- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

July 12

July 122016

E-Book Review: Enough to Be Dangerous by Brian McAboy

Although the field of trading psychology looks oversaturated at this stage, considering that we have such a jewel of the genre as Trading in the Zone by Mark Douglas, I would still like to share an e-book that offers an interesting approach to dealing with the psychological problems in trading. is a very short e-book written by Brian McAboy, a trading psychology coach and business consultant. Brian is also a founder of www.InsideOutTrading.com (warning: auto-playing video inside!) — a training […]

Read more July 11

July 112016

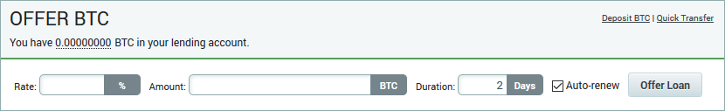

Tutorial: Bitcoin Investment in Margin Lending

Many think of bitcoin as an investment and rightly so, it has grown from being worth fractions of a penny to being worth hundreds of dollars in a few short years. Price fluctuations have made it a popular commodity to trade both in the futures market and in real time. Bitcoin now easily surpasses $100 million in daily trading volume on a regular basis. This type of volume has driven a large need for liquidity in the market — essentially, […]

Read more July 10

July 102016

Forex Brokers Update — July 10th, 2016

The list of changes to the brokers’ listings during the past three weeks includes the following: Forex Broker Inc. now offers free VPS to traders with deposits bigger than $5,000. Bloombex Options — no longer has offices in the USA and Germany. Opened office in the UK. Titan FX launched Chinese and Spanish versions of the website. Alpari became regulated by the National Bank of Republic of Belarus. Gallant Capital Markets is now registered with […]

Read more July 9

July 92016

Weekly Forex Technical Analysis (Jul 11 — Jul 15)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0788 1.0895 1.0972 1.1079 1.1157 1.1264 1.1341 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0887 1.0957 1.1072 1.1142 1.1256 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more July 8

July 82016

EUR/USD Stays Not Far from Opening After Nonfarm Payrolls

Nonfarm payrolls showed robust employment growth but other parts of the report were disappointing. EUR/USD demonstrated an erratic reaction to the data, sinking after the release but bouncing almost immediately afterwards. Currently, the currency pair trades below the opening level but the drop is very small. Nonfarm payrolls rose by 287k in June, exceeding market expectations of 175k by a wide margin. May’s already meager increase by 38k was revised […]

Read more July 7

July 72016

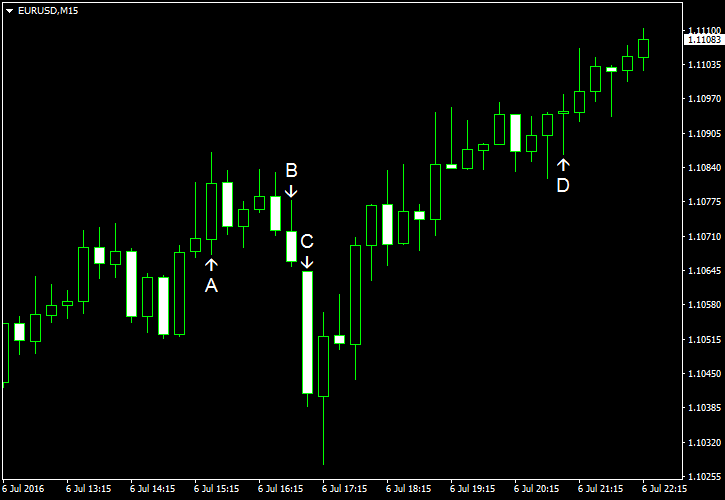

EUR/USD Goes Lower After US Employment Data

EUR/USD went lower today after the release of jobless claims and ADP employment data. Both reports were good, making market participants optimistic ahead of tomorrow’s nonfarm payrolls. ADP employment rose by 172k in June after growing by 168k in May. Experts had predicted slowdown to 158k. (Event A on the chart.) Initial jobless claims dropped to 254k last week from the previous week’s revised level of 270k. Analysts were counting […]

Read more July 6

July 62016

EUR/USD Bounces from Initial Decline

EUR/USD was moving lower during the current trading session, accelerating decline after the release of positive services data from the United States. Yet the currency pair has started a rebound shortly afterwards and continued to move higher after the release of the Federal Reserve policy minutes. Currently, EUR/USD is trading above the opening level. Trade balance deficit widened to $41.1 billion in May up from $37.4 billion in April. That […]

Read more July 4

July 42016

Improving Forex Trading Through Healthy Nutrition

Food has a direct effect on the performance of a trader. A healthy diet keeps a trader alert and active throughout the day. This would ultimately enable a trader to have a clear understanding of the price movement in the market, to validate signals without lack of concentration and to take successful trading decisions without any dilemma. In this regard, let us look at the nature of the diet required for a trader to remain physically and mentally alert throughout the trading session and beyond. Effect […]

Read more July 2

July 22016

Weekly Forex Technical Analysis (Jul 4 — Jul 8)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0816 1.0893 1.1015 1.1092 1.1213 1.1290 1.1412 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0905 1.1037 1.1103 1.1235 1.1301 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more July 1

July 12016

EUR/USD Rises a Little

EUR/USD rose today, but the gains were limited. US economic data released during the current session was mixed, with manufacturing reports being good while construction spending being surprisingly poor. Interestingly enough, the currency pair trimmed gains after the poor report, not the good ones. Markit manufacturing PMI rose to 51.3 in June from 50.7 in May according to the final estimate. The actual reading was not […]

Read more