Current Developments – Sentiment Recovers, USD Last Minute Recovery

Despite threats from China to call off trade deals with the US, sentiment rebounded on Monday as stocks rose. Investors appeared to have welcomed continued global economic growth prospects following the beat in last week’s US jobs report. However, most of the gains were realized via a gap higher as Wall Street came online. For the majority of the US session, the S&P 500 oscillated and finished the day 0.45% higher.

Amidst a recovery in risk appetite, the US Dollar performed poorly during the first half of Monday’s session. Traders may have continued unwinding their safety bets from last week. Despite the greenback’s decline, it finished the day only cautiously lower after a partial recovery towards the second half of the day. There, it rose with local government bond yields, signaling firming hawkish Fed rate hike bets.

Not surprisingly, the anti-risk Japanese Yen was amongst the worst performing currencies on Monday as Asian stocks rose earlier in the day. The sentiment-linked New Zealand on the other hand outperformed. Meanwhile the British Pound declined across the board. UK lawmakers are back this week from their recess as Prime Minister Theresa May has key decisions to make on Brexit. Perhaps traders were betting that they won’t go so well.

A Look Ahead – All Eyes on RBA for AUD/USD

The top tier event risk during Tuesday’s session is the RBA rate decision. Unlike the last few announcements, the Australian Dollar could be at risk of another status quo outcome. This is because yesterday, better-than-expected local retail sales and corporate profits sent local bond yields higher which suggested increasing RBA rate hike bets. AUD/USD simultaneously rose to its highest since March 23.

If the central bank reiterates its patient stance on raising rates, then some of those hawkish bets could be reversed. While still low, the probability of an RBA rate hike by the end of the year recently jumped to about 25% according to overnight index swaps from 19%. With that in mind, we shall see if a beat in today’s Caixin China PMI data adds more fuel to those expectations.

Join DailyFX Analyst Daivd Cottle who will be hosting the RBA rate decision webinar LIVE and covering the AUD/USD reaction

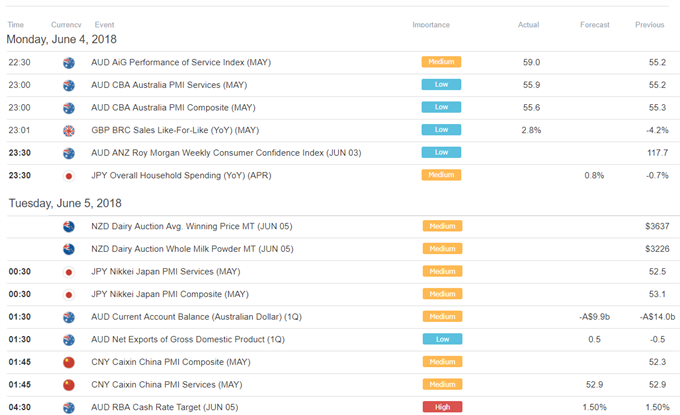

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

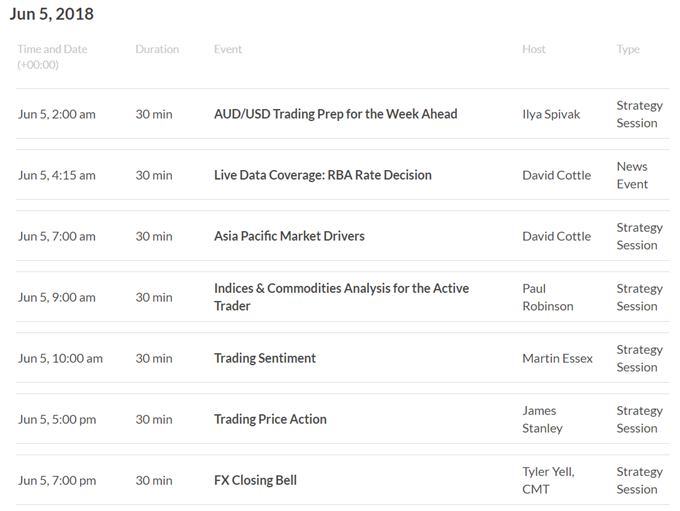

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

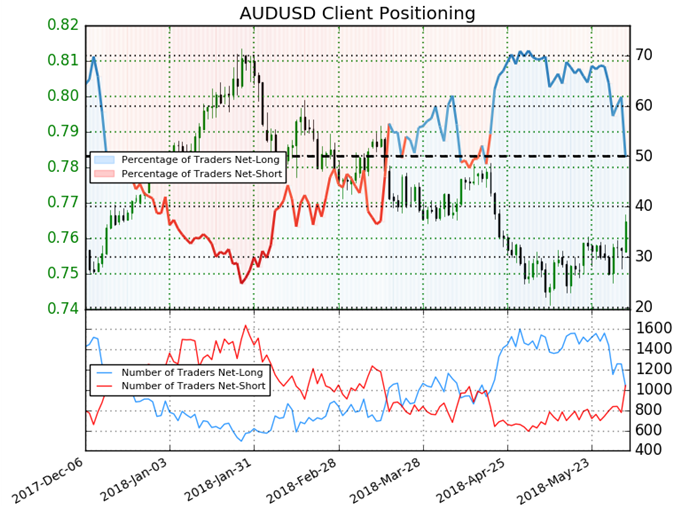

IG Client Sentiment Index Chart of the Day: AUD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 49.8% of AUD/USD traders are net-long with the ratio of traders short to long at 1.01 to 1. The percentage of traders net-long is now its lowest since Apr 12 when AUD/USD traded near 0.77563. The number of traders net-long is 19.5% lower than yesterday and 30.8% lower from last week, while the number of traders net-short is 34.5% higher than yesterday and 27.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bullish contrarian trading bias.

Five Things Traders are Reading:

- Australian Dollar Could Gain Despite RBA If GDP Comes In Solid by David Cottle, Analyst

- Counter Trend Patterns Working in USDJPY and EURUSD by Jeremy Wagner, CEWA-M, Head Forex Trading Instructor

- EUR/USD Rate Outlook Mired by Renewed Greek Fears by David Song, Currency Analyst

- AUD/USD Technical Outlook: Aussie Rebound Testing Key Resistance Hurdleby Michael Boutros, Currency Strategist

- US Dollar Drops to Support, AUD/USD Fresh Monthly Highs Ahead of RBA by James Stanley, Currency Strategist

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter