- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

July 21

July 212017

E-Book Review: Crowds, Crashes, and the Carry Trade by Valeri Sokolovski

Today, I would like to present a review of a research paper called Crowds, Crashes, and the Carry Trade. It was published by Valeri Sokolovski, a finance scholar at the Stockholm School of Economics. It was presented by Mr. Sokolovski at the conference called Exchange Rate Models for a New Era: Major and Emerging Market Currencies organized by the City University of Hong Kong. The article is available for free download in our Forex e-books section. Crowdedness As the title of the work […]

Read more July 17

July 172017

[Poll] Is Forex Trading Legal in Your Country?

Various countries deal with the retail Forex trading industry differently. Long gone are the days when regulators ignored small traders and their relationship with brokers. Developed countries set up the regulatory frameworks that protect the retail customers but create many restrictions. At the same time, some countries go as far as prohibiting retail FX trading altogether. Below, I will list some of the countries that have important […]

Read more July 3

July 32017

[Poll] Optimal Forex Account Size to Trade for a Living

Nowadays, it is normal for retail Forex brokers to offer trading accounts from as little as $1. Of course, when you start trading with such a low amount, you cannot earn anything significant without resorting to pure gambling. But where does that limit, which separates ‘just trying the taste of Forex’ from ‘serious trading to earn your payroll’, lie? Obviously, the answer largely depends on the scale of earnings […]

Read more June 19

June 192017

Trading High-Risk Events in Forex

Considering the polling results of the traders after the last year’s Brexit market chaos and the 2015 Greek referendum, the majority of the retail market participants managed to either benefit from the big moves caused by these scheduled yet dangerous events or at least not to get burnt by them. That seems to be an interesting statistics, considering how far the online brokers go these days to reduce the customers’ exposure to the markets during the periods of voting, elections, […]

Read more June 5

June 52017

How Do You Measure Trading Success in Forex?

Typically, when a Forex trader closes a position, the outcome is either positive (gain) or negative (loss); the breakeven trades happen but are quite rare and uninteresting. Trading platforms usually display the outcome as the value in pips or currency units, or both. Detailed account reports can also show them in percentage to the account balance at the moment of trade’s liquidation. Some reports also produce complex risk-adjusted metrics based on several trades, e.g. […]

Read more May 22

May 222017

Which Cryptocurrency Pairs Do You Trade in Forex?

My old poll about the popularity of currency pairs had rather predictable results — EUR/USD, GBP/USD, the JPY pairs are the leaders. But how about cryptocurrency trading? Can it be considered a part of the more traditional Forex scene? Given the fact that many FX brokers now support trading in crypto, should they be considered separate entities, or does BTC/USD or ETH/USD can be analyzed and traded on mostly the same […]

Read more May 12

May 122017

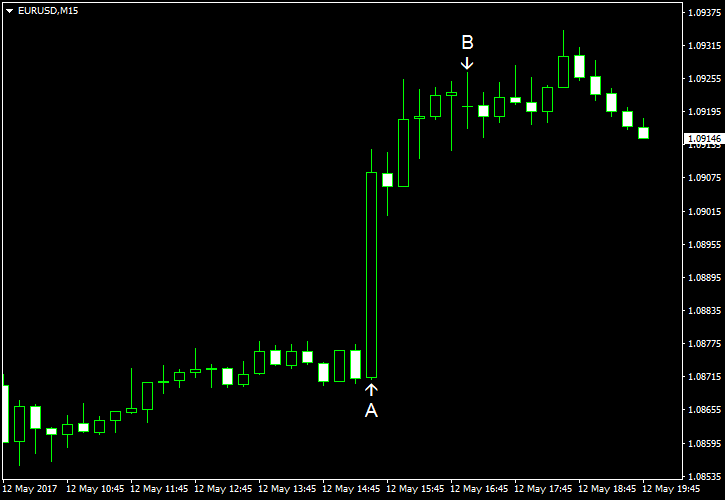

EUR/USD Surges Following Poor CPI and Retail Sales Data

The US dollar dropped abruptly against the single European currency today following a the release of the consumer inflation and sales data from the United States. EUR/USD rally was short-lived but strong. Minor US reports that had been released afterwards were ignored by market participants. US CPI increased by 0.2% in April, matching forecasts, after posting a 0.3% drop in March. At the same time, core CPI (excluding food and energy) […]

Read more May 8

May 82017

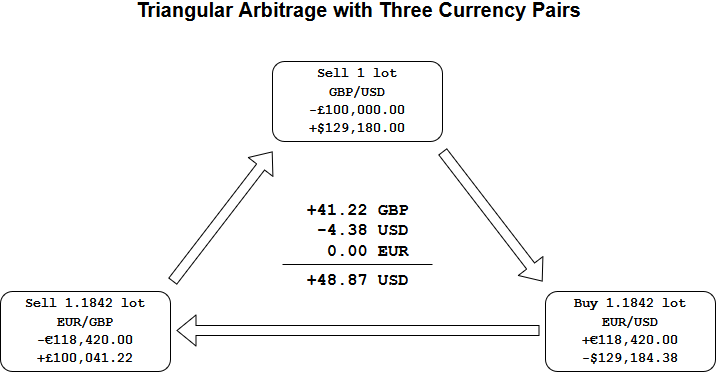

[Poll] Arbitrage for Retail Forex Traders

Arbitrage is a practice of earning money by simultaneously buying and selling the same asset on different markets without exposing yourself to the asset value risk. The simplest example of FX arbitrage would be to buy a currency at one broker at an Ask price that is lower than the Bid price you can sell it at another broker. There are four basic types of arbitrage in Forex: Plain intercurrency arbitrage between two brokers. […]

Read more May 2

May 22017

Social Trading: Business Ideas Now Available for Free

With Forex, there is a market available for absolutely everybody. With a platform so vast, it allows everyone to make a deposit and start trading instantly. However, in most cases, only professionals can see real results. Whilst getting started with trading is easy for any person from the street, they have no chance to make money on the market without an experienced mentor. Where can you get it? […]

Read more April 24

April 242017

Worst Forex Indicator/Tool Ever

Each trader has his or her own best trading tool — be it a simple moving average or a complex system that combines volume, market sentiment indicators, and Elliott Wave count done on Fibonacci numbers. It seems that Forex traders favor the simpler methods. The more straightforward the indicator is, the more fans it has, in my opinion. But when it comes to the indicators that people dislike, things are […]

Read more