The US dollar versus the Japanese yen currency pair seems to met difficulties in its appreciation attempts, not being able to pass the 107.00 psychological level.

Long-term perspective

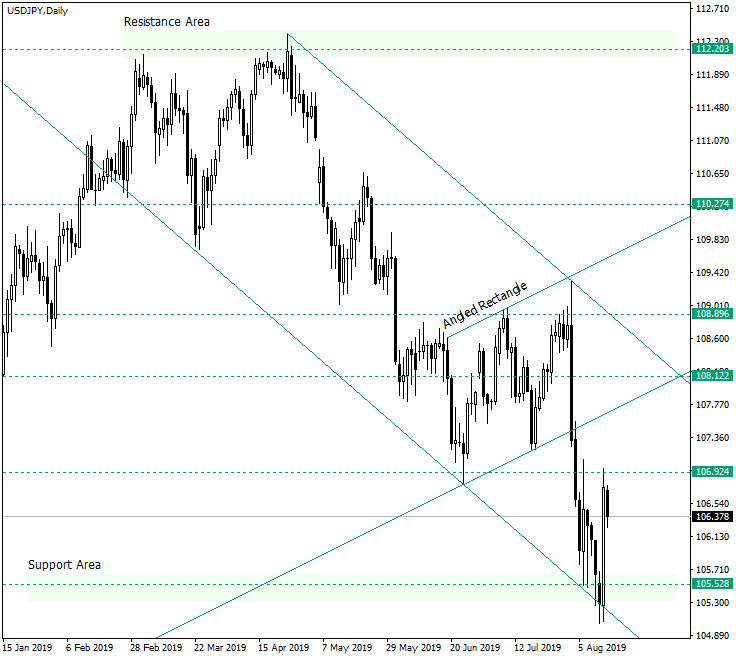

The impulsive wave that started at the triple resistance area — consolidated by the 108.89 level, the resistance line of the angled rectangle, and the upper line of the descending channel — stopped at 105.52, an important weekly support area. From there on August 13, the market printed a strong bullish bar that etched a high around the 106.92 level, which is the technical correspondent of the 107.00 psychological level. By doing so, it sent the message that 107.00 is now a resistance.

The candles that followed capped at around 106.67, telling that the bears are protecting this area. So, as long as the price oscillates in this zone new downwards movements are to be expected, targeting 105.50 first, followed by 104.70.

Only the breach of 107.00 would allow further advancement towards 108.12. In this case the upwards movement might be limited by the triple resistance craved by the 108.12 level, the upper line of the descending channel, and the support line of the angled rectangle, from where a new bearish intervention could occur.

Short-term perspective

The price appears to be limited by the 38.2 level of the Fibonacci retracement plotted on the decline that started after confirming the 109.12 level as resistance. As long as the 38.2 level holds, further decline is in the cards, with main targets at 23.6 and 11.4, the latter overlapping with the technical 105.51 support level.

If the price manages to continue with an upwards movement, 50.0 and the accompanying 107.08 level should limit the ascension. To be noted is the fact that if such a scenario takes place, then the fall may be limited by 38.2, as the price — as discussed for the daily chart — might aim for the 108.12 level.

Levels to keep an eye on:

D1: 106.92 105.52 108.12

H4: 105.51 107.08 and the Fibonacci retracement levels — mainly 50.0 38.2 23.6 11.4

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.