrioMarkets, Trust Capital, TurboForex, USGFX, VerumFX, Vipro Markets, Weltrade, WesternFX, XM.com, and XTB.

Under 1 minute

AAFXTrading, ActivTrades, Admiral markets, AxiTrader, Blackwell Global, BMFN (Boston Merchant Financial), FXCH, FXCL, FXCM, and FX Giants.

For the second query, the average response time was 2 minutes and 57 seconds. It took 20 minutes for the chat executive of FXCL to answer the second query, while the executives of Darwinex and AccentForex spent 9 minutes and 8 minutes on it respectively. Again, the customer support executive of FX Giants (Rijo Varghese) was the quickest of all with a response time of about 35 seconds.

The customer support executive of NordFX, Forex Broker Inc., and TradeKing did not answer to the queries (details provided later in this article).

For the third query, on average, it took 1 minute and 55 seconds for the customer support executive to respond. The chat executive of ICM Capital responded in 20 minutes. The representative of CMS Forex needed 7 minutes to reply to the third question. The executive of AAATrade required 6 minutes to provide the answer. It is needless to mention that the customer support executive of FX Giants (Rijo Varghese) was again the quickest of all with a response time of 35 seconds.

The chat support executive of Forex Broker Inc., NordFX, TradeKing, WesternFX, and xCFD did not provide the reply to the third query.

Form and email response time

The time taken by the customer support department to respond to the query sent via online form and via email is given below. It should be noted that in certain cases, to make sure that the customer support department has received our message, we sent a reminder. Still, all calculations were made only based on the first email we sent them.

Two days or more

eToro, FastBrokers, Milton Markets, PhillipCapital, AGEA, FCI Markets, MTrading, ATC Brokers, Core Liquidity Markets, 10Markets, Synergy FX, NewForex, AL Trade, Infinity Space Inc, and CM Trading.

Next day

ADS Securities, Alpari, Bolmax Management, Euro Pacific Bank, XGLOBAL Markets, Gallant Capital Markets, Global Futures, HYCM, JCMFX, Land-FX, Larson & Holz IT, LCG, Lite Forex (Europe), MahiFX, Real Trade, Renesource Capital, Solforex, TenkoFX, Trade360, VARIANSE, Titan FX, Trade Fintech, Price Markets, xCFD, and Interactive Brokers.

Same day

AFX Capital, Corner Trader, Bulbrokers, BDSwiss, Exness, Finam, Forexite, Formax, HMS Markets, iForex, PFD, Pepperstone, RoboForex, Spread Co, Sucden, Swissquote, TFI Markets, TradeWiseFX, Velocity Trade, Vomma Trading, BTFX, Solforex, RFXT, Tradeo, TempleFX, and LQDFX.

It took CM Trading 7 days to respond to the message. It took Infinity Space and AL Trade days to get back to us. The support department of 10Markets spent 5 days to respond to our message. Bulbrokers, BDSwiss, and Exness are some of the prominent brokers whose customer department responded within the same day with the relevant details.

Quality of the answers

The answers we received were categorized based on whether it serves the purpose or not. We considered a detailed answer, preferably backed with appropriate links, to be the most precise one.

For the first query (Is it possible to lose more than what I have in my account? Do you offer negative balance protection?), the answer can be a yes or no. However, if the chat executive is able to say that a negative balance is possible during periods of high volatility (the flash crash in the Pound or Swiss franc’s surge in January 2015 can be quoted as an example), then it is certainly considered as a good answer. The company may reset the balance to negative or claim the amount from the client. Either way, the reply would be considered to be a satisfactory one.

For the second query (If the company goes bankrupt, is my capital protected and how?), the executive should be able to provide the name of the regulatory body that ensures protection of capital and the amount for which the account will be protected. A segregated account may offer a reasonable protection but certainly not the kind of protection provided by a regulatory body. So, it is considered to be the second best answer possible. Any reply which is not based on solid facts was considered as an unreliable answer.

For the third query (Does the broker benefit from my losing trades?), an answer clearly explaining how there is no conflict of interest was considered to be the perfect one.

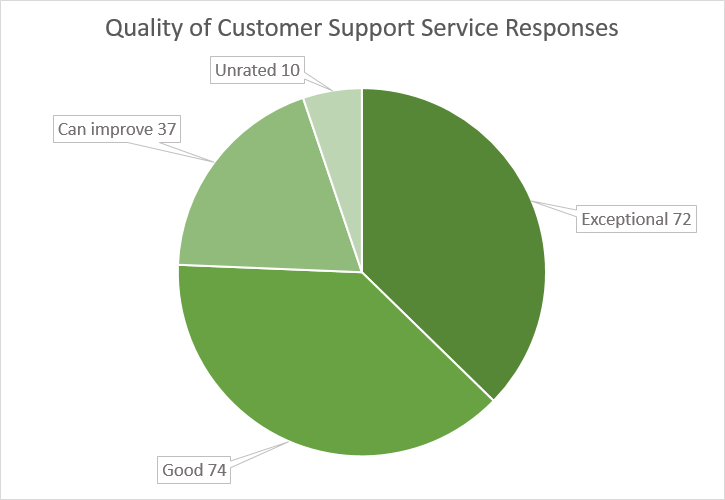

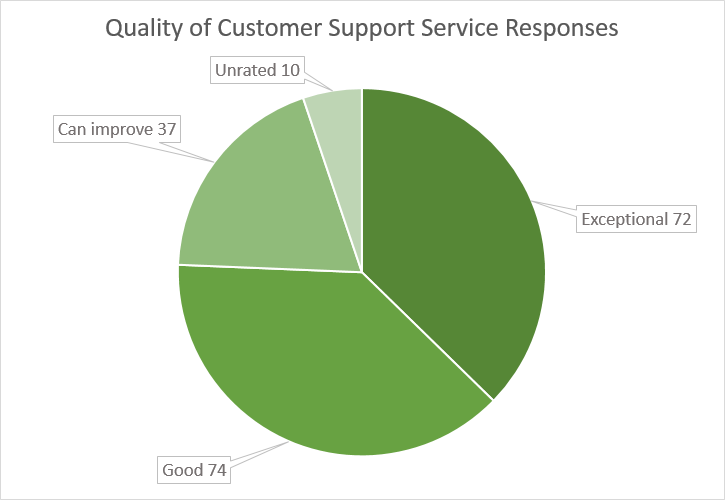

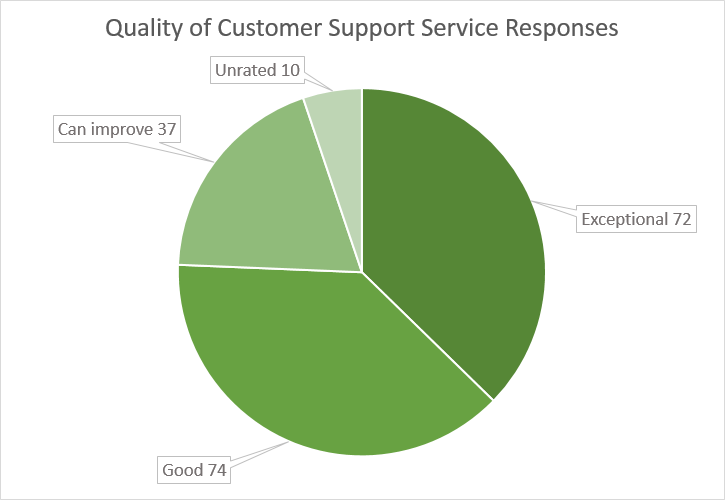

The Forex brokers were then categorized as Exceptional, Good, and Can improve, based on the answers we received from the chat executive or the customer support department via email.

Exceptional

The list of Forex brokers with an excellent customer support department is provided below:

Precise response with links (details include the name of organization which protects in case of bankruptcy):

Abshire-Smith, ActivTrades, Admiral Markets, Bulbrokers, Capital Index, Darwinex, DF Markets, FBS, FXCM, Gallant Capital Markets, GKFX, JFD Brokers, LMFX, Markets.com, Plus500, Renesource Capital, RoboForex, Spread Co, ThinkMarkets, and Vipro Markets.

Prompt and precise response (details include the name of organization which protects in case of bankruptcy, etc.):

AL Trade, Axiory, BDSwiss, Blackwell Global, Bolmax Management, CMS Forex, Core Spreads, Corner Trader, Dukascopy, eToro, Euro Pacific Bank, Finam, Forex.com, Formax, FreshForex, FX Giants, FXCH, FXDD, FXFINPRO Capital, FXOpen, FXOptimax, FxPro, GOMarkets, Hantec Markets, IFC Markets, Infin Markets*, Ingot Brokers, Kawase, LCG, LiteForex (Europe), MahiFX, MTI Markets, NatureForex, Price Markets, Swissquote, TempleFX, TenkoFX, TFI Markets, Tickmill, Traders Trust, TradingForex.com**, TrioMarkets, USGFX, Valutrades, Vantage FX, Varianse, Velocity Trade, Windsor Brokers, XGLOBAL Markets, XM.com, XTB, and Xtrade.

* Both IFC Markets and Infin Markets belong to the same group and handled by the same support staff.

** Both Traders Trust and TradingForex.com belong to TTCM Traders Trust Capital Markets Limited, and handled by the same support staff.

Good

Replied that segregated accounts will safeguard the customerâs capital in case of bankruptcy. Prompt and professional replies were given to the other two questions:

Alpari, BTFX, Core Liquidity Markets, Exness, FastBrokers, FinPro Trading, Forex.ee, Forex4you, FX Choice, FXCL, FxGlory, FxGrow, GDMFX, Grand Capital, Hirose Financial UK, HMS Markets, HotForex, Hydra Markets, IamFX, IC Markets, ICM Brokers, Invast Financial Services, JCMFX, JustForex, LQDFX, Milton Markets, MTrading, MXTrade, OctaFX, One Financial Markets, Pepperstone, PFD, Profiforex, Real Trade, RFXT, SimpleFX, Trade12, Traderâs Way, TradeView Forex, TradingBanks, and Trust Capital.

AAAFx — The executive asked us to go through the Terms and Conditions paragraph #15 for the first query.

AFX Capital — For the third query, the company stated that there is a possibility to gain from the clientâs loss in certain kind of accounts.

AGEA — For the first question, the support people informed that margin call and subsequent closure of position will prevent the balance from going negative. They also replied that segregated accounts will safeguard the customer in case of bankruptcy.

AMarkets, MEX Group, and Orbex — For the first query the executive simply stated that it is impossible to go negative. The reply to the rest of the query was precise.

ATC Brokers — For the second query, the executive stated that the account is protected by the client money rule. No further details were provided. The answers to the other two doubts were professional.

AxiTrader — The executive stated that segregation of accounts will protect clientâs capital in case of bankruptcy. We were also warned to take independent financial advice to understand the risks.

CIBFX — For the third query, the executive simply stated that they do not gain from clientâs profit or loss. When I asked her to confirm that there is no conflict of interest, the executive went silent. We waited for nearly 10 minutes online before closing the chat window.

City Index, ForexMart, and Trade360 — The executive stated that stop-out facility and margin call will protect the account from turning negative.

FCI Markets — They provided all the necessary details. However, they have mentioned that FCA protection will cover the client for up to £75,000 (instead of £50,000). That is the only reason for not placing them under exceptional category.

FIBOGroup, Forex Optimum, FXTM, and PaxForex — For the first query the executive simply stated that it is impossible to have a negative balance. For the second doubt, the support staff replied that segregation of accounts will protect the clientâs capital in a case of bankruptcy.

FirewoodFX — The executive sent the company registration certificate for the second query and stated that they do not possess any other regulation.

Libertex — For the third query, the executive simply stated that they do not gain from clientâs profit or loss.

FXFlat — Prompt and precise. They started chatting in German. When we expressed lack of proficiency in German language, they provided the details in English. The support chat also revealed that Interactive Brokers, the principal brokers of the company, is the custodian of the clientâs capital. For the first query, they simply stated that cash balance is required for the transaction. The executive was more than willing to explain everything to us. The politeness and willingness shown by the support team to clarify doubts gets them a good rating.

FX Globe — For the third query, the executive did not respond with a straight forward answer. We were told that they are looking for volumes to make profit. Other answers were precise and detailed.

FXGM — For the third query, a straight forward reply was not provided. The executive stated that they only provide the trading platform and do not participate in trading.

GBE Brokers — For the second query, the support executive stated that they have a European license, but did not elaborate on it.

ICM Capital — They gave all the information. However, it took a lot of time for them to gather and present the info and links. If they can quicken up, they will certainly get an exceptional rating.

Infinity Space Inc — The support department simply replied âNoâ to the third query.

Interactive Brokers and One Trade — For third query, the support department replied that they do not benefit from the losing trades. However, they refrained from providing any explanation.

Land-FX — The chat executive was unable to reply to the third query. She asked me to contact the support department. In a day, we received a prompt and precise email response.

LiteForex — For the second query, the chat representative simply stated that they are regulated by the authorities of Marshall Islands.

