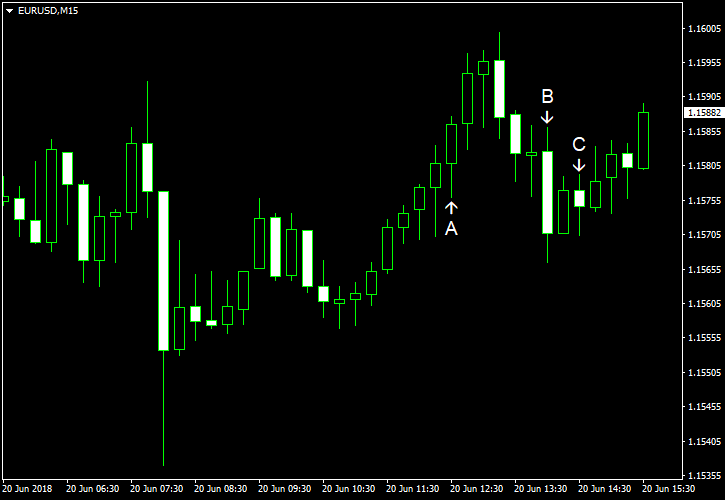

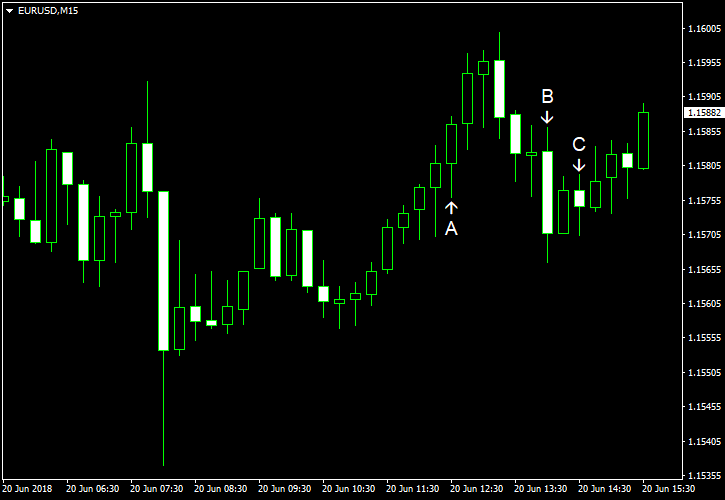

EUR/USD fell intraday during the current trading session but managed to bounce by now. The currency pair was under influence of various factors, including US tariffs and planned retaliation to them from the European Union, the speech of European Central Bank President Mario Draghi, and the positive surprise from the German Producer Price Index. As for US macroeconomic data, it was mixed.

Current account balance logged a deficit of $124.1 billion in Q1 2018, which was higher than the gap of $116.1 billion in Q4 2017. Still, it was below the consensus forecast of a $129 billion shortage. (Event A on the chart.)

Existing home sales were at the seasonally adjusted annual rate of 5.43 million in May. That is compared to the downwardly revised 5.45 million in April and the average forecast of 5.52 million. (Event B on the chart.)

Crude oil inventories dropped by 5.9 million barrels last week. The fall was far bigger than 2.1 million predicted by analysts and 4.1 million logged the week before. On the other hand, total motor gasoline inventories rose by 3.3 million barrels last week. (Event C on the chart.)

Yesterday, a report on housing starts and building permits was released. Housing starts were at the seasonally adjusted annual rate of 1.35 million in May, up from 1.29 million in April. Building permits were at the seasonally adjusted annual rate of 1.30 million, down from 1.36 million in the previous month. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.