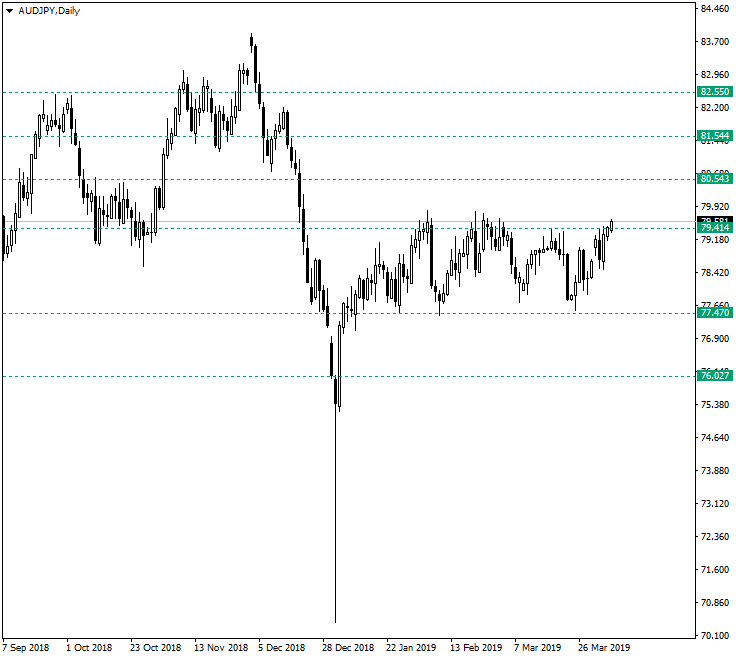

The Australian dollar vs. Japanese yen is developing at the resistance area where all the peaks of 2019 had formed. Of course, what will it do this time is the most interesting part of all.

Long-term perspective

Since the second half of January 2019, the pair evolves in a flat limited by 77.47 as support and 79.41 as resistance. Even thought the retracements from the support are fairly strong, the resistance manages to decrease the volatility of the price as it approaches its territory, yielding very calm and rounded confirmations. So, in other words, the bulls are very determined when they leave the support area, but don’t succeed in driving the price above the resistance for a long time and for a considerable amount of pips, as all the crossings resulted in short-lived oscillations above the resistance that were followed by a new fall.

What catches the eye this time is the fact that the current peak is higher than the previous one from March 18, 2019, and that the very bearish candle on April 02, 2019, was invalidated by the next one which engulfed it. These could be arguments for a continuation of the appreciation, the next target being at 80.54. This possibility will be nullified if the price comes back under 79.41.

Short-term perspective

Price pierced the selling area defined by 79.45 and 79.37. Thus, as long as the price sits above this area, further advancement is in the way, with the first resistance at 79.66 and then the second one at 79.78. If the situation unfolds in the opposite direction, with a failure of the price to maintain itself above the aforementioned selling area, drops would be expected to retest the 79.15, 78.95, and 78.72 support levels. Notice that 78.95 cements alongside the ascending trendline an important support area on the H1 chart, and that the break of it — and mainly of the trendline — will give the decision power to the bears, yet again.

Levels to keep an eye on

D1: 76.02 77.47 79.41 80.54

H1: 78.95 79.15 79.37 79.66 79.78

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.