Talking Points:

– Headline jobs growth comes in at +223K, while the net two-month revision was +15K.

– US wage growth increases to+2.7% y/y asthe unemployment rate dropped to 3.8%, a new cycle low.

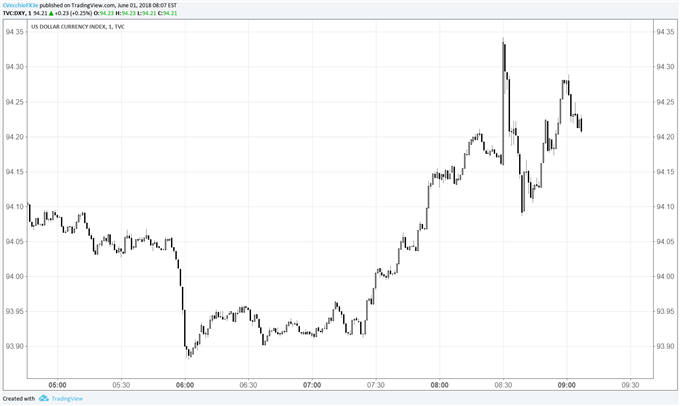

– The US Dollar turned higher following the data, with the DXY Index rising from 94.16 to as high as 94.34, at the time this report was written.

See our longer-term forecasts for the US Dollar, Euro, British Pound and more with the DailyFX Trading Guides

The fifth jobs report of 2018 has helped the US Dollar stabilize even further after its sharp selloff earlier this week. The greenback edged higher after the May US Nonfarm Payrolls report showed that the US economy added +223K jobs last month, beating expectations of +190K.

Other parts of the report suggested an overall steadily improving labor force. The unemployment rate (U3) dropped to a new cycle low of 3.8%, largely fueled by the labor force participation rate slipping to 62.7% from 62.8% – the only major blemish of the report.

It’s important to keep in mind that the US economy doesn’t need such strength in the headline figure to maintain the unemployment rate at its current “full employment” level. According to the Atlanta Fed jobs calculator, given a labor force participation rate of 62.7%, the US economy needs to add +100K jobs per month over the next 12-months in order to keep the unemployment rate at 3.8%.

To that end, the most important part of the jobs report was the wage growth figure, not the headline jobs figure. Average hourly earnings moved up to +2.7% from +2.6% (y/y), a small yet not insignificant increase. With the economy at “full employment,” higher wages are being generated (as the Phillips Curve implies), and thus, inflation expectations have risen.

The combination of higher wages, rising energy prices, and a weak US Dollar (relatively speaking, year-over-year) should boost inflation expectations and thus keep US Treasury yields pointing higher.

As far as near-term rate hikes are concerned, this report has had minimal impact. Fed funds rate expectations continue to price in June 2018 for a rate move, with hike odds holding at 100% after the data. Rates markets are now pricing in an additional hike in September (76.3%), with odds of a fourth rate hike this year in December having rebounded too (now 42.5%).

Here are the data driving the greenback this morning:

– USD Unemployment Rate (MAY): 3.8% versus 3.9% expected unch.

– USD Change in Nonfarm Payrolls (MAY): +230K versus +190K expected, from +159K (revised higher from +164K).

– USD Labor Force Participation Rate (MAY): 62.7% from 62.8%.

– USD Average Hourly Earnings (MAY): +2.7% versus +2.6% expected unch.

See the DailyFX economic calendar for Friday, June 1, 2018

DXY Index Price Chart: 1-minute Timeframe (June 1, 2018 Intraday) (Chart 1)

Immediately following the data, the US Dollar traded higher versus the Euro and the Japanese Yen, with the Dollar Index (DXY) rising from 94.16 ahead of the data, to as high as 94.34. At the time this report was written, the DXY Index was back to 94.21. The US Treasury 10-year yield reached as high as 2.927%, fueling broad US Dollar gains. EUR/USD was trading at 1.1670 and USD/JPY was trading at 109.67 at the time this report was written.

Read more: US Dollar Stable as Trump Administration Greenlights Tariffs

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX