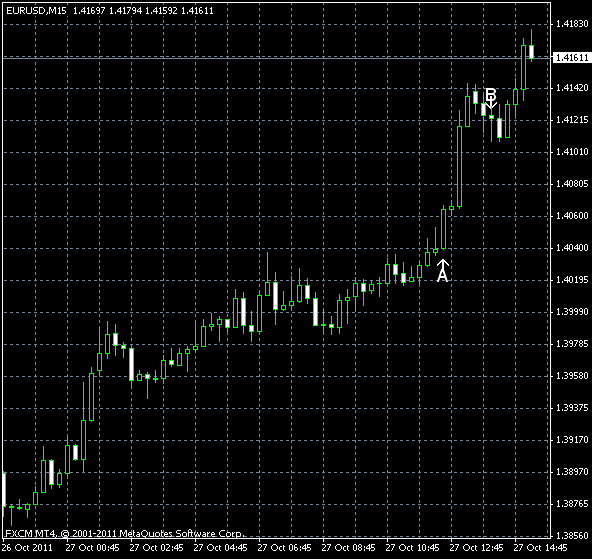

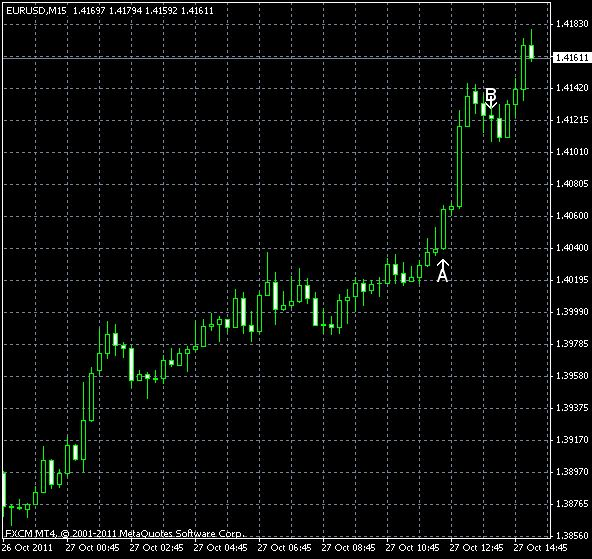

EUR/USD surged today to the highest level since September 7 as the European leaders made progress in devising plans for helping the

Advance report on US GDP was released today, showing an increase of 2.5% in the third quarter of 2011. That’s a big improvement over second quarter’s 1.3% and higher than forecast 2.4%. (Event A on the chart.)

Initial jobless claims were at the seasonally adjusted adjusted rate of 402k in the week ending October 22. It was a small change from the slightly revised 404k in the preceding week and in line with forecasts of 400k. (Event A on the chart.)

Pending home sales fell 4.6% in September, following the 1.2% drop in August. The report frustrated market participants who expected an increase by 0.2%. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.