PCM Brokers — For the first question, the chat executive stated that the company will strive to prevent negative balance. For the second doubt on bankruptcy, the executive informed us that segregate account will protect the client in such an eventuality. For the third question, the support executive simply answered âNoâ.

PhillipCapital — Both Canadian and UK branch offices did not respond. However, the Australian support department responded promptly. For the second query, they replied that segregated accounts will protect the clientâs capital.

SuperForex — For the question on bankruptcy, the executive stated that the company is IFSC regulated. However, no further details were provided.

TitanFX — The customer executive replied that segregated accounts maintained with National Bank of Australia will keep the clientâs capital safe. For the third question, they stated that clientâs profit or loss does not affect them in any manner. However, they did not divulge additional details.

Can improve

10Markets — It took a long time for the customer support department to respond to the query. For the bankruptcy related doubt, they informed us that the clientâs capital is protected as they are a regulated company. However, they did not provide any further details regarding the authority or the maximum amount, for which a clientâs account is protected.

AAATrade — The executiveâs reply for the third query was not clear.

AAFxTrading — For the first query, the executive simply said âYesâ. To the second question, the executive replied that the broker can never go bankrupt.

AccentForex — For the doubt on bankruptcy, the executive stated that they are a reputed firm (remains in operation since 2010).

Adamant Finance — For the first query, the executive mentioned that the stop-out level is a negative balance protection. For the second doubt, the executive stated that the broker does not use clientâs funds. For the third query, the answer was simply âNoâ. When I asked again whether the orders are directly passed to liquidity providers, the executive said âYesâ and asked me to refer to their website.

ADS Securities — They sent me the companyâs profile without answering the queries directly. They also attempted to call us. They had mentioned that the company has a capitalization of $400 million and regulated by the central bank of UAE.

Atiora — For the first query, the executive stated that a client cannot lose more than the sum invested. For the bankruptcy related question, the support staff replied that the funds are kept in a safe bank and they are an ECN broker.

bforex — For the first question, the representative replied that the account manager will take care. To the question on bankruptcy, the support staff answered that we are dealing with a legitimate company. For the third query, the staff stated: ‘Your profit or loss is yours.’

BMFN (Boston Merchant Financial) — The customer executive replied that the balance cannot go negative but was unwilling to confirm it. For the second and third query, he asked us to write to compliance department. We have not heard from them so far.

CM Trading — The support department asked us to open an account first of all. They were willing to provide us with the requisite clarifications after opening the account. For the first query, they have replied that negative balance protection is available. For the third query, they simply stated that they do not benefit from our losses. They did not elaborate on their replies. They have not responded to our second query.

DeltaStock — Precise replies were given to the first two queries. For the third doubt, the chat executive stated that he cannot provide the info for such a question.

easyMarkets — For the second query, the executive stated that they do what is written on their website. For the third query, she simply stated that they are market makers.

ForexChief — For the third query, the chat executive stated that they may gain from clients’ losses in some cases. The representative sent me a link which was about server stability and similar issues.

Forexite — For the third question, the customer support department stated that if the volume crosses certain limits, then it will be hedged.

Fort Financial Services — For the second question, the support staff answered that we will receive the funds back. No further details were provided.

FXPRIMUS — For the second query, the executive stated that our funds will be safe with them and they are following a robust risk management model.

Gainsy — For the second query, the support staff stated that a client can withdraw cash whenever he wanted and the company has no access to it.

GCI — For the question on bankruptcy, the support executive stated that they are in business for the past 15 years.

Global Futures — Sent us a profile of the company without clear cut answers to the questions.

HiWayFX — The support agent replied that segregated account will protect the clientâs capital. Interestingly, for the third query, they said that information cannot be disclosed.

InstaForex — For the second query, the representative asked us to read the website.

IronFX — The executive did not reply to the second and third queries. He wanted us to speak to the account manager. As we stood firm, he said that info would be passed on to the manager who will respond to the queries. He also stated that answers to these queries can be given only by the account manager. We have not heard from them still.

Larson & Holz IT — They stated that negative balance is not possible. For the second query, the executive sent us an email reply saying that the money would be parked in banks and they are in the business for a decade.

NewForex — They emailed us saying that the negative balance protection is available. For the bankruptcy related question, they answered that clientâs capital would be protected by the company. They did not reply to the third query.

StoxMarket — For the first question, the executive replied that there is no possibility of a negative balance. For the second query, we were asked to check the FAQ. In the same manner, for the third query, she simply stated that it is not the way they benefit.

Tallinex — For the doubt on capital protection, the executive replied that they are regulated by the authorities of Grenadines and also maintain segregated accounts. However, they did not explain the amount for which a clientâs account is protected.

Trade Fintech — They asked us to open account. They replied to the first and third questions, but did not explain why they do not benefit from our trading losses.

Tradeo — For the first query, the executive said that stop-out mechanism will protect the account from turning negative. To the bankruptcy related question, the support staff replied that money will be sent to our account in case of bankruptcy. No further details were provided.

TradeWiseFX — For the second query, the executive stated that money would be held by the prime brokers. For the third query, they replied that no gains are made from clientâs losses. However, no details were provided.

TurboForex — The staff stated that there is no possibility of a negative balance. For the bankruptcy related query, the support executive replied that they will protect small accounts.

UFX — Executive stated that they will not allow the account to fall into negative territory.

VerumFX — Support staff replied that there is no possibility of having a negative balance. Furthermore, the executive informed us that they do not offer any kind of protection for the capital.

Vomma Trading — They just sent us a list of documents necessary to open a trading account.

Weltrade — The executive stated that negative balance is impossible. To the bankruptcy question, the staff said that the capital, which is held in European banks, can be withdrawn in 30 minutes.

WesternFX — For the second query, she stated that bankruptcy is a rare situation. Still, they will return the money as promised.

WSSolution — For the first question, the support staff informed that company uses its own money. For the second question, executive answered that clientâs account is protected. However, no details were provided.

xCFD — For the doubt about bankruptcy, the support department stated that they are registered in New Zealand and regulated by VFSC (Vanuatu Financial Services Commission). No additional details were provided. For the third question, we were informed that the company derives its income from overnights.

Uncategorized

Alvexo — To the first question, the executive replied âNoâ, but added that it is not her specialty. For the rest of the questionnaire, the support staff asked me to check the website. We were asked to provide the email address and mobile number to revert back with details. We promptly provided the contact details. So, far we have not heard from them.

AvaTrade — The customer support executive (Jane) came online and asked us how she can be of assistance to us. When we placed our first query, she left the chat without any kind of response.

Forex Broker Inc. — The chat representative was not willing to continue as they cater only to US residents.

HYCM, Oanda, and SynergyFX — The companies’ representatives wanted to speak to us by phone for providing the information.

NordFX — After answering the first query, the support executive asked for our mobile number. We did give them with a condition that she would respond to our queries online before making a call (if it is really needed). Unfortunately, she did not heed to that and straight away called us. Still, we took the call and reminded her that she is yet to provide the reply. The executive asked us to open a real account first of all. We refused that. When we insisted for answer to the second query she said that NordFX is a multinational company and that trust matters more than anything else. She further stated that her job is to support the customers and it is better to speak to some other high official in the head office and seek the answers to our queries.

Solforex — Closing retail Forex services.

Sucden — They do not offer personal accounts and are willing to respond only to institutions which are on the lookout for a suitable Forex broker to open a trading account.

TradeKing — They said that they do not cater to non-US clients. Furthermore, TradeKingâs support executive stated that he is there to provide online support to the US stock market traders only and not to Forex traders.

Conclusion

The customer support executives of FX Giants (Rijo Varghese), FXCH (John), FXFINPRO Capital (Viktor), IC Markets (Dorina), and JFD Brokers (Antonia) deserve an appreciation for their lightning fast response.

In the same manner, FXDDâs customer care executive (Marina P.) also deserves a round of applause for the good knowledge she has about order routing. She was very polite as well. The chat support executives of FXOptimax (CS18) and FxPro (Yuri) provided the clarification in a detailed manner. Likewise, Dun Li, the chat support executive of Hantec Markets, clearly stated that in a real market, it is impossible to totally protect an account from negative balance during periods of high volatility. The customer support executive of FxGrow (Jennifer) was exceedingly polite and deserves appreciation.

Surprisingly, few big-name brokers excelled in our customer service survey. As you can see, only FXDD and FxPro are well-known companies. It might be due to the fact that smaller broker see a better support service as a competitive advantage they can use against industry giants. And, considering the recent regulatory actions, it might soon become the only way for brokers to compete for new traders in Europe.

A top class customer support department speaks volumes about a Forex broker. However, it is just one aspect of trading. A trader should choose a Forex broker based on a range of parameters and in accordance with the personal needs and objectives.

If you want to share your a story about your experience with Forex brokers’ customer support service, please use the commentary form below to do so.