EURUSD Analysis and Talking Points

- Italian assets retreat as Italy appoints Eurosceptics

- EURUSD falls to the lowest level since July 2017

Italian Fears Rise After Appointment of Eurosceptics

EURUSD fell to its lowest level since July 2017 at 1.1508 as Italian assets came under pressure with BTPs and the FTSE MIB falling to session lows. This followed reports that two Eurosceptic members had been appointed to the finance committee, subsequently raising concerns over the possible anti-EU stance that could unfold in Italy.

Eurosceptic Bagnai had been named as head of the Italian Senate Finance Committee, while Borghi, who is one of the top economic advisers for League leader Salvini had been chosen to head the budget committee in the Lower House of Parliament. Though it is not clear is not clear how prominent roles will be in regard to dictating economic matters, their critical views on the Euro is very clear. As such, this has prompted to flight away from Italian assets.

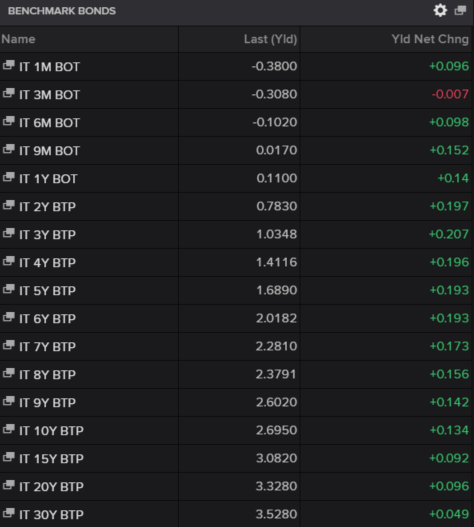

Italian Bond Yields Rise Across the Curve

Source: Thomson Reuters

EURUSD PRICE CHART: DAILY TIME FRAME (December 2016- June 2018)

The break below 1.1510 to hit to the lowest level since July 2017 at 1.1508, allows for a test at 1.1448, which coincides with the 50% retracement of the rise from 1.0340-1.2556. 1.1500 will likely act as near-term support.

IG Client Positioning Sentiment states that the fact that traders are net-long suggests prices may continue to fall. For full client positioning click here

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX